Author’s Note: This is our monthly series on dividend stocks, usually published in the first week of every month. We scan the universe of roughly 7,500 stocks listed and traded on U.S. exchanges and use our proprietary filtering criteria to select five relatively safe stocks that may be trading cheaper compared to their historical valuations. Some of the sections in the article, like “Selection Process/Methodology,” are repeated each month with few changes. This is intentional as well as unavoidable, as this is necessary for the new readers to be able to conceptualize the process. Regular readers of this series could skip such sections to avoid repetitiveness.

************

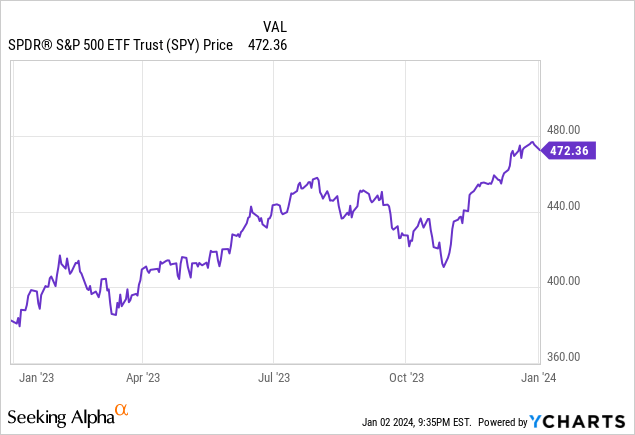

The year 2023 ended on a very high note for the markets. The S&P 500 gained nearly 26% for the year; the Nasdaq index did even better. The final push in the month

of December was mostly on the hopes of multiple rate cuts by the Fed in 2024, and the market may get its wish fulfilled. The worries about a recession have mostly faded away. However, the market is always full of surprises, and it often finds ways to act differently than most people expect.

Nonetheless, to be a successful investor, fortunately, we do not need to know exactly where the market is going. We believe it is not possible to catch the exact bottom (or the peak), so it is best to invest regularly and consistently in good, solid dividend-paying stocks when their valuations are attractive. Against this backdrop, keeping some cash reserves and dry powder ready to deal with any scenario is important.

The main goal of this series of articles is to shortlist and highlight companies that have a solid history of paying and raising dividends. In addition, we demand that these companies support strong fundamentals, carry low debt, and are offered at a relatively cheaper valuation. These DGI stocks are not going to make anyone rich overnight, but if your goal is to attain financial freedom by owning stocks that would grow dividends over time, meaningfully and sustainably, then you are at the right place. These lists are not necessarily recommendations to buy but a short list of probable candidates for further research. The purpose is to keep our buy list handy and dry powder ready so we can use the opportunity when the time is right. Besides, every month, this analysis is able to highlight a few companies that otherwise would not be on our radar.

Every month, we start with roughly 7,500 stocks that are listed and traded on U.S. exchanges, including over-the-counter (OTC) networks. Using our filtering criteria, the initial list is quickly narrowed to roughly 700 stocks, mostly dividend-paying and dividend-growing. From thereon, by using various data elements, including dividend history, payout ratios, revenue growth, debt ratios, EPS growth, etc., we calculate a “Dividend Quality Score” for each stock that measures the relative safety and sustainability of the dividend. In addition to dividend safety, we also seek cheaper valuations. We also demand that the selected companies have an established business model, solid dividend history, manageable debt, and investment-grade credit rating.

This month, we highlight three groups with five stocks each that have an average dividend yield (as a group) of 3.42%, 5.46%, and 7.30%, respectively. The first list is for conservative and risk-averse investors, while the second is for investors seeking higher yields but still wanting relatively safe dividends. The third group is for yield-hungry investors but comes with an elevated risk, and we urge investors to exercise caution.

Notes: 1) Please note that when we use the term “safe” in relation to stocks and investments, it should be interpreted as “relatively safe” because nothing is absolutely safe in investing. Even though we present only 5 to 10 stocks in our final list, one should have 15-20 stocks at a minimum in a well-diversified portfolio.

