Exploring the Upcoming Shift in Supply/Demand for a Vital Metal

Investors are presented with an opportunity that could yield significant returns over the next three-to-five years. While the wait may seem long, consider this:

The average S&P stock sees modest gains, unable to match the potential 5X return in five years. And the current valuation of market giants offers little promise of such explosive growth. Artificial intelligence stocks show potential but come with uncertainties. That’s where today’s focus lies.

Adventurous spirits might opt for AI stocks, but predicting tomorrow’s winners remains tricky. In contrast, the outlook for a specific metal is grounded in historical data, offering a clearer path to success.

What we face is a commodity with rising demand and diminishing supply, vital for cutting-edge technology yet facing a looming shortage. A scenario that spells out a significant trade with fewer abrupt fluctuations, providing a smoother ride for investors.

That metal is lithium.

You Can’t Afford to Overlook the Impending Lithium Boom

Expert Eric Fry leads our exploration of the lithium landscape. With a track record of seizing opportunities in the realm of industrial metals, his optimism speaks volumes.

Eric offers a contextual view of lithium, highlighting its critical role: as the lightest metal, its value lies in its energy storage capabilities crucial for powering our digital world.

Lithium, like many commodities, follows a cyclical pattern of boom and bust. Demand surge without adequate supply leads to exorbitant prices and soaring returns for top lithium miners. Take Albemarle (ALB) as an example, catapulting 504% from March 2020 to September 2022.

Source: StockCharts.com

However, surging prices attract new market players, saturating the market and driving prices down. Many miners struggle to survive, leading to a downturn in the cycle.

Currently, lithium prices are at a significant low, raising concerns about existing extraction operations in Australia and China. Anticipated growth in the electric vehicle (EV) market paired with restrained investment in new production facilities sets the stage for a potential supply shortage and subsequent price surge.

The history of lithium reflects a familiar narrative of sharp rises and falls dependent on supply and demand dynamics.

The Ongoing Struggle in the Lithium Market

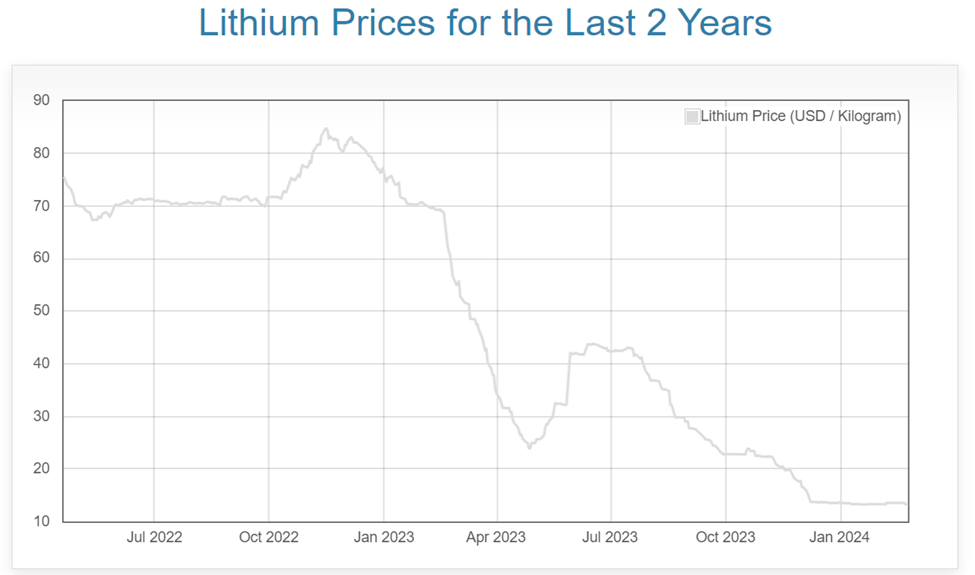

The fall in lithium hydroxide prices from around $85 in fall 2022 to $13.27 highlights the volatility in the market.

Source: DailyMetalPrice.com

Top lithium stocks have suffered in tandem with the market’s downturn, exemplified by the drastic price drop.

For more insights, dig into the upcoming analysis on the lithium market with Eric Fry in Investment Report.

Lithium Investment – Navigating the Ups and Downs of the Market

Unveiling the Bitter and Sweet Phases of Lithium Investment

Embarking on a fascinating journey within the world of investment, we glimpse a small bullish escapade nestled within a larger, daunting 63% decline that commenced in the depths of November 2022.

Similarly, the pain resonates within the lithium ETF LIT from Global X, housing esteemed lithium mining giants such as Pilbara, Mineral Resources, and Quimica. Witnessing a decline of 41% over this tumultuous period, the ride has been bumpy, to say the least.

Embracing the Road Ahead in Lithium Investment

While currently entrenched in the “bust” phase, the lithium industry holds promising prospects on the horizon. The ebbs and flows of this volatile market call for a keen eye, uncovering the reasons why the downturn may be approaching its twilight, signaling a dazzling boom on the horizon.

How Massive Demand and Scarce Supply Will Benefit Lithium Investors

Delving into insights from Eric:

Lithium, accompanying other commodities, exposes investors to extreme market oscillations. As the prevalent oversupply transitions towards undersupply over the forthcoming years, the downturn will fade, paving the way for a burgeoning rebound…

The initial step towards lithium investment stems from a pivotal data point: McKinsey Battery Insights anticipates a staggering nearly seven-fold surge in global battery cell demand for lithium by 2030. Should this astonishing trajectory materialize, lithium’s demand from batteries would encompass a substantial 95% of the overall global demand, translating into a colossal $400-billion industry.

Staggered by the sevenfold surge projection? Brace yourself for the exponential growth when projecting further ahead.

According to BloombergNEF:

By 2050, lithium demand, driven by the energy transition alone, is estimated to skyrocket to approximately 17.5 times the demand witnessed in 2020.

Eric’s final thoughts:

The fusion of fresh demand from renewable energy atop the conventional demand sources might ignite a fiery multidecade commodity supercycle.

The verity remains: the future augments dazzling growth in battery metals demand, while the mining industry’s capacity to meet this burgeoning demand remains uncertain.

Albeit these forecasts span multiple decades, the potential for fivefold returns within a shorter timeframe has already materialized. The probability of surpassing the average 7%-per-year S&P stock returns undoubtedly resides within the cards.

Charting Your Strategy in Lithium Investment

Our compass points towards Albemarle and LIT as lucrative investment avenues poised to reward investors generously as the market emerges from its current downtrend.

However, Eric has an alternative vision:

A momentous lithium discovery has surfaced in the desolate expanses of Nevada…

Only a solitary entity stands poised to exploit this deposit, potentially embarking on full-scale production in mere months…

Under construction is a significant lithium mine in Nevada, hosting the largest known lithium resource in the U.S. Furthermore, it is the sole fully authorized project in the U.S…

Upon commencing production later in the decade, the lithium mine’s operations could yield over $1 billion in gross earnings (EBITDA) before escalating to surpass $2 billion by the decade’s closure.

These future speculations are mere approximations. The actual outcomes might overshadow these projections by a significant margin…

For a detailed insight, refer to Eric’s comprehensive narrative here.

Why Lithium Investment Deserves Your Consideration

Although the market’s nadir remains elusive, we are not advocating for impulsive leaps into the lithium investment realm. While the current scenario reeks of metaphorical “blood in the streets,” the impending surge in demand beckons. History unfurls the potential for astute investors to reap substantial financial rewards. Do not underestimate this opportunity.

Have a pleasant evening,

Jeff Remsburg