Undervalued Real Estate Stocks Worth Watching

In the real estate market, certain stocks are showing signs of being oversold, presenting a chance for investors to acquire undervalued companies.

The Relative Strength Index (RSI) is a tool used by traders to measure a stock’s price momentum. It compares gains on days when prices rise to losses on days when prices fall, helping predict short-term performance. Typically, a stock is deemed oversold when its RSI falls below 30, as indicated by Benzinga Pro.

Below are notable real estate stocks that currently have an RSI near or below the 30 threshold.

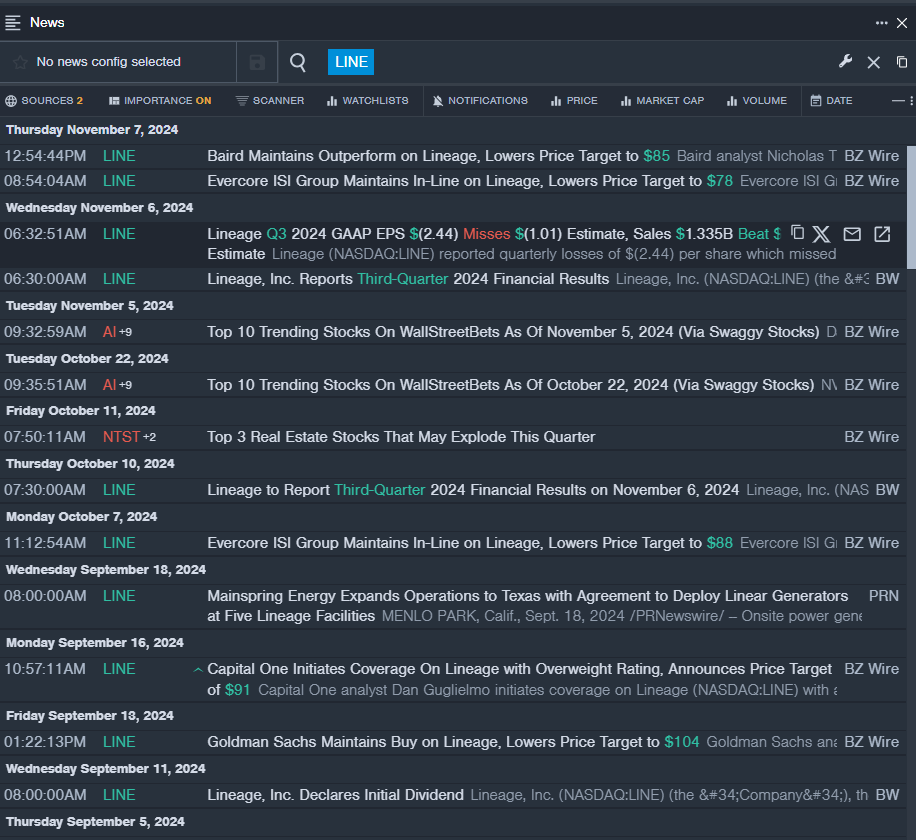

Lineage Inc LINE

- On November 6, Lineage reported a quarterly loss of $2.44 per share, falling short of the analyst estimate of a loss of $1.01 per share. However, its quarterly sales reached $1.335 billion, slightly exceeding expectations of $1.329 billion. Over the past month, the stock has dropped about 11%, with a 52-week low of $66.94.

- RSI Value: 22.05

- LINE Price Action: The stock closed at $67.32 after a decline of 1.1% on Friday.

- Benzinga Pro’s real-time newsfeed provided updates on the latest developments for LINE.

Americold Realty Trust Inc COLD

- Americold Realty Trust reported disappointing third-quarter results on November 7. CEO George Chappelle commented, “We are pleased with our third quarter results where we delivered AFFO per share of $0.35, an increase of 11% from last year.” Despite this growth, the company’s stock has fallen about 15% in the last month, hitting a 52-week low of $21.87.

- RSI Value: 18.80

- COLD Price Action: The stock ended the day at $22.76, down 1.8% on Friday.

- Benzinga Pro’s charting tool aided in analyzing the performance of COLD stock.

