Don’t judge a post by its title; I assure you this article is far from irrelevant. Let’s delve into the world of dividends, investments, and a rather bizarre metaphor about “cutting the cheese.”

Now, before you start associating our topic with flatulence, let’s clarify. In the context of this discussion, “cutting the cheese” refers to the potential for certain companies to reduce their dividend payouts. Yes, you read that right, we’re talking “cheddar.”

Let’s transport ourselves back to a bygone era – 1961, to be precise. A delightful book titled “The Definitive Fart Book” offers a lighthearted take on the subject, with phrases like “let one rip” or “copped a pop.” Perhaps not the most intellectual references, but they do reflect a time when such matters were perhaps less taboo.

For those not fully versed in the slang wisdom of the ’60s, don’t let that alarm you. Our modern discussion today is indeed about monetary dividends, not bodily emissions.

But why “cheese”? Well, it appears the slang is derived from a time when welfare benefits included actual cheese distributions. Odd, isn’t it? But over time, the term has evolved to symbolize money, particularly in relation to dividends paid by companies.

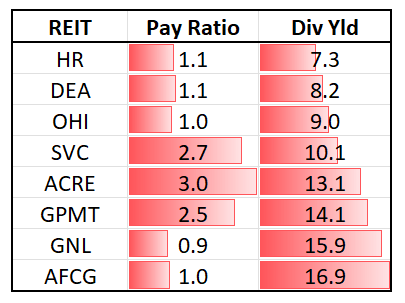

Given this, it’s only fitting to explore the REITs that could potentially “cut the cheese” – a list of real estate investment trusts that may slash their dividends.

Insights on Probable Dividend Cuts

The spark for this article originated from an enlightening piece by Al Root in Barron’s. In his work, he elaborated on the inevitability of dividend cuts, pointing out that a small percentage of companies tend to reduce dividends each year, outside of major financial crises.

Wolf Research strategist Chris Senyek also highlighted eight companies likely to “cut the cheese,” namely Vail Resorts, Hasbro, Whirlpool, Wendy’s, Cracker Barrel Old Country Store, Legget & Platt, LCI Industries, and Kohl’s.

Senyek estimated that these eight companies would allocate approximately 100% of their estimated 2024 free cash flow as dividends, in stark contrast to the S&P 500’s average payout ratio of 55%.

After perusing Root’s article, my thoughts naturally gravitated toward REITs in similar precarious situations. Here are eight that have caught my attention.

Let’s dive into inspections of eight REITs, starting with…

Assessment of Healthcare Realty Trust (HR)

HR, an internally managed real estate investment trust, specializes in developing, acquiring, and managing healthcare properties, primarily medical outpatient buildings located around leading hospital campuses in the U.S. Their portfolio, valued at approximately $6.2 billion, spans 35 states and comprises 700 properties focusing on 15 high-growth markets.

The vast majority of HR’s medical properties are associated with the provision of outpatient medical services, primarily multi-tenant medical properties on or near top healthcare systems. As of September 30, 2023, 72% of their medical properties were located on or adjacent to a hospital campus, further emphasizing their strategic positioning.

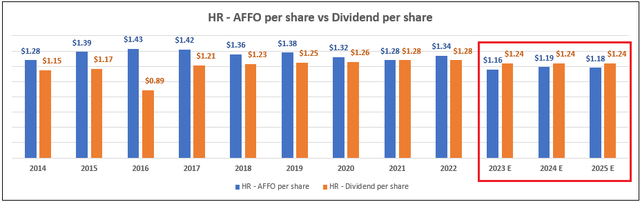

In terms of dividend history, HR displayed a cut in the fourth quarter of 2022, reducing its quarterly dividend from $0.325 to $0.31 per share. The annualized dividend for 2022, excluding special dividends, stood at $1.28 per share, whereas the annual dividend in 2023 amounted to $1.24, marking a 3% decrease.

What’s even more concerning is the analysts’ projections, indicating that HR’s dividend is anticipated to exceed their free cash flow or adjusted funds from operations (“AFFO”) for 2023, 2024, and 2025. In those years, the projected AFFO payout ratios stand at 106.90%, 104.20%, and 105.08%, respectively, marking a worrying trend.

While the stock offers a high dividend yield of 7.47%, the projected payout surpassing the free cash flow/AFFO generates apprehension regarding the sustainability of the dividend.

