“`html

The global insurance brokerage market, valued at approximately $140.38 billion in 2025, is projected to reach $171.93 billion by 2030, reflecting a compound annual growth rate (CAGR) of 4.14%. Key players benefiting from this growth include Brown and Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW), and Aon plc (AON). These firms are capitalizing on improved pricing, prudent underwriting, and heightened global demand for insurance products.

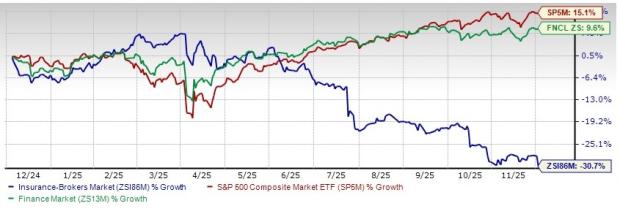

In the past year, the Insurance Brokerage industry has underperformed compared to the broader Finance sector and the S&P 500, with industry stocks declining by 30.7% while the Finance sector grew by 9.6% and the S&P 500 rose by 15.1%. Moreover, despite a healthy long-term growth projection across key players, the industry’s earnings estimates for 2025 have collectively declined by 18.8% over the past year.

As of now, the industry carries a Zacks Industry Rank of #101, placing it in the top 42% of over 243 Zacks industries, indicating encouraging near-term prospects driven by a positive earnings outlook and increasing operational efficiencies through technology adoption.

“`