As stimulus-driven spending gradually wanes and interest rates remain elevated, the Retail – Miscellaneous industry faces a pivotal juncture. Consumer sentiment is shifting towards more conservative spending habits, presenting challenges for businesses. However, companies including Ulta Beauty, Inc., Five Below, Inc., Arhaus, Inc., and Sally Beauty Holdings, Inc. are strategically positioned to capture evolving market opportunities.

About the Industry

The Zacks Retail – Miscellaneous industry encompasses retailers of sporting goods, office supplies, specialty products, and beauty products, including cosmetics, fragrances, skincare, and haircare products. It also includes speciality value retailers targeting tween and teen customers, along with recreational boat and yacht retailers. The profitability of industry players depends on a prudent pricing model, organized supply chain, and effective merchandising strategy.

Key Industry Trends

Cautious Consumer Environment: The industry faces challenges due to soft demand, high inflation, elevated interest rates, and geopolitical tension, prompting shifts in consumer behavior across various retail segments.

Pressure on Margins to Linger: Companies are vying for a larger market share, driving sales but incurring high costs. Initiatives to mitigate cost-related challenges include streamlining operations and optimizing supply networks.

Focus on Boosting Portfolio & Market Reach: Companies are working on providing a wide range of products, enhancing the online experience, and adopting favorable pricing strategies. Increased demand for personal care items, domestic merchandise, and fitness-related products is driving this trend.

Digitization, Key to Growth: Industry players have been investing in digital platforms, accelerating fleet optimization, and enhancing the supply chain. Retailers are focusing on in-demand merchandise and ramping up investments in digitization to cater to changing consumer shopping patterns.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Retail – Miscellaneous industry currently carries a Zacks Industry Rank #197, placing it in the bottom 22% of more than 250 Zacks industries. The industry’s negative earnings outlook and decline in earnings estimate revisions have contributed to this ranking.

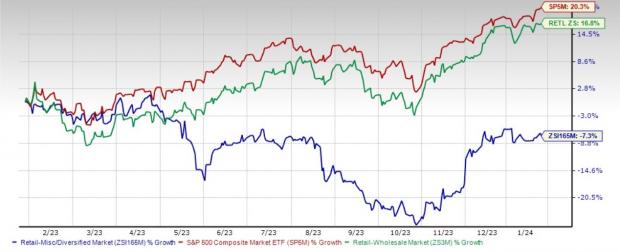

Industry vs. Broader Market

The Zacks Retail – Miscellaneous industry has underperformed the broader Retail – Wholesale sector and the Zacks S&P 500 composite over the past year, declining 7.3% while the S&P 500 rose 20.3%.

One-Year Price Performance

.jpg)

Industry’s Current Valuation

Based on forward 12-month price-to-earnings (P/E), the industry is currently trading at 16.2X compared with the S&P 500’s 20.31X and the sector’s 22.4X.

Price-to-Earnings Ratio (Past 5 Years)

.jpg)

4 Stocks to Watch

Sally Beauty: With strong free cash flow, strategic acquisitions, and a focus on optimizing operations, Sally Beauty is positioned for sustained growth. The introduction of concepts like Studio by Sally, Cosmo Prof Direct, and Happy Beauty Company represents a commitment to innovation.

Four Retail Stocks Gear Up for Revolutionary Growth

Sally Beauty and other retail companies have been pursuing aggressive strategies to expand their market reach, employing a blend of technological innovation, product enhancements, and diversification beyond core offerings.

The Sparkling Potential of Sally Beauty

Sally Beauty has a trailing four-quarter earnings surprise of 2.1%, on average. The Zacks Consensus Estimate for current financial-year EPS suggests growth of 2.7% from the year-ago reported figure. Despite a declining share price over the past year, the company’s Zacks Rank #2 (Buy) status indicates a resilient position in the market.

Price and Consensus: SBH

.jpg)

Ulta Beauty’s Radiant Journey

Ulta Beauty, a premier beauty destination, has been expanding its omnichannel business and embracing a blend of physical and digital experiences for its customers. Its trailing four-quarter earnings surprise of 5.8% reflects the solid potential. While experiencing a 5.5% decline in shares over the past year, the Zacks Rank #3 (Hold) company remains buoyant, with significant growth in the Zacks Consensus Estimate for current financial-year revenues and EPS.

Price and Consensus: ULTA

.jpg)

The Phenomenal Rise of Five Below

Five Below, known for its extreme-value retailing, is focusing on enriching its product selection and enhancing digital capabilities to attract more shoppers. With a strong average earnings surprise and significant anticipated revenue and EPS growth, the company’s Zacks Rank #3 status, despite a 3.8% share decline, underscores its potential to thrive in the market.

Price and Consensus: FIVE

.jpg)

Arhaus’ Illuminating Success Story

Arhaus, a premium home furnishings retailer, has been reaping the rewards of strong demand, successful product launches, and strategic expansions. The company’s substantial average earnings surprise and anticipated revenue growth indicate a bright future ahead, despite a 12.7% share decline in the past year.

Price and Consensus: ARHS

.jpg)

As these companies forge ahead with their visionary approaches, investors can anticipate a vibrant landscape in the retail sector. Their focus on customer experience, product innovation, and digital transformation could very well pave the path for a revolutionary journey.

Get a Free Stock Analysis Report for Ulta Beauty Inc. (ULTA)

Explore a Free Stock Analysis Report for Sally Beauty Holdings, Inc. (SBH)

Discover a Free Stock Analysis Report for Five Below, Inc. (FIVE)

Gain Access to a Free Stock Analysis Report for Arhaus, Inc. (ARHS)

Click here to read this article on Zacks.com.

Explore Zacks Investment Research

Please note that the views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.