Speculation over rate cuts is reaching an all-time high, and investors are closely monitoring the Federal Reserve’s actions. While the exact timing and number of rate cuts remain uncertain, it’s widely expected that the Fed will eventually reduce rates to maintain economic stability.

As we approach this potential catalyst, I’ll explore how investors can best position themselves in the market.

Image source: Getty Images.

The small-cap growth dilemma

Small-cap growth stocks have faced challenges due to high interest rates. Many of these companies rely on debt instruments for financing, which becomes more expensive when rates rise.

Consequently, some small-cap stocks are currently trading at negative enterprise values — a rare occurrence. While predicting how these stocks will respond to rate cuts is difficult, one likely outcome is a broad rally within this segment of equities.

Identifying potential winners

Here are four small-cap value stocks that could rebound sharply in response to rate cuts later in 2024 or early 2025. For this article, I define small-cap stocks as those with market capitalizations under $6 billion (a slightly different criterion than the textbook definition, but one used by top-tier indices like the CRSP US Small Cap Value index).

Four small-cap growth stocks to watch

1. Archer Aviation

Archer Aviation (NYSE: ACHR) is focused on electric vertical takeoff and landing (eVTOL) aircraft. As urban air mobility gains traction, Archer’s innovative technology could position it for significant growth.

Its stock is down 37% year to date. However, the company is staring down several major catalysts that could trigger a rebound soon.

2. Joby Aviation

Joby Aviation (NYSE: JOBY) is another eVTOL player. With a focus on air taxi services, the company aims to revolutionize short-distance travel. Rate cuts could boost investor confidence in this sector, and as one of the best-capitalized players in the space, Joby stands out as an intriguing speculative buy.

More specifically, Joby is racing toward a potential trillion-dollar commercial opportunity. The eVTOL market is expected to be exceedingly competitive, but Joby is one of the frontrunners that could be among the first to market.

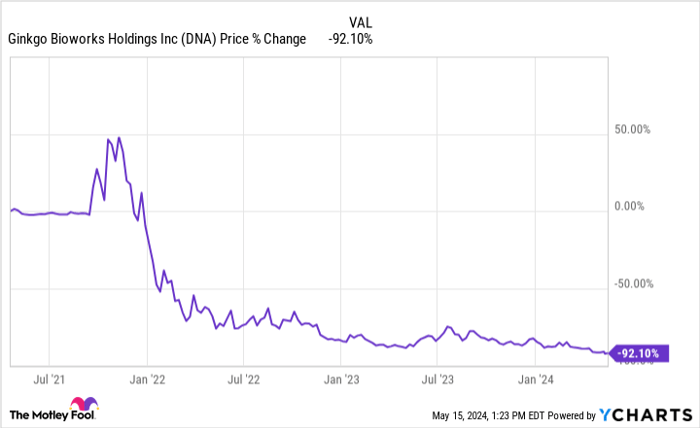

3. Ginkgo Bioworks

Ginkgo Bioworks (NYSE: DNA) specializes in synthetic biology and genetic engineering. As biotech rebounds in anticipation of a friendly capital-raising environment, Ginkgo’s unique approach to creating custom organisms could pay off big for patient shareholders. That said, Ginkgo’s shares have lost 92% of their value since their public debut, underscoring the high-risk nature of this emerging biotechnology platform.

DNA data by YCharts.

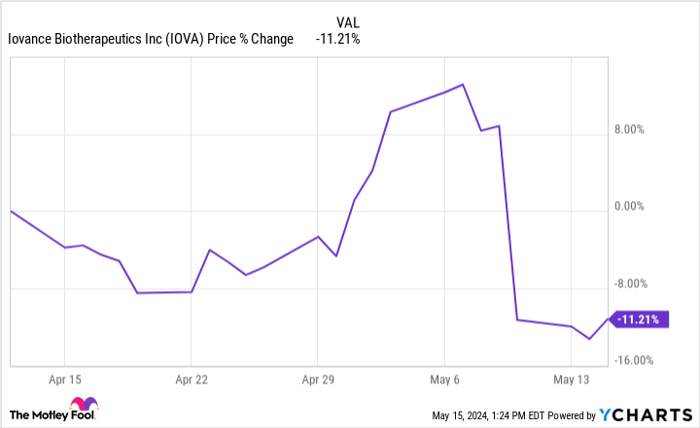

4. Iovance Therapeutics

Iovance Therapeutics (NASDAQ: IOVA) focuses on cancer immunotherapies, with a special emphasis on tumor-infiltrating lymphocyte therapies. Earlier this year, Iovance won a landmark regulatory approval from the Food and Drug Administration for Amtagvi as a treatment for certain forms of advanced melanoma.

As novel therapies generally take a few years to ramp up, some investors have moved to the sidelines following this regulatory approval. To wit: Iovance’s shares are down about 11% over the past 30 days. An improving financing landscape and growing Amtagvi sales could spark a turnaround.

IOVA data by YCharts.

Final thoughts

While no investment is risk-free, these small-cap value stocks offer intriguing opportunities. However, investors should consider the wisdom of buying baskets of these stocks or even a thematic exchange-traded fund (ETF) in the small-cap growth or value landscape.

After all, small caps are known for their extreme volatility at times. Moreover, individual small caps can underperform for long periods, which can weigh on your portfolio’s annual performance.

Should you invest $1,000 in Archer Aviation right now?

Before you buy stock in Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Archer Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $559,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

George Budwell has positions in Archer Aviation. The Motley Fool has positions in and recommends Iovance Biotherapeutics. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.