The Zacks Agriculture – Products industry has been grappling with high input costs, labor shortage, and supply-chain headwinds, compounded with the challenge of declining commodity prices. Nonetheless, the industry is buoyed by increasing consumer awareness of food ingredients and the growing preference for healthier alternatives. Additionally, alternative agricultural technologies like hydroponics and vertical farming are set to be pivotal drivers, offering inherent benefits to the sector.

Companies such as West Fraser Timber Co., CalMaine Foods, GrowGeneration, Hydrofarm, and Arcadia Biosciences stand poised to capitalize on the robust demand in their end markets and continued growth initiatives.

About the Industry

The Zacks Agriculture – Products industry encompasses companies engaged in storing agricultural commodities, distributing ingredients, and farming crops, livestock, and poultry. Some are involved in purchasing, storing, and selling agricultural commodities, while others offer innovative plant-based health and wellness products. The industry also includes companies producing lumber.

Future Trends in the Agriculture – Products Industry

Low Commodity Prices, High Costs Act as Woes: An array of factors such as high interest rates, a strong dollar, and favorable weather conditions have led to a decline in agricultural commodity prices. Coupled with rising production costs, this trend is expected to impact U.S. net farm income. Companies are responding by implementing cost-reduction measures and pricing strategies to uphold margins.

Solid Demand to Support Industry: With population growth and demographic changes, the global food demand is projected to rise, paving the way for companies to invest in innovation and offer healthier food alternatives. Improvements in grain-handling techniques and investment in larger storage spaces are set to bolster the industry.

Hydroponics & Cannabis Act as Key Catalysts: The popularity of hydroponics, which enables faster crop production and higher yields, along with the rising utilization of vertical farming, presents extensive growth opportunities. Despite challenges, the long-term prospects for the cannabis industry remain promising, especially as several states in the United States have legalized its use.

Industry’s Rank and Performance

Zacks Industry Rank Indicates Dull Prospects: The Zacks Agriculture – Products industry currently carries a Zacks Industry Rank #220, placing it in the bottom 12% of the 251 Zacks industries. This position reflects a downward earnings per share estimate for the constituent companies.

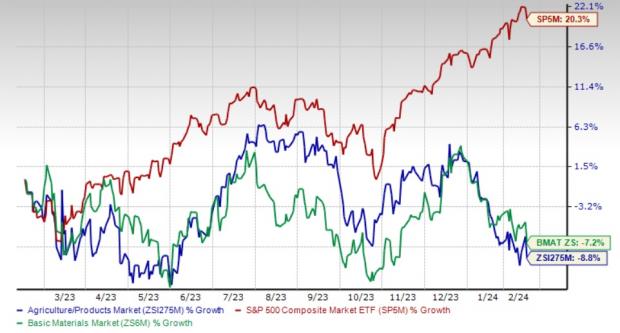

Industry Versus Broader Market: Over the past 12 months, stocks in the Agriculture – Products industry have underperformed the S&P 500 composite and the Basic Materials sector, declining by 8.8% as compared to the S&P 500’s growth of 20.3% and the Basic Materials sector’s decline of 7.2%.

One-Year Price Performance

Industry’s Current Valuation

Based on the trailing 12-month EV/EBITDA ratio, the Agriculture – Products industry is currently trading at 5.65X compared with the S&P 500’s 16.96X, while the Basic Materials sector’s trailing 12-month EV/EBITDA is 15.22X.

Enterprise Value/EBITDA (EV/EBITDA) Ratio (TTM)

Thriving Industries: A Look at 5 Agricultural Product Stocks

Highs and Lows of EV/EBITDA Ratio in the Industry

West Fraser: Nurturing Growth Amidst Demand Surge

As the agricultural industry grapples with fluctuating tides, West Fraser stands tall in the surge. The Vancouver-based company has solidified its foundation amidst the robust demand for Oriented Strand Board (OSB), plywood, and engineered products in North America, synonymous with the boom in new home construction markets. West Fraser’s strategic finesse, such as optimization through acquisitions and divestitures, has fortified its position in the market. The recent procurement of Spray Lake Sawmills in Cochrane, AB, aligns seamlessly with its lumber and treated wood business, showcasing a harmonious synergy between growth and stability. By emphasizing operational efficiency and cost reduction, the company is not only expanding its margins but also solidifying its competitive edge and financial flexibility.

