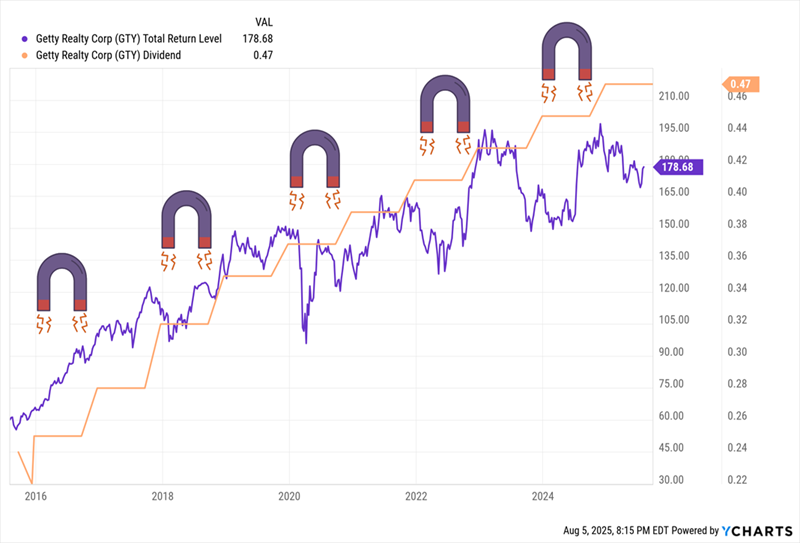

Investors are looking for reliable dividends in the current market environment, featuring seven low-beta stocks offering yields up to 8%. Low-beta stocks are less volatile than the broader market, providing more stability during downturns. Key examples include Getty Realty (GTY) with a 6.6% yield, and AES Corp. (AES) with a 5.5% yield, both exhibiting relatively low volatility and appealing dividend offerings.

Getty Realty owns over 1,130 retail properties across 44 states and asserts a 5-year beta of 0.86, indicating modest volatility. Meanwhile, AES Corp. distributes power to approximately 2.7 million customers and focuses on renewable energy, showcasing a 1-year beta of 0.88. Northwest Bancshares (NWBI) has a 6.8% yield, operating over 150 locations and maintaining lower volatility with a 5-year beta of 0.69.

Among consumer staples, Cal-Maine Foods (CALM) presents an attractive yield of 8%, benefiting from a long-term upcycle in egg prices, while Conagra Brands (CAG) offers a 7.4% yield yet faces significant challenges, including supply chain issues and declining profits. These stocks serve as potential income generators for investors cautious of market fluctuations.