2) All tables in this article are created by the author unless explicitly specified. The stock data have been sourced from various sources such as Seeking Alpha, Yahoo Finance, GuruFocus, and CCC-List (drip investing).

The Selection Process

Note: Regular readers of this series could skip this section to avoid repetitiveness. However, we include this section for new readers to provide the necessary background and perspective.

Goals:

We start with a fairly simple goal. We want to shortlist five large-cap companies that are relatively safe, dividend-paying, and trading at relatively cheaper valuations compared to the broader market. The objective is to highlight some of the dividend-paying and dividend-growing companies that may be offering juicy dividends due to a temporary decline in their share prices. The excess decline may be due to an industry-wide decline or one-time setbacks like negative news coverage or missing quarterly earnings expectations. We adopt a methodical approach to filter down the 7,500-plus companies into a small subset.

Our primary goal is income that should increase over time at a rate that at least beats inflation. Our secondary goal is to grow the capital and provide a cumulative growth rate of 9%-10% at a minimum. These goals are, by and large, in alignment with most retirees, income investors, and DGI investors. A balanced DGI portfolio should keep a mix of high-yield, low-growth stocks along with some high-growth but low-yield stocks. That said, how you mix the two will depend upon your personal situation, including income needs, time horizon, and risk tolerance.

A well-diversified portfolio would normally consist of more than just five stocks and preferably a few stocks from each sector of the economy. However, in this periodic series, we try to shortlist and highlight just five stocks that may fit the goals of most income and DGI investors. But at the same time, we try to ensure that such companies are trading at attractive or reasonable valuations. However, as always, we recommend you do your due diligence before making any decision on them.

Selection Criteria:

The S&P

Uncovering High Dividend Yield Companies

Currently, the S&P 500 yields less than 1.60%, making it challenging to find companies for a dividend income portfolio. The quest is to discover companies with yields at least matching or surpassing the S&P 500—without feverishly chasing unattainable returns. A screener set to filter dividend stocks yielding at least 1.50% presents nearly 2,000 potential companies on U.S. exchanges, including OTC networks. To refine these choices, a market cap of at least $10 billion and a daily trading volume exceeding 100,000 shares are required. Ensuring that dividend growth over the last five years is positive, with some exceptions, contributes to the stringent filtering process.

Finding stocks that trade at relatively cheaper valuations is also a priority, albeit not an immediate one. Yet, at this juncture, inclusivity reigns supreme to retain top-tier candidates on the list. Consequently, companies yielding 1% or higher are initially included. Furthermore, lower-yielding yet high-quality companies are added to the mix at this stage.

Refined Criteria

- Market cap > $10 billion ($8 billion in a down market)

- Dividend yield > 1.0% (some exceptions are made to include high quality but lower yielding companies)

- Daily average volume > 100,000

- Dividend growth past five years >= 0

Applying the above criteria yields a preliminary list of approximately 600 companies.

Narrowing Down the List

An initial step involves removing stocks with less than five years of dividend growth history. This entails cross-referencing an existing list of over 600 stocks with Dividend Champions, Contenders, and Challengers—a framework originally formulated by David Fish. According to this classification, stocks boasting more than 25 years of dividend increases are deemed Champions, those with over ten but under 25 years are considered Contenders, and those with over five but less than ten years are known as Challengers. Flexibility dictates the inclusion of companies paying dividends lower than 1.50% yet boasting commendable dividend records and robust dividend growth.

Following the application of these parameters, the list narrows down to 334 companies. However, a closer inspection reveals the possibility of company stability evident in consistent dividend payments despite a lack of dividend escalation from one year to the next. In certain cases, currency fluctuations might misconstrue these dividends as decreased when, in reality, this is not the case based on the native currency. To accommodate these anomalies, 74 additional companies—categorized as ‘B’ companies—earn a place on the list, resulting in a total of 400 (334 + 66) companies forming the initial roster.

