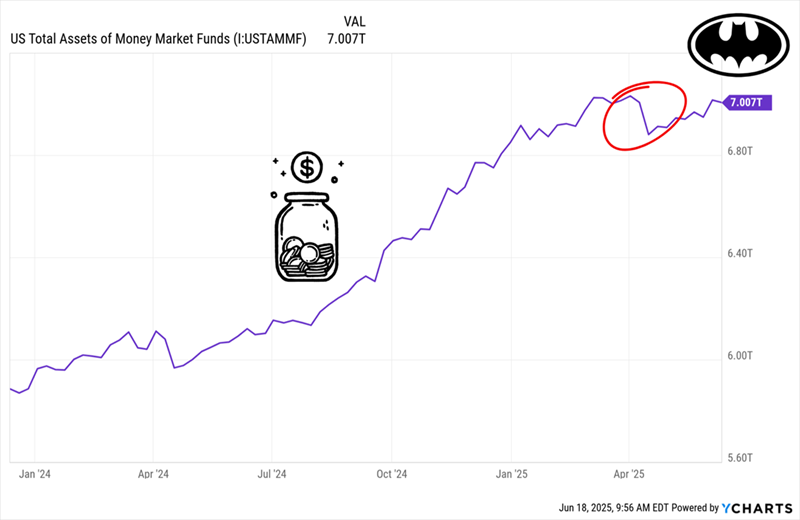

U.S. investors have $7 trillion in money-market funds, with expectations that a portion will be redirected into dividend stocks. This comes amid ongoing concerns about a projected $1.9 trillion budget deficit for fiscal 2025, as per the Congressional Budget Office.

Key players in this potential shift are dividend-paying stocks, including the Nuveen Quality Municipal Income Fund (NAD), yielding 8.1%, Dominion Energy (D), yielding 4.9%, and Union Pacific (UNP), yielding 2.4%. With interest rates set to decline, these stocks could become attractive as investors seek better income prospects.

The backdrop includes the Federal Reserve increasing bond purchases by $20 billion monthly while aiming to handle government debt effectively, setting the stage for potential rebounds in dividend stocks as money-market returns decrease.