Market Outlook: Four Key Factors Point to Rising Stocks

Throughout most of 2024, the Stock market experienced stable growth. Despite some pullbacks exceeding 5%, the S&P 500 surged nearly 20% from January 1 through the end of October.

However, the unfolding U.S. presidential election and Donald Trump’s subsequent win disrupted this upward trend, turning the market’s steady ascent into a tumultuous roller coaster ride.

As the new year commenced, stock prices initially fell, followed by a robust rally that pushed the S&P up over 5% by mid-February. Yet, another selloff began shortly after, resulting in approximately a 7% decline over the past month—the steepest drop since 2022.

Although uncertainties linger, we believe stocks are nearing a pivotal moment—and we anticipate a significant rise heading into summer.

Here are five crucial factors driving this optimistic forecast…

Resolution of Tariff Concerns

Primarily, we anticipate the ongoing tariff situation will soon be resolved.

The initial months of Donald Trump’s second term have seen a flurry of tariff announcements. For a period, new duties seemed to be threatened every week.

This uncertainty has fostered economic anxiety, leading to reduced economic activity, lower consumer confidence, and heightened fears of inflation.

A major development is expected on Wednesday, April 2—dubbed “Liberation Day” by Trump. On this day, he plans to unveil a significant round of tariffs. According to the president, this will be the “big one,” possibly involving reciprocal tariffs on several countries and sector-level tariffs (though recent information suggests this may not come to fruition).

However, we believe this event will end with more of a whimper than a bang.

Treasury Secretary Scott Bessent has recently indicated his expectation that the U.S. will begin negotiating trade deals with its major trading partners shortly after “Liberation Day,” implying that the tariffs may not be long-lasting. If he is accurate, the current turmoil could conclude swiftly.

Once the “big one” is delivered, Trump will negotiate his proposed trade agreements. If those tariffs are subsequently lifted, we foresee no further significant developments in the situation. Hence, we regard this as the culmination of this chapter.

The likely scenario includes: “Liberation Day” arrives, new tariffs are enforced, trade negotiations occur, tariffs are repealed, and we move past this turmoil.

Such a resolution should catalyze a stock market rally into summer.

Shifts Toward Tax Cuts and Rate Cuts

Once tariff uncertainties are alleviated, the White House is likely to focus on enacting tax cuts.

While Wall Street disdains tariffs, it welcomes tax cuts—this sentiment drove stocks higher after Election Day, with investors eager for substantial tax reductions.

Despite Wall Street’s expectations, the White House has remained focused on tariffs since Inauguration Day, delaying the progress on tax cut initiatives. However, this is slated to change by late April.

After resolving the “Liberation Day” agenda, we expect to see numerous headlines signaling progress toward tax cuts over the summer months.

This anticipated policy shift should provide a significant boost to stocks during April, May, and June.

Additionally, another turning point on the horizon is the U.S. Federal Reserve’s potential return to rate-cutting.

The Fed has enacted several interest rate cuts in 2024 but paused over the past four months due to lingering inflation concerns. Signs are emerging that inflationary pressures are easing, with oil prices falling below $70 per barrel and the Truflation rate dropping below 2% in March. Furthermore, the economy is showing signs of strain, evident in a decline in consumer spending and a notable drop in consumer confidence.

Consequently, the Fed is likely to resume its path toward rate cuts soon.

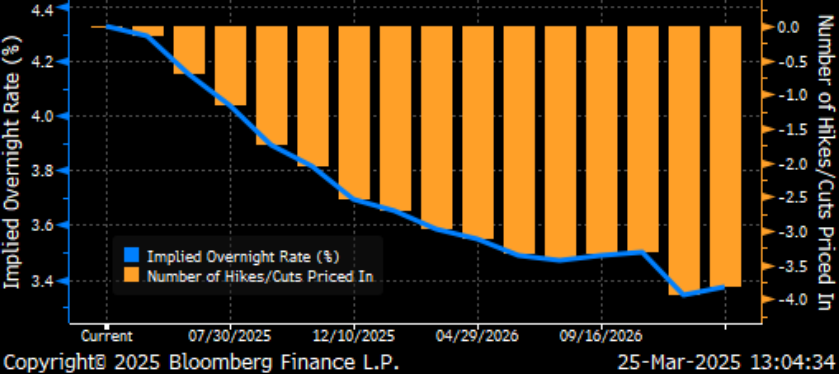

Wall Street anticipates another rate cut by July and expects the central bank to reduce rates two to three times this year. We believe the Fed could cut rates earlier, possibly in June, and foresee four cuts throughout 2025.

