Bitcoin Surges Past $97,000: A Look at Key Stocks to Watch

Important Highlights

- Bitcoin achieved a remarkable high of $97,628 on Wednesday, breaking through the $97,000 milestone for the first time.

- Stocks linked to Bitcoin such as NVIDIA Corporation (NVDA), BlackRock, Inc. (BLK), CME Group Inc. (CME), and Accenture plc (ACN) show strong potential for growth.

- Discover our free report on the 7 Best Stocks for the Next 30 Days!

The cryptocurrency market is experiencing a significant rally, with Bitcoin (BTC) reaching new records since Donald Trump’s victory in the U.S. presidential election. Specifically, Bitcoin’s price soared past $97,000, peaking at $97,628.

Prior to this surge, market analysts anticipated that Bitcoin would exceed $80,000 by the end of November. Bitcoin had previously dipped during the second and third quarters of 2024 after reaching an apex of $73,770 in March. Recent optimism, however, suggests that Bitcoin may soon hit $100,000, bolstered by expectations of a more favorable regulatory environment under Trump.

With this encouraging outlook, investing in Bitcoin-focused stocks such as NVIDIA Corporation (NVDA), BlackRock, Inc. (BLK), CME Group Inc. (CME), and Accenture plc (ACN) may represent a wise investment strategy. Each of these companies has reported improved earnings estimates over the past two months, holding Zacks Rank #1 (Strong Buy) and #2 (Buy) ratings. Access the full list of today’s Zacks #1 Rank stocks here.

Bitcoin’s Rally Towards $100,000

The surge in Bitcoin’s value can be traced back to the Federal Reserve’s announcement of a 50-basis point rate cut in September, marking its first reduction since March 2020, coinciding with Trump’s electoral victory.

Since the start of 2024, Bitcoin’s value has doubled, and it has jumped over 40% since Trump’s win. Notably, over $4 billion has flowed into Bitcoin ETFs listed in the U.S.

Trump’s campaign promises aimed to establish the U.S. as the “crypto capital of the planet,” including proposals for a strategic Bitcoin reserve and the appointment of supportive regulators, further fueling optimism for the cryptocurrency.

Moreover, the Federal Reserve’s subsequent interest rate cut following Trump’s election serves as a positive indicator for the cryptocurrency marketplace.

Top 4 Bitcoin-Focused Stocks to Consider

NVIDIA Corporation

NVIDIA Corporation has made significant strides in the semiconductor sector, emerging as one of the highlights in 2023. This company excels in designing graphic processing units (GPUs), whose demand rises considerably amidst a thriving cryptocurrency market. The essential role of GPUs in data centers, artificial intelligence, and cryptocurrency mining has been pivotal to NVIDIA’s success.

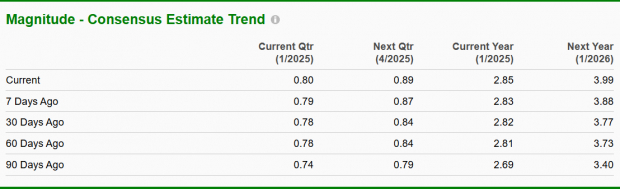

NVIDIA’s expected earnings growth rate for this year exceeds 100%. The Zacks Consensus Estimate for current-year earnings has increased by 1.4% over the last two months. Presently, NVIDIA holds a Zacks Rank of #1.

Image Source: Zacks Investment Research

BlackRock

BlackRock is globally recognized as one of the largest investment management firms and was among the pioneering traditional institutions to enter the Bitcoin ETF arena in June 2023.

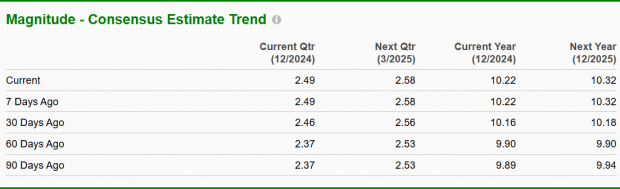

For the current year, BlackRock’s anticipated earnings growth rate is 14.3%. The Zacks Consensus Estimate has seen a 4.4% improvement in earnings over the last 60 days, with BLK holding a Zacks Rank of #1.

Image Source: Zacks Investment Research

CME Group

CME Group Inc. specializes in options that grant buyers the right to purchase or sell cryptocurrency futures contracts at a predetermined price. The company offers options on Bitcoin and ether, based on both standard and micro-Bitcoin and Ethereum futures contracts.

CME Group is projected to experience a 9.4% earnings growth rate this year. The Zacks Consensus Estimate for current earnings has improved by 3.1% in the past 60 days. Currently, CME holds a Zacks Rank of #2.

Image Source: Zacks Investment Research

Accenture plc

Accenture plc operates as a global system integrator, providing consulting and technology services, with a focus on Ethereum-based blockchain solutions for businesses, aimed at enhancing payment processes.

Accenture is expected to achieve a 6.9% growth in earnings this year. The Zacks Consensus Estimate has increased by 3.2% in recent months, and ACN currently holds a Zacks Rank of #2.

Image Source: Zacks Investment Research

Research Chief Names “Single Best Pick to Double”

From a selection of thousands, five Zacks experts have identified their top stock picks expected to rise by +100% or more in the upcoming months. From these, Director of Research Sheraz Mian has selected one that stands out for its explosive potential.

This company targets millennial and Gen Z consumers, generating nearly $1 billion in revenue last quarter alone. Recent price adjustments present an opportune moment for investment. Previous successful picks from Zacks include Nano-X Imaging, which surged by +129.6% in just over nine months.

Get free access: See Our Top Stock And 4 Runners Up.

Stay updated with the latest recommendations from Zacks Investment Research! Download your free report on 5 Stocks Set to Double today.

CME Group Inc. (CME): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

For the full article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.