Assessing the REIT Landscape: A Deep Dive Into Healthcare Realty Trust, Easterly Government Properties, and Omega Healthcare Investors

Dividend yields, acquisition strategies, and portfolio compositions; exciting elements of the game! But before drawing conclusions, let’s scrutinize the nitty-gritty details that underlie the fascinating world of Real Estate Investment Trusts (REITs). There’s a plethora of juicy investment tidbits to uncover beneath the glossy surface.

Healthcare Realty Trust (HR)

Healthcare Realty Trust is a company that specializes in healthcare-related properties. With a market cap of approximately $5.0 billion, its portfolio spans 23 U.S. states and consists of 229 properties. Healthcare Realty Trust’s primary focus is to provide real estate to the healthcare industry and enhance the delivery of patient care.

Currently, the stock is trading at a P/AFFO of 14.28x, compared to its average AFFO multiple of 20.05x. Given these metrics, a speculative buy rating has been assigned to HR, albeit with a word of caution. Potential investors are advised to remain vigilant as the current dividend might face a reduction if HR fails to improve its operations and return to a growth trajectory.

We rate Healthcare Realty Trust a Spec Buy.

Easterly Government Properties (DEA)

DEA is an office REIT that specializes in the development and acquisition of Class A office properties. The company’s portfolio boasts a market cap of approximately $1.2 billion and includes 90 operating properties with a weighted average remaining lease term of 10.4 years. The tenant base includes the likes of the Department of Veterans Affairs, the Federal Bureau of Investigation, and the Drug Enforcement Administration, among others. These tenants represent the vital cogs in the machinery of the U.S. Government.

Currently, the stock is trading at a P/AFFO of 13.19x, marking a downtrend compared to its average AFFO multiple of 19.38x. Despite the discounted valuation, the prudent stance of ‘Hold’ is maintained due to enhanced dividend risk.

We rate Easterly Government Properties a Hold.

Omega Healthcare Investors (OHI)

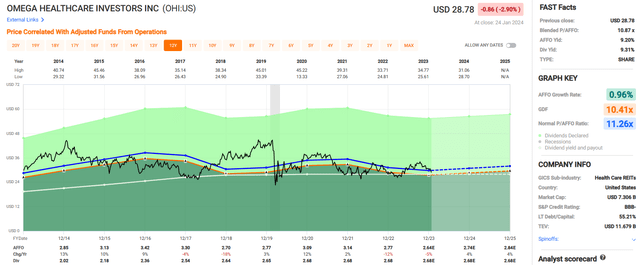

OHI invests in Skilled Nursing Facilities (SNF) and Assisted Living Facilities (ALF), providing capital and financing to national and regional healthcare providers. The company’s expansive portfolio comprises 883 properties containing 86,201 beds spread across 42 states and the U.K.

The dividend yield of OHI stands at an impressive 9.31%, which, unfortunately, is not covered by its 2023 expected AFFO. Furthermore, analysts anticipate a decline in AFFO per share, accentuating the need for caution.

Despite this cautious note, we see potential in the long-term prospects for skilled nursing and assisted living real estate, thereby acquiring a speculative buy rating.

We rate Omega Healthcare a Spec Buy.

Distressed Waters: Service Properties Trust (SVC) and Ares Commercial Real Estate (ACRE) in Trouble

The Woes of Service Properties Trust (SVC)

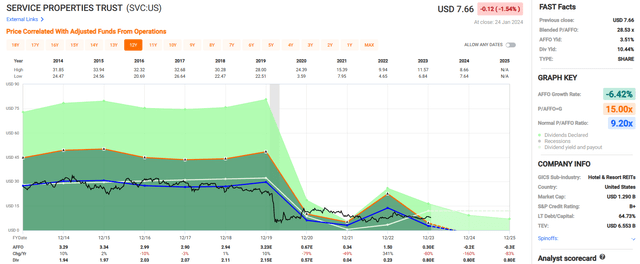

Service Properties Trust (SVC) is an externally managed REIT (real estate investment trust) that concentrates on hotels and net lease retail properties, catering primarily to service-oriented ventures. SVC flaunts a market cap hovering around $1.29 billion and possesses a mansion of 221 hotels, housing about 37,700 rooms sprawling across the United States, Puerto Rico, and Canada.

