Delving into the Role of Copper in Clean Energy Transition

Amidst the accelerating global shift towards sustainable energy solutions, copper emerges as a linchpin in the clean energy narrative. Esteemed for its unparalleled conductivity amongst non-precious metals, its malleability allowing for versatile applications, its superior thermal efficiency surpassing aluminum, and its endless recyclability without compromising performance.

The surge in demand for copper is inevitable as multiple clean energy technologies like solar power, wind energy, electric vehicles (EVs), and bioenergy are heavily reliant on this industrious metal. Projections by S&P Global Market Intelligence indicate an 82% surge in copper demand between 2021 and 2035, underscoring the vital role copper will play in the foreseeable future.

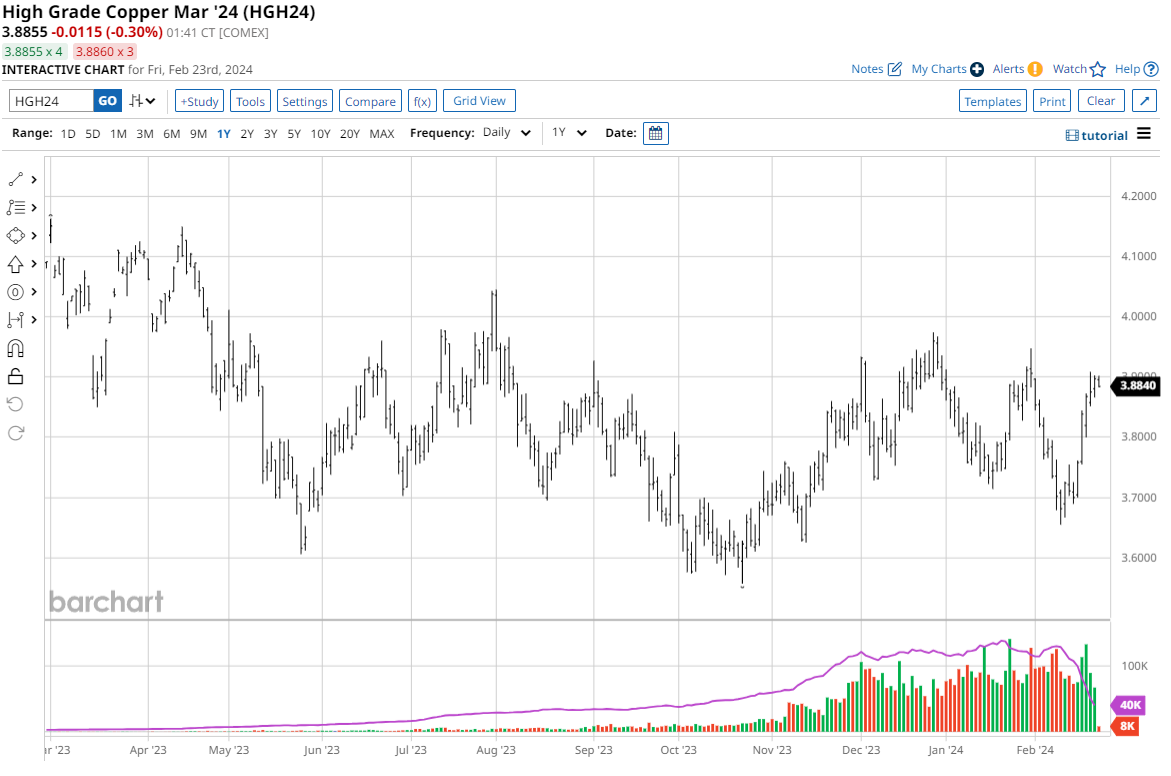

The Chinese Influence and Recent Price Volatility

Nonetheless, recent fluctuations in copper prices have rattled the market, with much of the blame resting on China’s subdued economic activity. The world’s largest consumer of copper has experienced a slowdown, contributing to a dip in March copper futures. Though prices have rebounded from recent lows, the uncertainty continues to linger.

Exploring 5 Copper ETFs to Consider

US Copper (CPER)

US Copper (CPER), established in October 2012 by USCF Investments, focuses on tracking copper futures contracts net of expenses, reflecting its strong belief in copper’s future growth trajectory. With an AUM of $125.1 million and an expense ratio of 0.88%, this ETF presents a compelling opportunity amidst the evolving copper landscape.

GX Copper Miners ETF (COPX)

Launched in May 2011 by Global X ETFs, the GX Copper Miners ETF (COPX) seeds investments in companies actively engaged in copper mining and exploration, aiming to provide exposure to the lucrative copper industry. Boasting an AUM of around $1.4 billion and an expense ratio of 0.65%, COPX is a strategic bet on the future of copper.

Sprott Junior Copper Miners ETF (COPJ)

Introduced in January 2023 and managed by Sprott Asset Management, COPJ directs its investments towards mid-, small-, and micro-cap companies entrenched in copper mining, generating a nuanced exposure to this vibrant sector. Despite being down 4.1% on a YTD basis, COPJ with an AUM of $4.9 million offers potential opportunities in the junior copper mining space.

iShares Copper and Metals Mining ETF (ICOP)

Under the stewardship of BlackRock, the iShares Copper and Metals Mining ETF (ICOP) offers investors exposure to U.S. and non-U.S. companies primarily engaged in copper and metal ore mining. With an AUM of $4.9 million and an expense ratio of 0.47%, ICOP presents an intriguing avenue to tap into the dynamics of the copper mining sector.

iShares Global Select Metals & Mining Fund (PICK)

Also managed by BlackRock and initiated on January 31, 2012, PICK grants investors exposure to a diversified basket of global companies engaged in metals and mining operations. With an AUM of $1.1 billion and an expense ratio of 0.39%, PICK, despite being down 7.4% YTD, serves as a comprehensive play on the broader metals and mining landscape.

The opinions expressed in this article are for informational purposes only and do not constitute financial advice. The author may not hold positions in the securities mentioned. Always conduct thorough research before making any investment decisions.

The expressed views and opinions are solely those of the author and not reflective of Nasdaq, Inc.