InvestorPlace – Stock Market News, Stock Advice & trading Tips

The Rise of the Electric Vehicle Industry Amid Turbulent Times

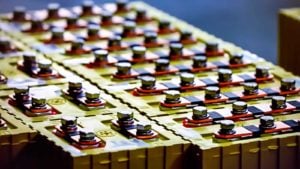

The electric vehicle industry is navigating choppy waters, battling fierce competition and macroeconomic challenges. Despite these hurdles, major global automakers are recalibrating their focus on EV investments. As a consequence, EV stocks have witnessed a downtrend, offering a plethora of undervalued opportunities. In this climate, investors with a long-term vision may find themselves at a prime buying juncture. This chapter zeroes in on undervalued battery stocks that stand to benefit from the impending market rally.

Fueling Growth: The Evolving Landscape of Electric Vehicles

It’s noteworthy that in 2022, electric vehicles accounted for a mere 14% of new car sales. However, with favorable policy tailwinds, the industry is poised for substantial expansion. Projections suggest that by 2030, over 60% of new car sales could belong to the EV segment. This surge in demand is expected to significantly drive the need for batteries.

To put this into perspective, global demand for Li-ion batteries is forecasted to surge from 700 GWh in 2022 to a staggering 4.7 TWh by 2030. This exponential growth presents a lucrative opportunity for key players in the battery sector.

Riding the Wave: 7 Battery Stocks Poised for Growth

Panasonic Holdings (PCRFY)

Amidst the broader EV sector slump, Panasonic Holdings (OTCMKTS:PCRFY) has stood out, delivering total returns exceeding 10% over the past year. With a modest forward price-earnings ratio of 7.3, PCRFY stock appears primed for a potential doubling in value over the next 24 months. Noteworthy, Panasonic is actively innovating, developing silicon-based batteries that could revolutionize the EV range and refueling time. Additionally, plans to expand EV battery capacity to 200GWh by 2031 position the company for robust revenue growth and margin expansion.

QuantumScape (QS)

QuantumScape (NYSE:QS) is on a mission to commercialize solid-state batteries after a decade-long R&D focus resulting in 300 patents. With backing from automotive giants and a strategic partnership with Volkswagen (OTCMKTS:VWAGY), QS holds a promising future. Shipping prototype battery cells to partners signals a significant milestone, paving the way for high-volume production by 2025.

Solid Power (SLDP)

After weathering a deep correction, Solid Power (NASDAQ:SLDP) stock has stabilized and shows signs of an impending rally. Collaborating with Ford (NYSE:F), BMW (OTCMKTS:BMWYY), and SK On, Solid Power is making headway in solid-state battery commercialization. Noteworthy progress includes the delivery of sample cells for validation testing and a prudent cash management strategy, boasting $415 million in liquidity for continued R&D.

Lithium Americas (LAC)

Lithium Americas (NYSE:LAC) has surged 45% in the last month, following a substantial funding commitment for the Thacker Pass project. Set to commence production in 2027, the project underscores the undervaluation of LAC stock. With an estimated $1.1 billion annual EBITDA post-commencement, LAC stock presents a compelling investment opportunity.

Piedmont Lithium (PLL)

Piedmont Lithium (NASDAQ:PLL) emerges as an undervalued gem, with stock prices plummeting by 75% over the past year. Positioned as a long-term play, PLL stock boasts a quality asset base and promising growth potential. The company’s minuscule market valuation vis-à-vis its asset value makes it an enticing prospect during the lithium bear market.

The Electric Future: A Look at Key Players in the EV Battery Industry

Piedmont Lithium (PLL)

Source: InvestorPlace

The electric vehicle (EV) revolution has placed companies like Piedmont Lithium (NASDAQ:PLL) in the spotlight. With its U.S. assets valued at $2.1 billion, PLL is seeking strategic partnerships to fuel its growth. The recent announcement of a combined after-tax NPV of $4.5 billion for the Carolina and Tennessee assets has sent ripples of excitement through the industry.

Securing financing is the linchpin for PLL stock, and the company is actively pursuing partnerships for its U.S. assets. Once construction financing is in place, the trajectory of PLL’s valuation is expected to soar. Notably, Piedmont has already inked supply deals with industry giants like LG Chem and Tesla (NASDAQ:TSLA), ensuring stable cash flows and solidifying its position as a market frontrunner in the electric vehicle battery sector.

Ford (F)

Source: Mikbiz / Shutterstock

Ford (NYSE:F), a stalwart in the automotive industry, is making bold moves towards an all-electric future. With plans to transition its portfolio towards electric vehicles (EVs), Ford’s foray into EV battery production is a key strategic move. Trading at a modest forward price-earnings ratio of 7.4 and offering an enticing dividend yield of 4.4%, F stock presents a compelling investment opportunity.

A joint venture with SK On aimed at producing 60 GWh annually in traction battery cells showcases Ford’s commitment to scaling its EV battery capacity. The company’s global BEV plan targeting at least 240 GWh of battery cell capacity by 2030 signals a strong growth trajectory. Despite a recent adjustment in plans for a Michigan battery plant, Ford’s financial strength positions it well to capitalize on evolving market trends and drive future investments.

Standard Lithium (SLI)

Source: Shutterstock

Standard Lithium (NYSE:SLI) emerges as a hidden gem in the realm of electric vehicle battery companies. Despite a 70% decline in SLI stock over the past year, its current valuation paints an undervalued picture with immense growth potential. Analysts project SLI stock to deliver remarkable returns, potentially reaching 10x to 20x growth by 2030.

With a present market valuation of $210 million and a key asset boasting an after-tax net present value of $4.5 billion, SLI’s growth prospects are compelling. The pending financing of $1.2 billion for its South West Arkansas asset looms as a pivotal catalyst for SLI stock to catapult into the stratosphere. As sentiments around lithium stocks turn positive and funding is secured, Standard Lithium is poised for a meteoric rise.

On the date of publication, Faisal Humayun did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the author and follow the InvestorPlace.com Publishing Guidelines.

More From InvestorPlace

The post 7 Battery Stocks to Buy Before the Next Big Rally appeared first on InvestorPlace.

The views and opinions expressed are those of the author and do not necessarily reflect those of Nasdaq, Inc.