Top 5 Stocks to Watch for Long-Term Growth

Investors aim to own quality stocks at reasonable prices, holding onto them for years while their values increase. However, identifying those companies can be a challenge. Below, we present five strong investment options worth considering—make sure to find the right price and keep an eye on them. (One of these is an exchange-traded fund, which operates like a stock.)

Image source: Getty Images.

Here’s a summary of their performance records. While these results are impressive, remember that past performance does not guarantee future success.

|

Asset |

5-Year Average Annual Return |

10-Year Average Annual Return |

15-Year Average Annual Return |

|---|---|---|---|

|

Costco Wholesale (NASDAQ: COST) |

25.5% |

22.7% |

20.5% |

|

Paycom Software (NYSE: PAYC) |

(4.8%) |

25.8% |

N/A |

|

Amazon (NASDAQ: AMZN) |

16% |

28.6% |

27.7% |

|

Intuitive Surgical (NASDAQ: ISRG) |

21.9% |

25.1% |

20.7% |

|

Vanguard Information Technology ETF (NYSEMKT: VGT) |

23.3% |

21.8% |

19.1% |

Source: Morningstar.com as of Oct. 17, 2024.

1. Costco

Costco Wholesale’s market capitalization recently surpassed $390 billion. The company successfully balances the needs of its employees, consumers, and shareholders with competitive pay, solid dividends, and low prices, maintaining markups mostly capped at 13% to 14%. Currently, Costco operates 891 warehouse stores, with 614 (or 69%) located in the U.S.

While Costco’s quarterly dividend yields only 0.5%, it also provides substantial “special” dividends, such as $15 per share in 2023 and $10 per share in 2020. However, its stock appears to be overpriced, with a forward price-to-earnings (P/E) ratio of 50.1 compared to a five-year average of 37.5. If you don’t own it yet, consider adding it to your watch list.

2. Paycom

Paycom presents a more attractive valuation with a forward P/E of 18, significantly lower than its five-year average of nearly 44. Recently, the company began paying a dividend that yields about 0.9% at current share prices.

This software company offers payroll and human resources management tools. Though its business faced challenges recently, due largely to its new self-service Beti platform pulling customers from other services, the impact is expected to be temporary. Paycom remains profitable with no debt, and its revenue grew by 9% year over year in the second quarter.

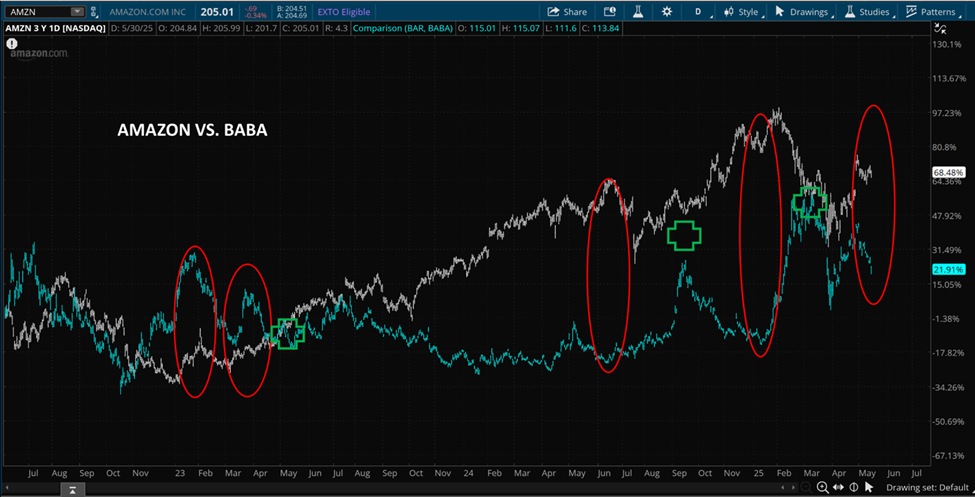

3. Amazon

Amazon is universally recognized—chances are, you’ve received a delivery from them. Its stock currently has a forward P/E of 31.6, which is attractive compared to its five-year average of 53.4.

As part of the “Magnificent Seven” stocks, Amazon operates in various segments beyond just its vast online marketplace, including Amazon Web Services, a leading cloud computing provider. Despite its size, Amazon continues to grow its revenue and is exploring new sectors such as healthcare. The company does not pay a dividend.

4. Intuitive Surgical

In healthcare, Intuitive Surgical leads the market in robotic surgical systems. As of June, over 15 million surgeries have been performed using its da Vinci systems, with 9,800 devices installed globally.

Recently, the company reported an 18% year-over-year increase in procedure volume, with revenue up 17%. A significant portion of its revenue is recurring, derived from service contracts and related supplies. Expect further growth as the market expands. However, Intuitive’s stock is currently valued at a forward P/E of 62.9, above its five-year average of 52.7, indicating it may not be a bargain at this time.

5. Vanguard Information Technology ETF

The Vanguard Information Technology ETF encompasses over 300 stocks, with about 44% of its value concentrated in three major companies: Apple, Nvidia, and Microsoft. For those not keen on picking tech stocks individually, this ETF offers a diversified investment option across numerous tech leaders.

Consider researching any of these investments that catch your eye. Gaining familiarity with them might lead you to invest or track them for future opportunities.

Explore New Investment Opportunities

Have you ever felt you missed out on purchasing high-performing stocks? If so, now might be the right time to act.

Every so often, financial analysts recommend stocks they believe will soon rise in value. If you think you’ve lost your chance to invest, consider acting now. Historical returns speak volumes:

- Amazon: A $1,000 investment in 2010 would now be worth $21,294!

- Apple: A $1,000 investment in 2008 would now be valued at $44,736!

- Netflix: A $1,000 investment in 2004 would now be an impressive $416,371!

Currently, “Double Down” recommendations are available for three promising companies, and opportunities like this do not appear often.

See three “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Selena Maranjian has positions in Amazon, Apple, Costco Wholesale, Intuitive Surgical, Microsoft, Nvidia, and Paycom Software. The Motley Fool holds and recommends these stocks as well. They also recommend long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.