Notably, SVC’s asset portfolio consists of diverse service-level hotels with 40.1% and 22.6% categorized as full service and select service, respectively, while 37.3% are extended stay.

Propping up their hospitality prowess, SVC boasts a 13.4 million square foot net lease retail property empire dotted across 46 U.S. states, with TravelCenters of America playing the role of the premier tenant.

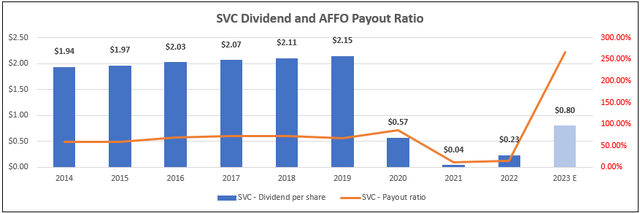

However, SVC’s financial health took a beating in 2020 during the pandemic, resulting in a drastic decline of 79% in its AFFO (adjusted funds from operations) and a subsequent constrictive cut in dividends, forcing a remorseful downgrade from $2.15 to a paltry $0.57 per share.

The sequel to this financial fiasco unfolded in 2021 when SVC’s AFFO plummeted by 49%, settling at a meager $0.34 per share, while the dividend sulked to just $0.04 per share.

Seeking redemption in 2022, SVC’s earnings witnessed a salvage, showcasing an AFFO gloriously rebounding to $1.50 per share. This was followed by a spirited move to bump up the dividend from $0.04 to $0.23 per share, only to hit a bumpy road ahead in 2023 with analyst predictions hinting at an alarming 80% plummet in AFFO.

Should these predictions hold true, investors would be left gaping at a distressing AFFO payout ratio of 266.67% for 2023!

Adding insult to injury, analysts foresee SVC’s financial misery transcending into 2024 and 2025 with projected negative cash flows per share for both years. The gloomy clouds seem to be painting a probable picture of another dividend cut looming on the horizon.

Further compounding the sweltering financial crisis, SVC’s shares currently trade at a premium P/AFFO of 28.53x, significantly outstripping their historical average AFFO multiple of 9.20x. Ironically, this incongruity is not a result of the shares sky-rocketing, but rather a manifestation of the company’s deteriorating earnings.

In light of these disconcerting developments, we cautiously advise investors to avert Service Properties Trust (SVC).

The Predicament of Ares Commercial Real Estate (ACRE)

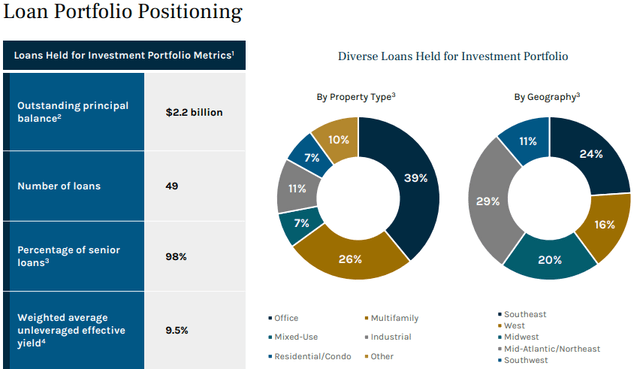

Ares Commercial Real Estate (ACRE), an externally managed mortgage REIT (mREIT), specializes in originating and managing commercial real estate debt-related investments, offering a wide array of financing solutions. The mREIT commands a market cap of approximately $544 million and presides over a loan portfolio boasting an outstanding principal balance of $2.2 billion.

The bedrock of ACRE’s offering is senior mortgage loans, constituting a lion’s share of about 98% of the loan portfolio, complemented by subordinate financing, preferred equity, and mezzanine loans.

Geographically, ACRE’s roots run deep in the Mid-Atlantic/Northeast and the Southeast, while office properties and multifamily dwellings make up the cornerstone of their loan portfolio.

