Co-produced by Austin Rogers

Picture a mountain of cash patiently biding its time, waiting for the right moment to transform into a driving force in the financial markets.

Even as the stock market approaches its previous all-time highs, there sits trillions of dollars in money market accounts, yielding over 5%. A tantalizing prospect for investors and savers alike.

Financial markets are currently housing nearly $6 trillion in money market funds (“MMFs”). This figure is a staggering 50% higher than the peak reached during the Great Financial Crisis in 2009.

What happens when the Federal Reserve initiates a decline in its key Fed Funds Rate, which serves as the basis for money market yields? The answer is obvious: cash in MMFs will migrate to other destinations.

A familiar pattern unfolds, whereby cash flows into MMFs as the Fed escalates its policy rate. Conversely, when the Fed rapidly lowers rates due to economic fragility, investors are spurred to transfer their funds from stocks to MMFs.

On average, it takes about a year after the Fed lowers rates for MMFs to convert from inflows to outflows. Why the delay? Investors typically require time to regain confidence in the market and seek alternative savings vehicles.

Will all $6 trillion eventually find its way into stocks? It’s highly improbable. The diversion will see portions going into money market funds, bonds, real estate, and bank accounts.

Paving the Way for REITs’ Performance

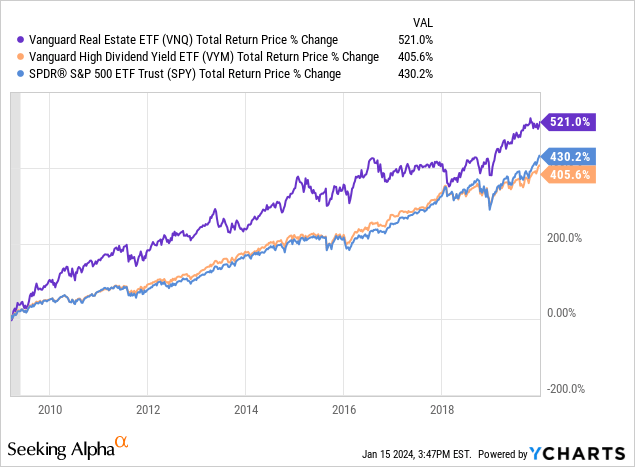

During 2010 and 2011, a substantial outflow from MMFs drove considerable sums into real estate investment trusts (“REITs”) due to their high yields. This influx significantly lifted the Vanguard Real Estate ETF (VNQ), propelling it to outperform both the S&P 500 (SPY) and high-yield dividend stocks (VYM) from 2009 through 2019.

A closer look at the chart reveals that the outperformance in REITs commenced right after the Great Recession concluded and a new bull market emerged, driven by a shift of outflows from MMFs into REITs.

The correlation persisted during the MMF net outflow period from 2002 through 2006, resulting in substantial outperformance of the Vanguard Real Estate Index Fund (VGSIX) over the SPY.

Why does this relationship exist? Even though REITs do not fundamentally behave like bond alternatives, investors treat them as such. A rise in bond yields leads to a drop in demand for REITs, while falling bond yields lead to increased demand for REITs.

We anticipate a robust year ahead for REITs, as valuations continue to rebound off their lows and interest rates continue to trend downward. However, the historical analysis of MMF outflows that drive REIT stock inflows indicates that the true upswing for REITs is yet to kick in.

If funds flow out of MMFs and into REITs similarly to what occurred in 2002-2006 and 2010-2011, then REITs are poised to experience a multi-year period of robust performance, potentially even outperforming the broad market in terms of total return.

Three Particularly Attractive REITs

Instead of simply investing in the VNQ to access all REITs in one click, there are individual REITs that remain highly bullish, even after the REIT rebound since November 2023.

Uncovering Undervalued REITs in Today’s Market

Alexandria Real Estate Equities (ARE) is a formidable force in the United States, owning and developing top-tier life science research facilities. However, despite its robust balance sheet and exceptional management team led by Joel Marcus, its valuation has plummeted since the Great Financial Crisis.

ARE’s current price/AFFO of 17x is strikingly lower than its 5-year average of 25.5x, signaling a potentially tantalizing 50% upside to reach its historical average valuation. The company’s negative sentiment, stemming from being mistakenly categorized as an office REIT, has obscured its true potential in the vibrant life science real estate sector.

A Strong Contender: Alexandria Real Estate Equities (ARE)

The market’s apprehension regarding the potential repurposing of office spaces into life science buildings, amplifying competition for limited life science tenant demand, has unjustly clouded ARE’s prospects. However, the indomitable quality and strategic locations of ARE’s properties serve as an impregnable fortress; attracting premier biotech companies globally to conduct R&D activities at the best life science facilities.

Amidst the market turmoil, EPR Properties (EPR), a net lease REIT focusing on entertainment, recreation, and education properties, has faced its own share of challenges due to the lingering impact of COVID-19. Despite resilient fundamentals, investor sentiment has remained subdued, creating a golden opportunity for astute buyers.

Evaluating EPR Properties (EPR)

With stable AFFO margins and a price-to-AFFO ratio currently at 9.2x (25% below its five-year average), EPR presents an enticing 25% upside to its historical valuation. The company’s unwavering fundamentals are masked by prevailing market sentiments, offering perceptive investors an entry point amidst the lingering pessimism.

Lastly, NNN REIT (NNN), renowned for its conservative financial management, owns a portfolio of single-tenant, net leased retail properties in the retail space. While maintaining an impeccable BBB+ rated balance sheet and an enviable 33-year dividend growth record, NNN’s valuation remains near its lowest point since the Great Financial Crisis.

Exploring NNN REIT (NNN)

NNN’s prudent financial strategy is reflected in its conservative valuation. With a 5.25% dividend yield, even modest growth prospects can yield high single-digit or low double-digit total returns for discerning investors.

Bottom Line

The future of REITs appears promising, poised for a multi-year bull market due to capital inflows into yield vehicles. Patient investors who can see past the current disruptions are likely to be rewarded handsomely in the long run.