Global Semiconductor Industry Sees Significant Growth, Driven by AI Demand

The global semiconductor industry is demonstrating impressive growth, with February 2025 sales reaching $54.9 billion, as reported by the latest Semiconductor Industry Association report. This marks a substantial 17.1% increase from February 2024 and highlights the 10th consecutive month of double-digit year-over-year growth.

However, a slight month-to-month decline of 2.9% from January was noted. Despite this, strong industry momentum persists, particularly in the Americas, which experienced a remarkable 48.4% year-over-year sales increase. Contributing to the global uptick, the Asia Pacific/All Other segment reported a 10.8% rise, followed by China at 5.6%, and Japan at 5.1%. Conversely, Europe faced an 8.1% decline.

Key players in the semiconductor market—including Broadcom (AVGO), NVIDIA (NVDA), Marvell Technology (MRVL), and Qualcomm (QCOM)—are well-positioned to capitalize on the booming data center market in 2025. This growth is largely fueled by the rapid expansion of artificial intelligence (AI) and high-performance computing (HPC), sectors which IDC expects to grow by over 15% in 2025. The demand for advanced logic process chips and high-bandwidth memory (HBM) is driving double-digit growth throughout the industry.

In particular, sales in the memory segment are expected to surge more than 24% this year, largely thanks to high-end products like HBM3 and HBM3e that are essential for AI accelerators. The anticipated launch of HBM4 in the latter half of 2025 is expected to further energize this segment.

Positive Industry Outlook Amidst Challenges

Despite recent challenges posed by tariffs introduced by President Trump—including a 54% total tariff on Chinese imports and 32% on Taiwanese goods— the semiconductor industry’s long-term prospects remain strong. These geopolitical issues introduce uncertainty and could disrupt global supply chains, potentially heightening manufacturing costs and complicating vital trade relationships.

Notably, the semiconductor market is forecasted to grow from $755.28 billion in 2025 to $2,062.59 billion by 2032, achieving a compound annual growth rate (CAGR) of 15.4% throughout this period. As of 2024, the Asia Pacific region is projected to represent 50.94% of the global market share.

Significant investments in chip manufacturing are underway, with companies like TSMC enhancing their production capabilities for traditional 2nm and 3nm processes in Taiwan, as well as 4nm and 5nm facilities in the U.S. Overall, wafer manufacturing capacity is expected to grow by 7% annually in 2025, with advanced node capabilities increasing by 12%.

The increasing integration of semiconductors across various industries—from data centers and automotive to consumer electronics and industrial automation—continues to fuel strong demand. As AI technologies expand their reach to edge computing, personal computers, smartphones, and IoT devices, the semiconductor industry is positioned for sustained growth, reinforcing its critical role in global technological advancement.

Our Top Picks

In our analysis, we highlight four semiconductor stocks with a favorable combination of a Growth Score of A or B along with a Zacks Rank of #1 (Strong Buy) or #2 (Buy). The Growth Style Score consolidates relevant financial metrics to provide insight into a company’s growth quality and sustainability. Stocks that fulfill these criteria are considered promising investment opportunities. You can view the full list of today’s Zacks #1 Rank stocks here.

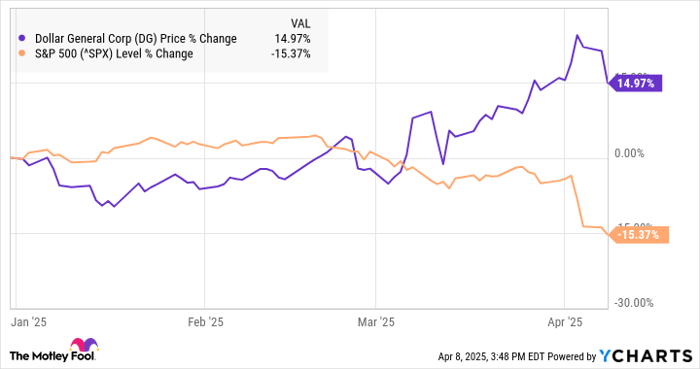

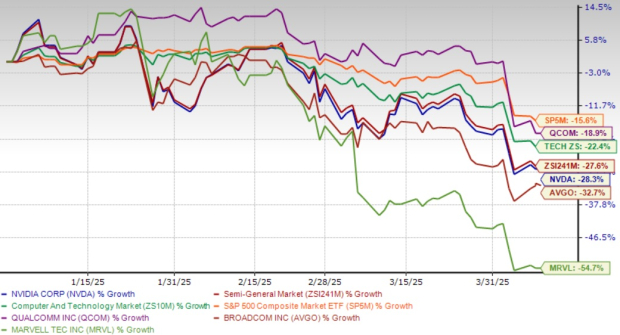

Year-to-Date Performance

Image Source: Zacks Investment Research

Broadcom: Leader in AI Semiconductor Innovation

Broadcom’s $10 billion share buyback program reflects strong confidence in its growth strategy, particularly within AI infrastructure. The introduction of its Sian3 and Sian2M chips provides exceptional power efficiency for AI data centers, and its expanding optical interconnect solutions are designed to meet critical bandwidth requirements. Established partnerships with Apple and an increasing adoption of its custom AI chips by cloud service providers looking for alternatives to Nvidia position Broadcom advantageously within the semiconductor landscape. Innovations in PCIe Gen6 also augment its competitive edge.