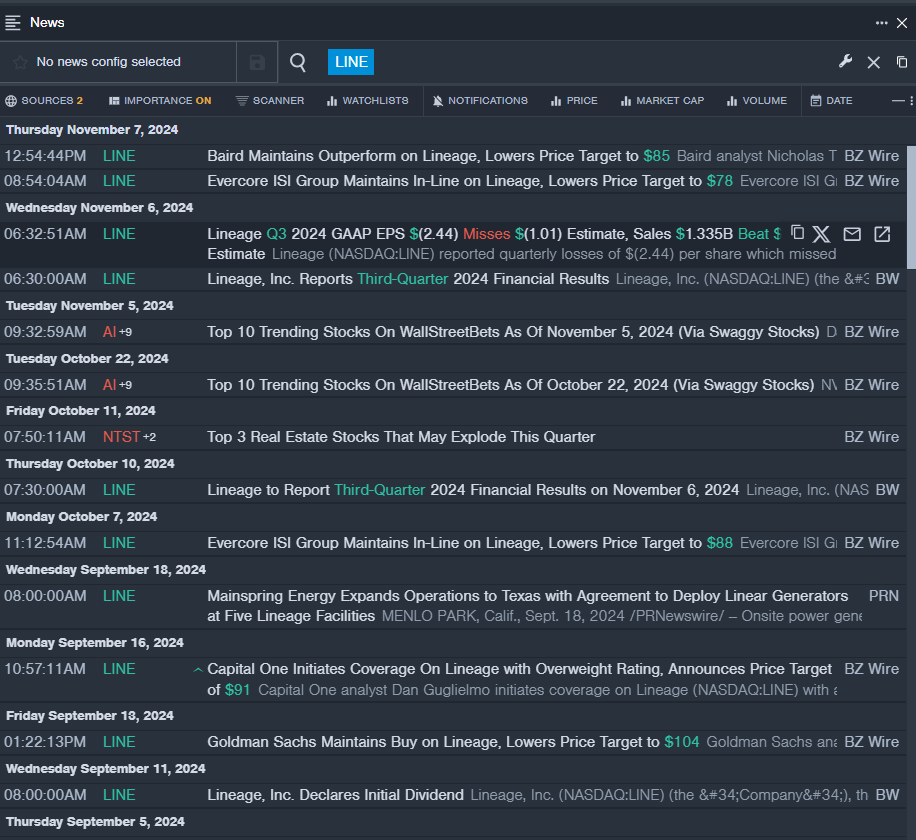

Diversified Healthcare Trust DHC

- On November 4, Diversified Healthcare Trust experienced a significant drop in share value following disappointing third-quarter results. The stock plummeted about 25% in just five days, with a 52-week low recorded at $1.94.

- RSI Value: 25.68

- DHC Price Action: It closed at $2.63 after a decline of 1.9% on Friday.

- Benzinga Pro’s signals feature identified a potential for a breakout in DHC shares.