Data elements are assembled from various sources, including CCC-list, GuruFocus, Fidelity, Morningstar, and Seeking Alpha, among others. Weights are then assigned based on differing criteria:

- Current yield: Reflects the yield based on the current price.

- Dividend growth history (number of years of dividend growth): Provides insights into a company’s sustained dividend payouts and increases. For category ‘B’ stocks, consecutive years of dividends paid are considered.

- Payout ratio: Indicates the company’s capacity to pay dividends from its earnings, with a preference for a low ratio suggesting potential for future dividend growth.

- Past five-year and 10-year dividend growth: Serves as indicators for recent earnings and dividend growth rates, offering insight into potential future performance.

- EPS growth: The average of the previous five years of growth and anticipated next five years’ growth, offering a comprehensive view of the company’s earnings trajectory.

- Chowder number: A metric derived by adding the current yield and the past five years’ dividend growth rate, with values of “12” or more (“8” for utilities) deemed favorable.

- Debt/equity ratio: Illuminates the company’s debt load in relation to its equity, crucial for evaluating financial stability.

- Debt/asset ratio: Provides insight into the company’s debt in relation to total assets, complementing the debt/equity ratio.

- S&P’s credit rating: Reflects the company’s debt servicing capabilities.

- PEG ratio: Also known as the price/earnings-to-growth ratio, gauges the stock’s valuation and potential for appreciation.

- Distance from 52-week high: Offers perspective on the company’s valuation and trading position in the market.

Refining the Select 50: A Step-by-Step Process

The process of paring down 399 stocks to just 50 is akin to trying to pick out the ripest apples from a bountiful orchard. It involves careful consideration, critical analysis, and a discerning eye for quality. The journey from a vast universe of stocks to a select 50 is not just a battle against quantity, but a quest for the most promising and enduring performers.

Selection Of The Top 50

First, we embark on a two-step journey, wherein the initial top 20 names are chosen based on the total weight or quality score, drawing a parallel to selecting the crème de la crème from a broad canvas of colors. Subsequently, guided by the compass of the highest dividend yield, we navigate through the overcrowded seas of industry segments to single out the top 10 stocks, thus setting the stage for the next phase of this epic culling.

- Step 1: The diverse stock tapestry is whittled down to 20 names, based on the phenomenal symmetry of total weight or quality score, prioritizing sectors that may tend to overflow at the summit. In this clash of contenders, the top two emerge victorious, earning their ticket to the next level, while the rest fade into the shadows.

- Step 2: The pursuit continues with a quest for the top 10 names, founded on the highest dividend yield. Navigating through the farrago of industry segments, we carve out a niche for two or three names from each sector, ensuring that no single domain monopolizes the stage. These 10 stocks emerge triumphant, securing their passage to the penultimate round.

- Step 3: Relying on the sacred testament of five-year dividend growth, we meticulously rank the contenders, invoking a reverence for ascension, and cherry-picking the top 10 names for further consideration, akin to finding the finest pearls in the vast ocean of stocks.

- Step 4: Embarked on the mission to uphold stocks with the highest credit rating, we construct a pantheon of reliability, culminating in the selection of the top 10 stocks adorned with the laurels of stellar credit ratings. The sanctity of diversity is upheld, ensuring no sector eclipses the other.

- Step 5: Finally, we embark on a quest for the ten names bearing the highest discount, the stocks that may be trading cheaper than their historical valuation. However, caution is exercised, with a discerning eye for their alignment with other pivotal quality criteria, fostering a symphony of resilience and prudence.

Upon the culmination of these monumental sieves, 60 names emerge for the final consideration. However, a critical review unearths the presence of duplicity, beckoning the removal of ten duplicates, and thus, leaving us with 50 names pristine in their singularity.

With each industry segment offering a platter of names, our aim is to accommodate a maximum of two or three names from any one sector, presenting a tangible exhibit of diversity and resilience within our grand roster.

