Alphabet’s Q1 Earnings Spark Optimism Amid Economic Concerns

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) recently updated investors with a positive outlook during its first-quarter earnings release. The results were better than anticipated, offering a relatively optimistic forecast for the upcoming year. This information counters several investor worries about the potential impact of tariffs, although the effect on Alphabet will become clearer as the year progresses.

In its Q1 earnings report, the company also announced an impressive $70 billion share repurchase authorization. This significant amount of capital is expected to make the buyback program particularly noteworthy, given the current market conditions.

Ad Revenue Under Potential Pressure

Recognized mainly as the parent company of Google, YouTube, and the Android operating system, Alphabet’s revenue primarily stems from advertising, leading to a degree of pessimism in the Stock market. Advertising expenditures are often among the first to be cut when companies face economic downturns, which could significantly affect Alphabet.

When management addressed concerns during the earnings call regarding tariffs, they highlighted that the elimination of de minimis exemptions could be a challenge. This change may specifically impact their operations with low-cost Chinese retailers like Temu and Shein. Chief Business Officer Philipp Schindler stated that this would represent only a “slight” headwind, expressing confidence in Alphabet’s proven ability to navigate through uncertain times.

Following the earnings announcement, the stock initially rose but later experienced a minor decline, suggesting some investors remained skeptical about Alphabet’s resilience against potential significant impacts.

With no major catalysts likely to influence the Stock until the next earnings report, the $70 billion share repurchase initiative appears particularly compelling, especially given the stock’s current undervaluation.

Buyback Potential Reflects Current Valuation

This core principle is simple: lower stock prices allow for more shares to be repurchased with the allocated budget. Alphabet’s Stock is currently priced among its lowest this decade, making the repurchase program more impactful.

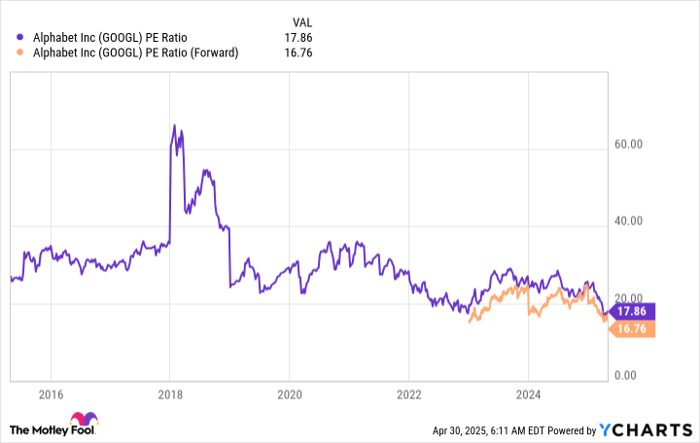

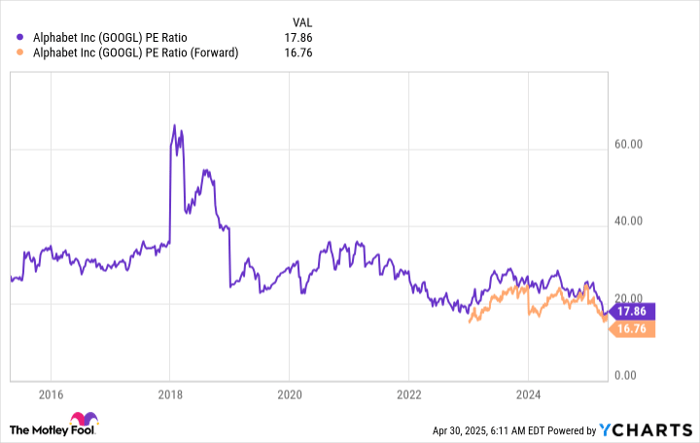

GOOGL PE Ratio data by YCharts.

Currently valued at 17.9 times trailing earnings and 16.8 times forward earnings, Alphabet is favorably priced compared to the S&P 500, which trades at 22.1 times trailing earnings and 20.5 times forward earnings.

Despite fears about maintaining ad revenue, there are additional concerns about the Department of Justice’s ongoing efforts to address Alphabet’s alleged illegal monopoly. A district judge has ruled in two separate cases that Alphabet possesses an illegal monopoly in both its search engine (Google Chrome) and advertising platform. While potential remedies are being discussed, a resolution is likely years away.

This situation may eventually reach the Supreme Court, with a lengthy timeline ahead. Investors concerned about holding through this uncertainty could drive down Alphabet’s Stock price, which adds to the effectiveness of the $70 billion buyback program.

By decreasing the total share count, Alphabet can enhance its earnings per share (EPS), even if overall earnings remain constant, as the denominator in the equation declines. This strategy is particularly crucial amid current economic challenges, where Alphabet may encounter some growth headwinds.

Although uncertainties loom over Alphabet, their potential impact on the Stock remains uncertain. Market sentiment has likely factored in significant negative scenarios already, suggesting this may present a strong buying opportunity for those willing to invest for the next three to five years.

Evaluating Investment in Alphabet

Before making an investment in Stock of Alphabet, it’s important to consider certain factors:

The Motley Fool Stock Advisor analyst team recently recommended what they believe to be the 10 best stocks for immediate investment, which notably did not include Alphabet. The identified stocks are projected to yield substantial returns in the upcoming years.

For example, consider when Netflix was included on December 17, 2004… if you had invested $1,000 at that time, it would be worth $610,327!* Similarly, Nvidia was listed on April 15, 2005… a $1,000 investment then would now be worth $667,581!*

It’s also notable that Stock Advisor has an impressive total average return of 882% compared to 161% for the S&P 500. For more details, consider joining Stock Advisor!

*Stock Advisor returns as of April 28, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet. The Motley Fool holds positions in and recommends Alphabet. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.