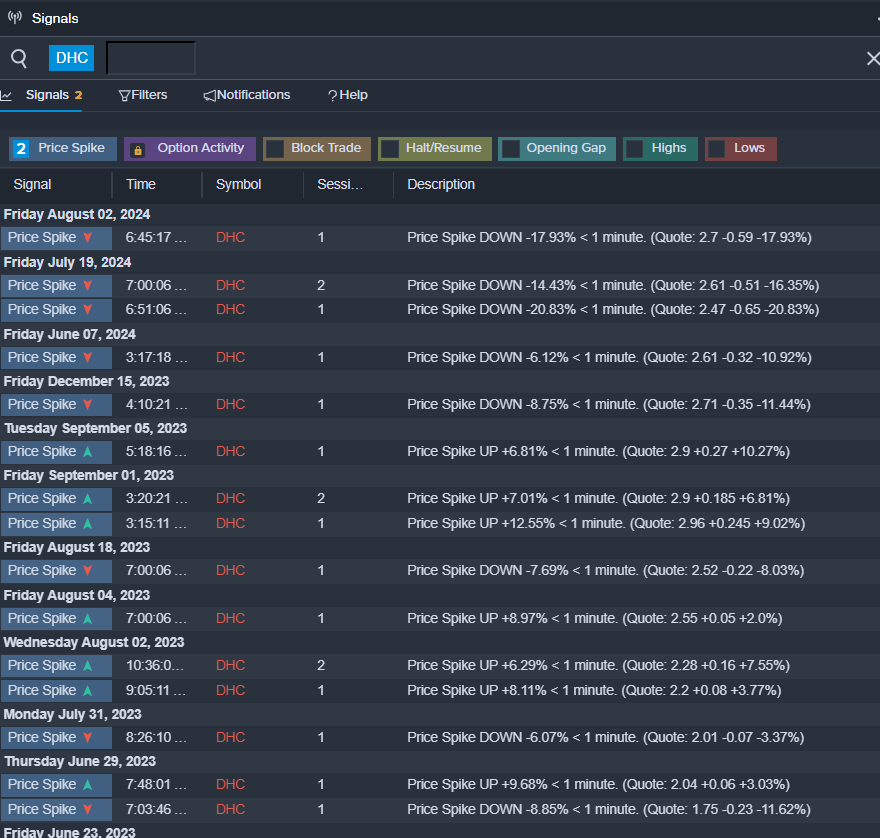

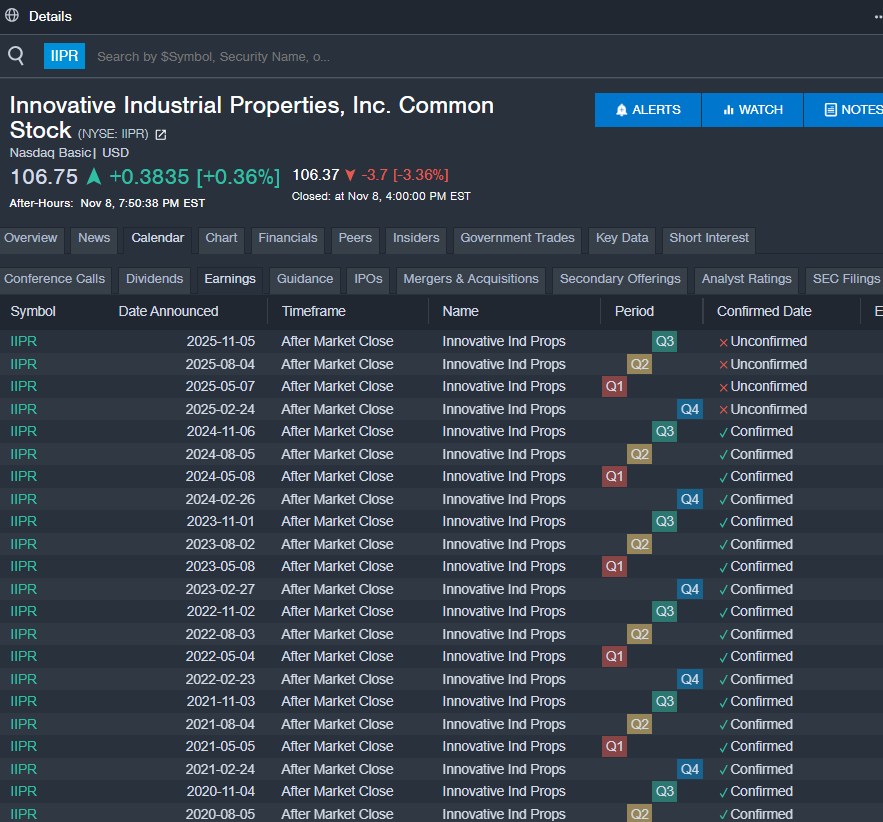

Innovative Industrial Properties Inc IIPR

- On November 6, Innovative Industrial Properties also reported third-quarter results that disappointed investors. The stock suffered a drop of approximately 16% in five days, with a 52-week low of $73.04.

- RSI Value: 20.87

- IIPR Price Action: The stock ended the day at $106.37 following a decline of 3.4% on Friday.

- Benzinga Pro’s earnings calendar provided important insights into upcoming IIPR earnings reports.

Read More:

Market News and Data brought to you by Benzinga APIs