Presenting the Standouts from Each Sector

Financial Services, Banking, and Insurance:

The financial terrain unfolds with its array of luminaries:

Banks- Regional: (MTB), (CFG)

Banks- Major: (JPM), (BNS)

Financial Services – Others: (MS), (ARCC)

Insurance: (CINF), (OTCQX:ZURVY)

Business Services/ Consulting:

(ADP), (V)

Industrials:

The industrial enclave showcases its prominent torchbearers:

(GWW), (PH), (DE)

Transportation/ Logistics:

(ODFL)

Materials/Mining/Gold:

Materials: (ALB)

Consumer/Retail/Others:

Fashioning the fortresses of consumer resilience:

Cons-Staples: (HSY), (PEP), (PG), (CAG)

Cons-Retail: (TGT), (TSCO), (DKS)

Tobacco: (MO), (BTI)

Communications/Media

(VZ)

Healthcare:

Pharma: (BMY), (JNJ), (MRK), (PFE)

Healthcare Ins: (UNH), (CI)

Technology:

(MSFT), (NXPI), (CSCO)

Energy:

Encompassing the energy realm, we are accompanied by:

Pipelines/ Midstream: (EPD), (ENB), (MPLX)

Oil & Gas (prod. & exploration): (EOG), (FANG)

Energy Majors: (CVX)

Utilities:

(NEE), (AES), (NRG)

Housing/ Construction:

(LEN)

REIT:

(AMH)

Final Step: Narrowing Down To Just Five Companies

In this climactic phase, we curate three distinct lists, each encompassing five stocks, tailored to meet diverse goals, dividend income, and risk levels.

The lists are:

The ‘Conservative Income’ List: Top Dividend Picks

Investors who pore over dividend stocks can breathe easy — with Seeking Alpha’s “Relatively Safe (Low-yield) Dividend list,” “Moderately High Dividend List,” and “Ultra High Dividend List,” as well as a combine list of the three, they’re sure to find a promising pick. The top 50 companies are subjected to rigorous judgments to form these lists. Making selections based on research and perceptions, the filtering process is largely automated, except for the subjective touch of the final step. Seeking Alpha prioritizes diversification across various sectors and industry segments, ensuring that the safety of dividends aligns with the overall risk profile of the group. However, additional research on the highlighted names is encouraged.

A-List (Conservative Income) Analysis

Final A-List (Relatively Safe Income):

Average yield: 3.42%

- (NEE)

- (PEP)

- (V)

- JNJ

- (ENB)

Table-1A: A-LIST (Conservative Income)

A-List Company Selections

NEE (NextEra Energy):

NextEra Energy (NEE) stands tall in the Utility sector, with a lead in clean and renewable energy production. Currently trading at a significant discount from 52-week highs, NEE’s value dip is attributed to interest rate hikes and the market’s overreaction to prolonged higher rates. Despite the short-term impact, the long-term trajectory remains unscathed. Seeking Alpha views this as an attractive and relatively safe investment amidst the current pricing environment.

PEP (PepsiCo):

PepsiCo, a global heavyweight, commands a diverse portfolio of household brands. Despite the stock trading almost 9% lower than the previous month, PepsiCo’s recent ascent to Dividend-King status, marking 50 years of consistent dividend hikes, is a notable achievement. Although the current yield is slightly reduced, its position remains indispensable in a DGI portfolio, contingent on a prudent entry price.

ENB (Enbridge):

Enbridge, a Canadian midstream energy magnate, flaunts an extensive liquid transportation network that extends across Canada and the United States. Currently trading at a considerable markdown from its fair value and nearly a quarter below its 52-week peak, Enbridge’s dividend yield, at 7.1%, is compelling and well-supported by distributable cash flow. Bolstering investor confidence, the company demonstrated robust performance in its latest quarterly results, underscoring its potential to sustain dividend growth, albeit at a tempered pace.

V (Visa):

Visa, part of the payments-processing hegemony alongside Mastercard, presents a modest dividend yield of 0.80%. Despite the tepid yield, including Visa in a group of dividend stocks augments the growth profile of the ensemble.

