Embracing the Power of Diversification

In an industry where risk can never be fully eradicated, the strategy of product diversification emerges as the knight in shining armor, aiding Zacks Multiline Insurance entities in lowering concentration risk and facilitating a consistent revenue stream. Companies like MetLife Inc., American International Group Inc., Prudential Financial Inc., The Hartford Financial Services Group, and Assurant Inc. are set to reap the fruits of better pricing, astute underwriting, and a favorable economic rebound, akin to ships navigating steady waters in a stormy sea.

The accelerated march towards digital adoption provides an added wind in the sails of the Multiline Insurers, ensuring seamless operations in a digitally transforming world.

Unveiling the Industry’s Essence

Comprising companies that offer a myriad of insurance coverages under a single umbrella, the Zacks Multiline Insurance industry stands as a powerhouse catering to the needs of individuals and enterprises alike, covering a spectrum of risks and rewards. From property and auto to life and health, these players orchestrate a symphony of protection and service, enhancing customer retention while fostering financial stability.

3 Forces Shaping the Industry’s Tomorrow

Diversified Portfolio Mitigates Risk: The canvas of Multiline Insurers mirrors a diverse tapestry of products and services, shielding them against concentration risk and propelling sales growth. As the globe embraces green energy and intangible assets, insurers stand poised to seize new avenues of growth.

M&A Frenzy: The landscape of mergers and acquisitions in the industry is evolving, as players seek to expand their horizons and fortify their market presence through strategic partnerships and diversification efforts, akin to chess masters plotting their next move.

Technological Uprising: The era of digital transformation has dawned upon the insurance realm, with technologies like AI, blockchain, and cloud computing redefining business paradigms. Real-time data usage, online policy sales, and enhanced underwriting capabilities stand as testaments to the industry’s tech-savvy evolution.

Insights from Rankings and Performance

The Zacks Industry Rank unveils a promising horizon for Multiline Insurance, positioned within the fertile grounds of the broader Finance sector. With a top-ranking #32 among 255 Zacks industries, the Multiline Insurance cohort basks in the glow of positive analyst sentiment, as earnings estimates surge skyward for the fiscal year.

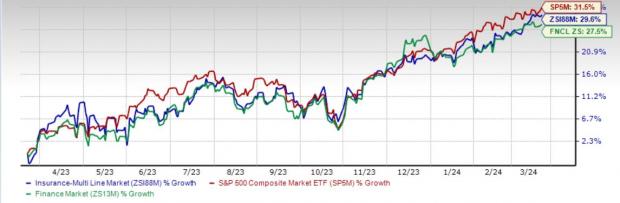

While the industry’s performance has outshone its sector contemporaries over the past year, a closer inspection reveals a slight lag behind the S&P 500 composite. Nonetheless, with a price-to-book ratio that paints a picture of value and potential, the Multiline Insurance sector stands poised for future growth and prosperity.

Five Multiline Insurance Gems to Keep on Your Radar

Among the constellation of Multiline Insurance stocks, one beckons as a Zacks Rank #2 (Buy), while four others flaunt the esteemed Zacks Rank #3 (Hold). Whether it’s the vibrant hustle of New York-based Assurant or the solid capital wisdom of The Hartford Financial Services Group, these stocks offer a tantalizing glimpse into insurance’s dynamic world.

Embracing the Roaring Path Ahead in the Insurance Industry

Looking at the Leaders

As technology reshapes the insurance sector, companies like Assurant, American International Group (AIG), MetLife, The Hartford Financial Services Group, and Prudential Financial stand at the forefront of this revolution. Embarking on a journey marked by resilience and adaptability, these insurance giants are poised to navigate the changing market dynamics ahead.

Assurant Inc.

With an unwavering commitment to innovation and customer-centric solutions, Assurant Inc. continues to impress shareholders. The company’s robust revenue growth lays a solid foundation for future expansion, projecting double-digit growth in the foreseeable future.

Price and Consensus: Assurant

.jpg)

Glimpse into the Future

American International Group (AIG), headquartered in New York, positions itself as a key player in the insurance landscape. With strategic business de-risking, cost-control efforts, and capital deployment strategies, this Zacks Rank #3 insurer is primed for growth on multiple fronts.

Price and Consensus: AIG

.jpg)

Charting a Path to Success

MetLife, based in New York, emerges as a global financial services company that resonates with both individual and institutional clients. With a focus on sustainable growth strategies and cost-efficiency measures, MetLife embraces a future laden with possibilities.

Price and Consensus: MET

.jpg)

Strength through Adversity

The Hartford Financial Services Group, anchored in Hartford, CT, exemplifies resilience in the face of challenges. With a stronghold on the mortgage insurance sector and stringent capital compliance, this Zacks Rank #3 insurer charts a promising path ahead.

Price and Consensus: HIG

.jpg)

Setting a Vision for Tomorrow

Prudential Financial, headquartered in Newark, NJ, emerges as a beacon of stability in the financial services realm. With a comprehensive product portfolio and a thrust on international operations, Prudential Financial is well-positioned to soar to greater heights in the market.

Price and Consensus: PRU

.jpg)

Capturing the essence of the insurance zeitgeist, these industry stalwarts stand ready to write the next chapters of growth and prosperity in the insurance landscape.