S&P 500 Correction: Top Stocks to Consider Now

Last week, investors witnessed a significant market development: the S&P 500 entered correction territory, defined as a decline of at least 10%. However, this correction may be short-lived. Currently, the S&P 500 is down less than 8% from its all-time high, suggesting a potential rebound.

Despite the overall market’s recent resilience, numerous high-quality S&P 500 stocks have seen a decline of 20% or more. Among these are Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Vistra (NYSE: VST), Dollar General (NYSE: DG), and Airbnb (NASDAQ: ABNB).

Start Your Mornings Smarter! Subscribe to Breakfast news for market insights every trading day. Sign Up For Free »

Here are reasons to consider buying these four stocks while they are down.

1. Alphabet

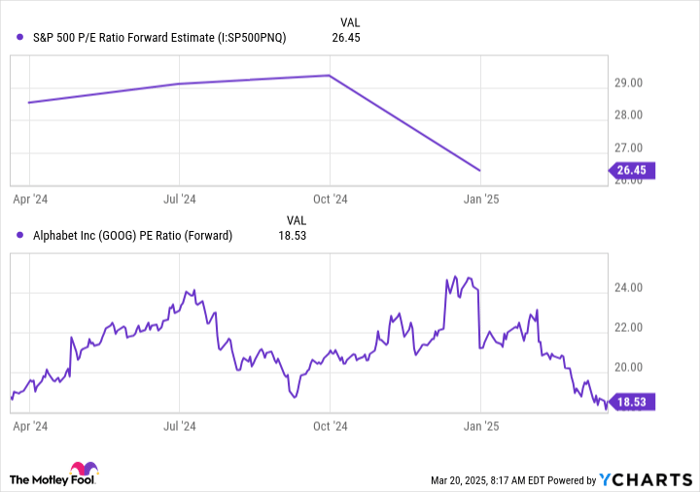

Alphabet, part of the “Magnificent Seven”—the world’s most valuable companies—stands out for its valuation. Currently, it trades for less than 19 times its projected earnings, making it the cheapest of the group and below the S&P 500 average, which exceeds 26 times, according to YCharts.

S&P 500 P/E Ratio Forward Estimate data by YCharts

Some may question if Alphabet is below average because of its valuation. However, the company provides access to various high-growth businesses, including its vast advertising segment, which grew 11% year over year to $72 billion in 2024. Additionally, its cloud computing division saw impressive growth of 30% to $12 billion.

Alphabet is well-prepared for future growth in sectors such as artificial intelligence (AI), quantum computing, and robotics. As trends evolve over the next decade, Alphabet is likely to remain a fundamental player in these areas.

For investors, missing the opportunity to invest in a quality company like Alphabet at a reduced price could lead to regret. With its stock down 20% from highs, Alphabet warrants serious consideration at this time.

2. Vistra

While the AI trend might not resonate with every investor, the increasing demand for electricity certainly does. This is why a closer look at Vistra Stock is worth considering, especially as it is down 32% from its peak earlier this year.

The U.S. Energy Information Administration reported that from 2012 to 2022, electricity consumption grew at a meager 0.5% annually. In contrast, Grid Strategies forecasts that U.S. electricity demand will surge at 3% annually through 2029, fueled by trends like AI and electric vehicles.

With the current electricity grid under pressure, companies like Vistra are well-positioned for significant growth. Analysts expect a heightened reliance on nuclear energy by companies like Vistra, which is the second-largest competitive nuclear power producer in the country.

This year, Vistra anticipates adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $5.5 billion to $6.1 billion. Given its enterprise value of $62 billion, this represents a valuation of just 10 to 11 times EBITDA, appealing for a company poised for long-term growth.

3. Dollar General

This may not be the most exciting stock, but Dollar General remains an investment to consider. Currently, it has plummeted 68% from its highs in late 2022.

Despite the decline, the company maintains solid fundamentals, as evidenced by a 5% increase in net sales, reaching a record $40.6 billion in 2024. Moreover, customer traffic was down only 1% from the previous year, showing consumer loyalty remains intact.

While profit margins have suffered, the stock now trades at a low valuation of just 16 times current earnings. Management is working to stabilize financial performance, suggesting potential for earnings growth in 2025 and beyond.

In the current economic climate, consumers often seek out Dollar General for savings, enhancing the company’s resilience and growth prospects moving forward.

4. Airbnb

Finally, we turn to Airbnb Stock, which is down 21% from its 2025 highs. It has not reached an all-time high since early 2021, which is surprising considering its growth trajectory and opportunities ahead.

Although some investors criticize Airbnb, alleging it is losing market share to hotels due to its service fees, such claims lack substantiation according to market data. In reality, Airbnb’s growth potential continues to highlight its resilience in the travel and hospitality sector.

Airbnb Surpasses Booking Records with Strong Cash Flow in 2024

In 2024, Airbnb recorded more nights and experiences booked than ever before, despite rising average prices. This trend suggests that increased demand persists even amidst higher costs.

The uptick in bookings is generating record free cash flow for Airbnb, which is a vital indicator of the company’s profitability. Notably, the stock currently trades close to its lowest valuation from a free cash flow standpoint.

ABNB Price to Free Cash Flow data by YCharts

Airbnb’s stock remains a compelling buy, having dipped 21% from its highs in 2025. Investors are also presented with an opportunity for additional growth as management plans to introduce new business initiatives inspired by Amazon starting in 2025.

From my perspective, Airbnb presents an attractive investment based solely on its core operations. If the company experiences unexpected success in other ventures, similar to Amazon’s feats in cloud computing, shareholders could benefit significantly.

Whether you find Airbnb appealing or favor giants like Alphabet, Vistra, or Dollar General, a universal truth remains: every solid stock faces a drop of 20% or more at some stage. Hesitating on the sidelines awaiting such declines can lead to missed opportunities. Conversely, capitalizing on price drops is an effective strategy for enhancing long-term returns.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

If you’ve ever felt like you’ve missed the chance to invest in top-performing stocks, you’ll want to pay attention now.

Our expert analysts occasionally issue a “Double Down” Stock recommendation for companies poised for growth. If you believe you’ve missed your chance to invest, now is an excellent time to enter before the opportunity slips away. The numbers substantiate this approach:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $305,226!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $41,382!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $517,876!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and this may be a rare chance you won’t want to overlook.

Continue »

*Stock Advisor returns as of March 18, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, also holds a position on the board. Jon Quast has investments in Airbnb, Dollar General, and Vistra. The Motley Fool invests in and recommends Airbnb, Alphabet, and Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.