Broadcom (AVGO) holds a Zacks Rank of #1 and a Growth Score of B. Recent adjustments have increased the Zacks Consensus Estimate for AVGO’s fiscal 2025 EPS by 0.6% to $6.60.

Stay updated with all quarterly releases: explore Zacks earnings Calendar.

NVIDIA: The AI Infrastructure Powerhouse

NVIDIA stands out as an exceptional investment for 2025, consistently leading in the AI semiconductor market. The Blackwell platform serves as the backbone for NVIDIA Media2, facilitating next-generation digital twins within the Omniverse and enhancing its technological position against competitors. The expansion of its ecosystem, including NIM microservices and AI Blueprints, provides an end-to-end solution across data centers and consumer devices. Moreover, plans for collaboration on the Nintendo Switch 2 underscore NVIDIA’s ability to monetize its AI technology across differing market sectors. As businesses accelerate their AI integration, NVIDIA’s unmatched portfolio of hardware and software will likely allow it to capture a substantial share of this expanding market.

NVIDIA (NVDA) has a Zacks Rank of #2 and a Growth Score of A. The Zacks Consensus Estimate for NVDA’s fiscal 2026 EPS has recently been adjusted upwards by 0.5% to $4.41.

Marvell: Pioneering AI Data Center Innovation

Marvell is strategically positioned within the semiconductor industry, offering an extensive range of PAM chips, digital signal processors, and silicon photonics crucial for AI infrastructure. With AI revenues likely exceeding $1.5 billion in fiscal 2025, and projections of surpassing $2.5 billion in fiscal 2026, Marvell’s growth potential is undeniable. Recent collaboration with TeraHop introduces the industry’s first complete PCIe Gen 6 over optical technology, showcasing Marvell’s commitment to innovation. While exposure to the Chinese market presents challenges, the company’s solid fundamentals, steady gross margins above 60%, and leadership in transitioning from copper to optical connectivity make it an attractive investment choice in 2025.

Marvell (MRVL) holds a Zacks Rank of #2 and…

Qualcomm Enhances AI Capabilities Through Strategic Acquisition

The Zacks Consensus Estimate for Marvell Technology, Inc. (MRVL) indicates a positive growth outlook, with its fiscal 2026 earnings per share (EPS) now projected at $2.76, a slight increase of one cent over the past month.

Qualcomm Advances AI Innovations with MovianAI Acquisition

Qualcomm has made a strategic move by acquiring MovianAI from VinAI, significantly broadening its artificial intelligence capabilities and enhancing research potential. This acquisition deepens Qualcomm’s long-standing relationship with Vietnam’s technology landscape. By leveraging VinAI’s strengths in generative AI, machine learning, computer vision, and natural language processing, Qualcomm aims to solidify its leadership in AI innovation. This encompasses a wide range of applications including smartphones, PCs, vehicles, and Internet of Things (IoT) devices.

Despite certain competitive challenges, Qualcomm’s diversified strategy, robust Snapdragon product lineup, and expanding automotive sector uniquely position the company to benefit from the ongoing AI revolution. Presently, Qualcomm (QCOM) holds a Zacks Rank of #2, with a Growth Score of B. Over the past month, the Zacks Consensus Estimate for QCOM’s fiscal 2025 EPS has risen by 0.2%, now standing at $11.78.

5 Stocks Poised for Significant Growth

Zacks experts have identified five stocks as potential high-growth opportunities, each selected as the top choice to potentially yield returns of +100% or more within 2024. While past performance does not guarantee future success, previous selections have shown impressive gains of +143.0%, +175.9%, +498.3%, and even +673.0%.

Many of these stocks remain under the radar of Wall Street, presenting an excellent opportunity for investment at an early stage. For insights on these five stocks with growth potential, click here.

Looking for the latest investment recommendations from Zacks Investment Research? You can download the “7 Best Stocks for the Next 30 Days” for free. Get the report here.

For more in-depth analysis, consider the following free stock reports: QUALCOMM Incorporated (QCOM), NVIDIA Corporation (NVDA), Marvell Technology, Inc. (MRVL), and Broadcom Inc. (AVGO).

This article initially appeared on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.