Price & Consensus: WFG

CalMaine Foods: Elevating Growth Trajectory with Strategic Acquisitions

CalMaine Foods hails as the leading producer and distributor of fresh shell eggs in the United States, soaring high with its commitment to expansion and innovation. The company’s strategic acumen comes to the fore with the acquisition of the commercial shell egg production and processing facilities of Fassio Egg Farms, bolstering its endeavor to expand its cage-free egg production capacity. In the wake of surging demand for specialty eggs, including cage-free eggs, the company is treading on a profitable path augmented by meticulous acquisitions. Such strategic prowess has propelled CalMaine Foods to a vantage position driven by forward-looking consumer preferences and state mandates, seamlessly translating into a larger share of its product mix and burgeoning sales of cage-free eggs. With its recent agreement to acquire a broiler processing plant, hatchery, and feed mill in Dexter, MO, the company is poised to further stamp its footprint in Missouri and surrounding markets.

Price & Consensus: CALM

.jpg)

GrowGeneration: Nurturing Growth Amidst Digital Transformation

In the heart of Greenwood Village, GrowGeneration has been scripting its success story with an unwavering focus on expanding its store presence and digital transformation endeavors. The company is wading through uncharted waters by building and growing its private brands, investing in accretive acquisitions, and expanding its footprint in the United States. Its steadfast approach to acquire well-established, profitable hydroponic garden centers and proprietary brands epitomizes its unwavering commitment to nurturing growth. The company’s emphasis on managing costs, lowering inventory, and consolidating its store footprint is bearing fruit, evident in the anticipated margin expansion and the favorable impacts of a greater proportion of private label and proprietary brand sales. This, coupled with its relentless progress on digital transformation efforts, sets the stage for an era of enhanced supply chain efficiencies and bolstered results, underlining a narrative of resilience and adaptability.

Price: GRWG

Hydrofarm: Pioneering Operational Efficiency Amidst Expansion

Amidst a challenging operating environment, Hydrofarm emerges as a beacon of operational efficiency and strategic optimization. The Shoemakersville-based company is navigating through turbulent waters by streamlining operations, reducing costs, and enhancing efficiencies. By undertaking monumental initiatives such as narrowing the product and brand portfolio and relocating and consolidating certain manufacturing and distribution centers, Hydrofarm is sculpting a paradigm of resilience and adaptability. These epochal efforts are not only expected to bolster margins but also catalyze the reduction of costs by improving the brand sales mix and enhancing productivity, accentuating Hydrofarm’s unwavering commitment to pioneering operational efficiency amidst geographic expansion and pivot towards serving a wider spectrum of end users.

Price: HYFM

Arcadia Biosciences: Navigating Growth Trajectory with Strategic Innovation

Arcadia Biosciences, based in Davis, CA, continues to embellish its growth narrative by steering a course of strategic innovation and prudent cost management. The company’s relentless endeavors in executing Project Greenfield, its three-year strategic plan, have ushered in an era of growth and profitability. By streamlining its business to focus on higher-margin brands and aggressively managing costs, Arcadia has etched a narrative of resilience and adaptability, affirming its resolve to foster growth and profitability. The company marches forward with unequivocal momentum, with a strategic thrust in expanding its range with the launch of better-for-you pancake and waffle mixes, marking a significant foray into an established category. This relentless spirit of innovation and expansion underscores Arcadia’s signature blend of strategic acumen and unwavering commitment to fortifying its growth trajectory amidst changing tides and dynamic consumer preferences.

Price: RKDA

Opportunity Beckons for Arcadia Biosciences, Inc. (RKDA)

The Promising Breakthrough

Amidst the vast sea of stocks, Zacks experts have handpicked a single stock with the potential to double, and that stock is none other than Arcadia Biosciences, Inc. (RKDA). Lauded for its “watershed medical breakthrough,” the company is on a mission to revolutionize the treatment landscape for patients grappling with liver, lung, and blood-related diseases.

As it emerges from the depths of a bear market, RKDA is ripe for the picking, offering an investment opportunity akin to finding a treasure trove in the midst of desolation.

A Sprouting Pipeline

Beyond its groundbreaking medical innovation, Arcadia Biosciences, Inc. (RKDA) is also in the process of nurturing a robust pipeline of projects. These undertakings hold the promise of bringing about a paradigm shift in the lives of countless patients grappling with various ailments. The potential embedded within RKDA is akin to a budding rosebush, poised to blossom into something truly magnificent.

Rivaling the Success Stories

The aspirations for Arcadia Biosciences, Inc. (RKDA) soar high, with the potential to rival or even surpass the astronomical success of recent companies like Boston Beer Company and NVIDIA, which saw their stocks double and then some. The percolating potential within RKDA is reminiscent of a hidden gem waiting to be discovered and cherished by discerning investors.

Free: See Our Top Stock And 4 Runners Up

West Fraser Timber Co. Ltd. (WFG) : Free Stock Analysis Report

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

Arcadia Biosciences, Inc. (RKDA) : Free Stock Analysis Report

GrowGeneration Corp. (GRWG) : Free Stock Analysis Report

Hydrofarm Holdings Group, Inc. (HYFM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.