Potential Federal Reserve Rate Cuts Could Boost Stock Market

Multiple rate cuts by the Federal Reserve seem likely, which could substantially benefit stock markets.

Economic Recovery Ahead with Tariffs and Interest Rates Shifting

As tariff tensions ease, expectations for tax cuts increase, and the Federal Reserve potentially lowers interest rates, the economy could regain considerable strength.

Currently, key economic indicators show troubling trends. Consumer spending is slowing down, and consumer confidence is wavering. The Guardian reported that the Conference Board’s latest survey revealed future expectations plunged to a 12-year low, signaling potential economic downturn.

Moreover, economic activity is diminishing while inflation expectations are on the rise. According to the Federal Reserve Bank of Atlanta, businesses’ inflation expectations for the next year climbed by 0.2 percentage points to an average of 2.5 percent this March.

Despite this, we anticipate a reversal in these trends due to the ongoing adjustments. A rebound in consumer confidence and spending is expected alongside an uptick in economic activity, which would help moderate inflation expectations.

If these anticipated shifts materialize, they could provide a significant boost to stock markets this spring.

To summarize, as tariff issues resolve, tax cuts are introduced, and the Fed implements rate cuts, the economy is likely to gather momentum. Furthermore, strong quarterly earnings reports could enhance this positive outlook.

Wall Street has already begun to adjust earnings estimates downward, reflecting recent economic challenges. While some bearish analysts view this as a reason to sell stocks, we see it as a buying opportunity.

Lowered earnings expectations mean companies may find it easier to meet or exceed their targets in the upcoming reporting season. By that time, we believe key economic indicators will have improved.

In turn, robust earnings could contribute to further stock market growth.

The combination of these factors presents a compelling case for a potential recovery in stocks as we approach summer.

Assessing Risks in a Potential Stock Market Rally

While the outlook is optimistic, some risks persist.

Our bullish perspective hinges on one major assumption: that new tariffs set to be introduced next week will not linger for long.

There is always the possibility that the United States might struggle to finalize significant trade agreements, leading to prolonged tariff conditions. This scenario could entrench the current trade disputes further into the global market landscape.

If such developments occur, the stock market may face substantial challenges in the coming months.

From our viewpoint, the artificial intelligence (AI) sector presents a possible safe haven during broader market downturns.

Bloomberg’s Artificial Intelligence Aggregate index (Stock-ticker”>BAIAET) offers a strong representation of this sector. It is currently at critical support levels, specifically the 250-day moving average, which it has yet to breach. Additionally, trading at a forward P/E of 21X marks the lowest valuation since the index’s inception, despite consistently rising forecasts for AI companies.

Investing in the Future: The Rise of Physical AI and Humanoid Robots

The landscape of artificial intelligence is transforming rapidly, signaling opportunities for both security and surplus in investment. The next phase of this technological revolution appears to be centered around the development of physical AI and humanoid robots.

Traditionally, AI has been associated with software applications and virtual assistants. However, advancements are paving the way for a new era, where physical manifestations of AI, such as robots, become commonplace. The introduction of Tesla‘s (Stock-ticker”>TSLA) Optimus robot exemplifies this shift, and major tech companies are now entering the competition, following in the footsteps of Elon Musk.

The next chapter of the AI revolution is unfolding now.

As we stand on the brink of this significant breakthrough, the opportunity to invest alongside influential figures such as Musk is emerging. Many speculate that Optimus could fundamentally reshape society and may become viewed as Musk’s crowning achievement.

Furthermore, there exists a strategic way to gain exposure to this innovative trend through investments in key suppliers involved in the development of humanoid robots.

Discover how you can engage with this transformative market opportunity today.

On the date of publication, Luke Lango did not hold (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. Stay updated with Luke’s latest insights and market analysis by checking our Daily Notes! Visit our Innovation Investor or Early Stage Investor subscriber sites for the latest updates.