The Zacks Medical – Outpatient and Home Healthcare industry has undergone a digital transformation post-pandemic, revolutionizing the nature and landscape of the sector. The surging demand for telemedicine and AI-powered technology services has underscored a remarkable shift in the modus operandi of healthcare companies, propelling them towards a tech-centric approach. As per a Precedence Research report, the global healthcare analytics market is expected to soar to $121.1 billion by 2030 at a CAGR of 15.9% from $37.15 billion in 2022. This seismic evolution in the industry is paving the way for players such as DaVita Inc., Encompass Health Corporation, Option Care Health, Inc., and Addus HomeCare Corporation to capitalize on the burgeoning opportunities.

An Industry in Transition

Shaping the Future of the Outpatient and Home Healthcare Industry

The industry encompasses companies offering ambulatory care either in an outpatient setting or at home, deploying advanced medical technologies for diagnosis, treatment, and rehabilitation services. Despite the challenges posed by the pandemic, the industry has exhibited steady growth, fostering a sense of optimism for the future. Notably, the inherent potential for scaling up innovation and the prevalence of value-based care models augur well for the industry’s continued growth trajectory.

Major Transformative Trends

Cost Effectiveness: A Defining Characteristic

The industry’s hallmark cost-effectiveness draws from its ability to provide a wide array of treatment and diagnostic options coupled with minor surgical procedures, all without the burden of extended hospital stays. This emphasis on lower-cost care settings has been further bolstered by the rise of financial incentives like health plans and government program payment policies.

AI’s Pervasive Influence: Reshaping Healthcare

The integration of AI into outpatient and home healthcare has unleashed a wave of innovation. From managing health information to achieving more efficient and personalized care, the industry is reaping rich dividends from AI. The crucial role AI plays in mental healthcare at home, particularly in detecting warning signs of mental health deterioration, has been a breakthrough for patient well-being.

Dependence on Telehealth: A Paradigm Shift

The pandemic-induced decline in outpatient clinic visits triggered a rapid adoption of telehealth solutions, becoming a lifeline for home healthcare providers. This shift, accompanied by the broader demand for home-based health care, especially among the elderly and individuals with chronic illnesses, has spurred a surge in the utilization of telehealth platforms.

Staffing Shortages: A Lingering Challenge

The pervasive staffing shortages in the U.S. healthcare industry have been exacerbated by the COVID-19 pandemic, culminating in high burnout rates among workers. This shortage has steered a gradual shift towards home healthcare for non-critical patients, amplifying the need for remote monitoring solutions.

Market Performance and Prospects

Zacks Industry Rank

The Zacks Medical – Outpatient and Home Healthcare industry has garnered a Zacks Industry Rank #69, positioning it among the top 28% of nearly 250 Zacks industries. Notably, industries in the top 50% of the Zacks ranking have historically outperformed the bottom 50% by a factor of more than 2 to 1, indicating bright near-term prospects.

Examining the sector’s recent stock performance and valuation provides a nuanced insight into the industry’s positioning for the future.

Outpatient and Home Healthcare Industry: A Resilient Outlook

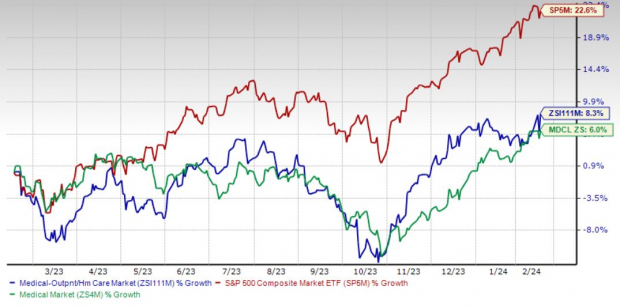

The outpatient and home healthcare industry lately has shown remarkable resilience in a challenging economic environment. Over the past five years, the industry has managed to thrive, posting an impressive rise of 8.3%, despite the S&P 500’s surge of 22.6%. Moreover, the broader sector has also seen a commendable inching up of 6% in the same time frame.

One Year Price Performance

Image Source: Zacks Investment Research

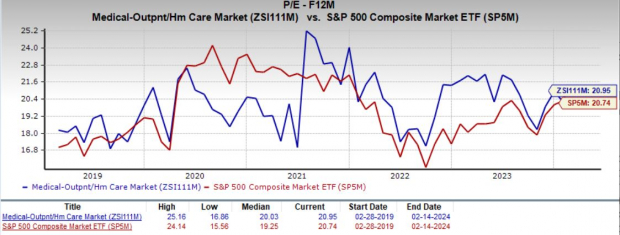

The industry’s current valuation, based on the forward 12-month price-to-earnings (P/E) ratio, stands at 20.9X compared with the S&P 500’s 20.7X and the sector’s 23.3X. Over the last five years, the industry has seen a high of 25.2X and a low of 16.9X, with the median resting at 20X.

Price-to-Earnings Forward Twelve Months (F12M)

Image Source: Zacks Investment Research

4 Outpatient and Home Healthcare Stocks to Watch Right Now

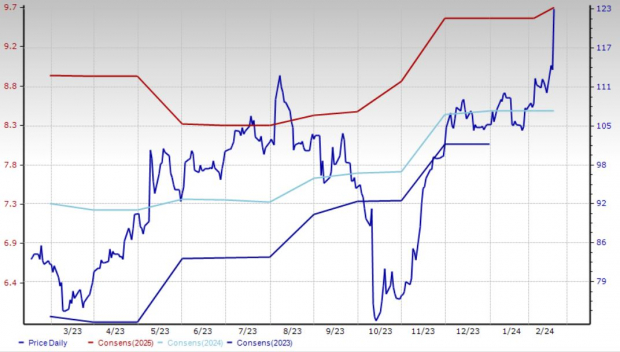

DaVita: This renowned global comprehensive kidney care provider reported its fourth-quarter 2023 results this month. The company registered an uptick in its overall top line and dialysis patient service and Other revenues during the period. The opening of dialysis centers within the United States and acquiring centers overseas were also recorded. The expansion of both margins bodes well for the stock. The per-day increase in total U.S. dialysis treatments for the fourth quarter on a sequential basis was also witnessed. DVA currently carries a Zacks Rank #2 (Buy).

For this Denver, CO-based company, the Zacks Consensus Estimate for 2024 revenues suggests growth of 1.4%.

Image Source: Zacks Investment Research

The company’s return on equity (ROE) of 64.9% compares favorably with the industry’s 4.9%.

Encompass Health: This well-known owner and operator of inpatient rehabilitation hospitals in the United States reported its fourth-quarter 2023 results this month. The company recorded a solid uptick in its overall top and bottom line results on the back of an increase in discharges (including same-store growth) and higher net patient revenue per discharge. EHC carries a Zacks Rank #2.