In a historic turn of events on Feb 14, the foremost cryptocurrency, Bitcoin (BTC), achieved a momentous milestone by closing the day with a market capitalization exceeding $1 trillion, a feat not seen since December 2021. During intraday trading, the digital currency surged to $52,079, marking its highest level in over a year. This remarkable milestone caps a period of resurgence for the crypto market, following an impressive rally in the preceding year. The highly-anticipated reform in the cryptocurrency space materialized on Jan 10 as the U.S. Securities and Exchange Commission (SEC) sanctioned rule changes, permitting the creation of spot Bitcoin exchange-traded funds (ETFs). A total of 11 spot Bitcoin ETFs were introduced last month, setting the stage for an eventful year in the cryptocurrency domain.

After skyrocketing by 157% in 2023, Bitcoin has sustained its upward trajectory in 2024, registering a year-to-date surge of over 20%. The enduring allure of Bitcoin is underscored by the SEC’s epoch-making decision, poised to integrate the entire crypto sphere into mainstream finance. The SEC’s landmark ruling positions Bitcoin as an attractive investment avenue for individuals, money managers, and financial institutions, enabling them to gain exposure to the world’s largest cryptocurrency sans direct ownership. Furthermore, the impending Bitcoin halving in the first half of 2024 looms large. As a halving event entails a reduction in the reward for mining new blocks, it intensifies the challenge for miners to earn net Bitcoins, historically inducing scarcity and propelling the value of Bitcoin due to diminished supply.

Our Top Selections

We have diligently winnowed down our prospects to five cryptocurrency-centric stocks that exhibit robust potential for 2024. Each of our picks holds a Zacks Rank #2 (Buy). Check out the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NVIDIA Corp. (NVDA) stands out as a semiconductor juggernaut and one of the most resounding success stories of 2023. As a premier designer of graphic processing units (GPUs), NVDA stock typically surges in tandem with a flourishing crypto market, owing to the pivotal role of GPUs in data centers, artificial intelligence, and cryptocurrency creation. NVIDIA is anticipated to witness an earnings growth rate of 63.1% for the current year, ending January 2025. The Zacks Consensus Estimate for its current-year earnings has edged up by 1.8% over the past 30 days.

CME Group Inc., through its CME options, endows the buyer of the call/put with the right to buy/sell cryptocurrency futures contracts at a predetermined price in the future. CME offers Bitcoin and ether options predicated on the exchange’s cash-settled standard and micro-Bitcoin and Ethereum futures contracts. CME Group is expected to witness a 2.3% earnings growth rate for the current year, with the Zacks Consensus Estimate for current-year earnings demonstrating a 0.4% improvement over the last 60 days.

Interactive Brokers Group Inc. (IBKR), a global automated electronic broker, executes, processes, and trades in cryptocurrencies and also provides customers with the opportunity to trade cryptocurrency futures via its commodities futures trading desk. The company is anticipated to experience a 5.6% earnings growth rate for the current year, with the Zacks Consensus Estimate for current-year earnings witnessing a 0.7% enhancement over the last 60 days.

CleanSpark Inc. (CLSK) operates as a bitcoin miner in the Americas, owning and operating data centers that primarily run on low-carbon power. CLSK’s infrastructure catalyzes Bitcoin, serving as a digital commodity and a conduit for financial independence and inclusion. CleanSpark is poised for an earnings growth rate of 81.4% for the current year, ending September 2024, with the Zacks Consensus Estimate for current-year earnings having surged by more than 100% in the past seven days.

Iris Energy Ltd. (IREN), a Bitcoin mining enterprise, constructs, owns, and operates data center infrastructure, with a focus on venturing into regions with abundant and/or under-utilized renewable energy resources to power its operations. IREN anticipates an earnings growth rate exceeding 100% for the current year, ending June 2024, with the Zacks Consensus Estimate for current-year earnings having soared by over 100% in the last 30 days.

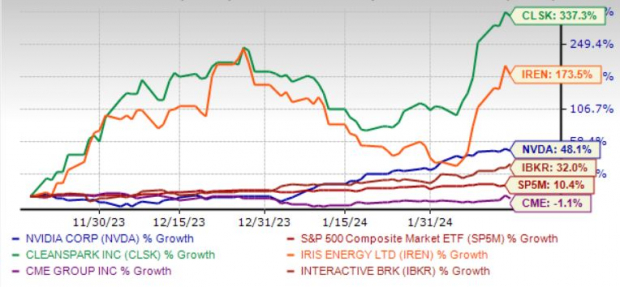

The chart below depicts the price performance of our five selections over the past three months.

Image Source: Zacks Investment Research

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CME Group Inc. (CME) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Cleanspark, Inc. (CLSK) : Free Stock Analysis Report

Iris Energy Limited (IREN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.