JNJ (Johnson and Johnson):

Johnson & Johnson, an eminent player in the healthcare domain, flaunts a diverse revenue stream and a formidable economic moat. With a comprehensive presence in medical devices, consumer healthcare products, and pharmaceutical markets, J&J maintains an enviable revenue balance. The company’s pharmaceutical division, accounting for roughly half of its revenue, enhances its appeal as a prime dividend stock.

BMY, ARCC, PFE, & VZ: A Deeper Look at High Yield Stocks

The Financial Landscape of Johnson & Johnson

Johnson & Johnson (J&J) predominately operates in three major divisions, the pharmaceutical segment being the leading revenue generator contributing to a majority of the company’s sales. The medical devices division trails closely behind with approximately 33% of the revenue share. The consumer division fills the remainder.

In a strategic move, the company is currently in the process of divesting its consumer healthcare group, Kenvue.

Financial Performance and Dividend Growth

J&J’s robust free cash flow, amounting to roughly 20% of its sales, has paved the way for a consistent and enviable track record of increasing dividends for 61 consecutive years. The company boasts a decent dividend yield of slightly over 3%, which has experienced a commendable annualized growth rate of over 6% in the last decade.

High Yield Stocks: B-List

In a quest for high yield stocks, notable contenders are recognized in the B-list:

- Bristol-Myers Squibb Co (BMY)

- Bristol-Myers Squibb Co (BMY)

- PepsiCo (PEP)

- Ares Capital (ARCC)

- Enbridge (ENB)

The B-list offers an average yield of nearly 5.25%, with an average of 30 years of dividend history and an average discount of -26% from 52-week highs, providing investors with a relatively safe income source.

Bristol-Myers Squibb Co (BMY)

Bristol-Myers Squibb Co (BMY) presents an enticing investment opportunity with its highly undervalued share price and an attractive dividend yield of 4.68%. Despite facing challenges such as patent expirations and debt from the Celgene acquisition, Bristol has demonstrated adeptness in forming strategic partnerships, fortifying its drug development pipeline, and expanding its market potential through recent licensing deals. Hence, BMY stands out as an appealing prospect for income investors.

Ares Capital (ARCC)

Ares Capital (ARCC), as one of the largest Business Development Companies (BDCs), offers investors a high yield of over 10%. With a diversified portfolio and a proven track record of generating substantial net investment income, ARCC operates within a sustainable payout ratio, making it an attractive income-focused investment despite limited potential for capital appreciation.

High Yield Stocks: C-List

For investors seeking high yield but willing to accept elevated risk, the C-list offers an average yield of 7.30%:

The C-list includes Pfizer (PFE) and Verizon (VZ) among others, striving to offer potentially lucrative opportunities with higher yields, although accompanied by greater levels of risk.

Pfizer (PFE)

Pfizer (PFE) emerges as an intriguing choice, characterized by a cost-effective valuation and a substantial dividend yield of 5.84%. Despite facing downward pressure on its stock price due to various market factors, Pfizer has bolstered its cash position through the acquisition of Seagen Inc. and ramped up research and development initiatives to enrich its drug pipeline, making it an enticing option for stable income with modest growth prospects.

Verizon (VZ)

In a challenging operating environment, Verizon (VZ) has persevered, striving to uphold its competitive position in the telecommunications industry while offering investors an avenue for high yield returns. Despite the inherent risks, VZ presents an opportunity for those inclined to venture into a higher risk-reward spectrum.

Decoding the World of Dividend-Paying Stocks

For investors, the world of dividend-paying stocks holds a peculiar allure, much like an enticing chess game where the pieces move to the rhythm of risk and reward. The enticing quest for high yield often comes with a labyrinth of cautious steps, tempting snares, and potential treasure troves. For Verizon, the stock had been on a constant decline since mid-2022, reaching a nadir that saw nearly 40% of its value vanish from the peak. Although recently, in the last few months, it has staged a remarkable recovery, surging nearly 25% from the bottom. The lingering question: Is this a lurking value trap or a hidden gem of a massive dividend opportunity?

In 2023, a cloud of allegations hovered over legacy telecom companies like Verizon and AT&T, that they left behind lead-sheathed cables. This further depressed share prices due to the looming fear of liabilities and expensive lawsuits. However, recent events suggest that the fallout may be more evenly distributed amongst carriers, deflecting any competitive disadvantage. Moreover, the recent trajectory of price recovery hints that the upheaval was somewhat overstated. Another pivotal factor contributing to the colossal decline was the surge in interest rates. Laden with a hefty debt load exceeding $125 billion, VZ faced a substantial rise in interest burden. However, potential rate cuts looming on the horizon in 2024 have kindled a newfound optimism. To add to the glimmer of hope, Verizon still boasts the best EBITDA margins among the top three telecom companies in the U.S. The most recent quarterly earnings report (3Q23) disclosed a commendable uptick in wireless service revenue and an enhanced cash flow.

Diverse Perspectives on the C-List

In the realm of dividend growth investing (DGI), the C-List sits as a tantalizing banquet for yield-hungry investors. Its alluring spread offers dividends as high as 7.30%, akin to picking the ripest fruit from the highest branch. Yet, this list is not for the faint-hearted or the conservative investor. It stands as a realm of moderate safety in dividends but with an undeniable allure of high yields that come hand in hand with an elevated level of risk. The intoxicating aroma of opportunity mingles with the piquant scent of risk, demanding thorough due diligence to ascertain its suitability. As the old adage goes, nothing comes for free, and indeed, this bountiful feast carries a heightened element of risk. However, the savory serving of companies presents a high degree of diversification spread across five different sectors, an exotic blend catering to the bold at heart.

Caution beckons us to reflect on the inherent risks and concerns that accompany each company. Some risks may prove tangible, while others may prove to be mere chimeras, exaggerated and temporary. Thus, it stands as a prudent pursuit to engage in comprehensive research and diligence before taking a proverbial bite out of this sumptuous offering.

Unveiling the Harmonious Symphony of the Combined Lists

Should we dare to amalgamate the three lists and excise the duplicates—a necessary surgical procedure in the realm of financial medley—we arrive at an elite ensemble of eleven names. Amongst them, ARCC, ENB, NEE, and PEP stand as two-time duplicates. Keeping a keen eye on diversity, we judiciously retain BMY, parting ways with JNJ and PFE from the medical segment, along with bidding adieu to ENB from the energy sector. What transpires is a judicious curation of eight names, an assortment that spans an opulent seven industry segments.

Painted with vivid colors of financial metrics, the amalgamated group assumes an alluring allure with an average yield of 5.26%, a tantalizing discount of -14.51% from their 52-week high, an average 5-year dividend growth of 7.29%, six of the names boasting an impressive 10-year dividend growth of 10.3%, and a restrained average payout ratio of 47.7%. The final flourish lies in the impressive average Total Quality Score of 76.18, an embodiment of the harmonious convergence in the symphony of these companies.

Concluding Thoughts

Like the onset of a new month, the exploration of dividend-paying stocks commences with a wide lens, eventually tightening focus to reveal a select few stocks that align with our selection criteria and income goals. This voyage, encapsulated in this article, presents three distinct groups of stocks, each catering to divergent goals, resonating with the unique needs of a diverse audience. While each group embodies its own risk profile, they stand resolute in their balanced and diversified nature.

The first group, a sanctuary for conservative investors, bestows a yield of 3.42%, showcasing a resolve to safeguard capital above all else. Conversely, the second group boldly reaches for a higher yield, imparting 5.46% without consenting to an exponential surge in risk. However, the enigmatic C-list, tailor-made for the most intrepid of investors, embraces elevated risk, signaling its unsuitability for the faint-hearted.

In a theatrical display reminiscent of a grand performance, the combined group, a harmonious amalgamation of the three lists sans duplicates, unfurls an even more diverse tapestry, boasting eight positions and a bountiful 5.26% yield. As the curtain falls on this endeavor, it is imperative to note the caveat—some stocks discussed may not trade on a major U.S. exchange, underscoring the vital importance of being acutely cognizant of the associated risks.