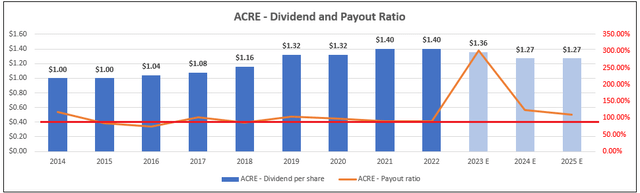

On the earnings front, ACRE traditionally dispenses nearly all of its earnings to shareholders in the form of dividends, with the dividend payout ratio breaching the 90% mark in six of the years between 2014 and 2022. Eerily, analyst projections portend the dividend payout ratio soaring to an astronomical 302.22% in 2023, propelled by a disheartening 71% slump in EPS.

Although analysts foresee a resurgent earnings trajectory with a projected 126% surge in 2024, the anticipated EPS in 2025 might fall short, representing an expected EPS dividend payout ratio of 110.43% in 2025, overshadowing the anticipated dividend.

At present, ACRE offers an enticing 13.08% dividend yield and trades at a P/E of 20.72, signifying a premium compared to its historical average P/E ratio of 10.63x, stemming from the anticipation of a steep earnings decline in 2023.

Alas, the company’s financial prospects appear bleak with their expected EPS in 2024 calling into question the sustainability of the salient yield, underscoring the critical juncture at which Ares Commercial Real Estate finds itself.

As the company navigates these shoals, investors would be wise to approach Ares Commercial Real Estate with caution and a discerning eye, attuning themselves to the perils lurking beneath the surface.

The Unsteady Ground of REIT Investing

ARES Commercial Real Estate is rated as a Hold.

Granite Point Mortgage Trust (GPMT)

Granite Point Mortgage Trust (GPMT), an internally managed mREIT, focuses on a portfolio of debt-related instruments primarily consisting of senior loans collateralized by CRE properties in the US.

The company has a market cap of approximately $301 million and a balanced loan portfolio with 77 investments, totaling $3.1 billion. The vast majority of its investments are senior loans, 99% of which are floating rate, and include a diverse range of property types such as office, multifamily, retail, hotel, and industrial, with the majority being office and multifamily properties representing 43.7% and 32.5% of GPMT’s portfolio respectively.

As of the end of Q3-23, GPMT reported a realized yield of 8.4% and a weighted average stabilized loan-to-value (“LTV”) of 63.3%.

However, it is important to note that GPMT’s dividend payout ratio has been consistently high, exceeding 100% in most years between 2019 and 2023, indicating a potentially unsustainable dividend.

The company’s track record raises concerns, as its adjusted operating earnings and EPS have experienced significant declines since 2019, with a dividend payout ratio consistently exceeding 100% except in the year following a dividend cut of -61.31% in 2020.

Analysts expect a temporary increase in 2023 EPS, but a subsequent significant fall of nearly 40% in 2024. Based on the current 13.77% dividend yield and a P/E ratio of 18.63x, we recommend investors to exercise caution and avoid investing in Granite Point Mortgage Trust.

Global Net Lease (GNL)

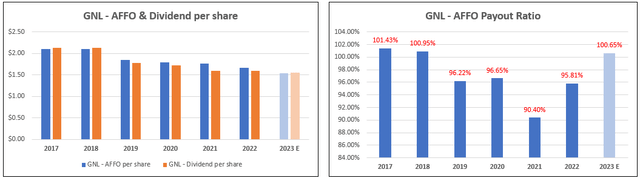

Global Net Lease (GNL), an internally managed net lease REIT, focuses on acquiring and managing a diversified portfolio of commercial properties, primarily consisting of single-tenant properties.

With a market cap of approximately $2.0 billion, GNL’s 66.8 million SF portfolio spans 11 countries, encompassing over 1,300 properties. Most of its portfolio is derived from single-tenant properties, representing approximately 73%.

The company has demonstrated a concerning trend in its performance, with a declining blended average AFFO growth rate since 2017. From 2017 to 2023, GNL’s AFFO per share has experienced six years of decline, with only one year showing a marginal increase of 1%.

It is important for investors to recognize that the sustainability of a REIT’s dividend is closely tied to the quality of its earnings. With consecutive years of declining cash flow and AFFO per share, investors should approach GNL cautiously.

The Unpredictable Terrain of Financial Aguero: GNL and AFCG Scrutinized

Uncertainties Lurk for GNL

Global Net Lease (GNL) faces a tough dilemma – to either cut its dividend, slow its growth, or sustain an unsustainable payout rate – none of which signal good tidings. It exhibited the ability to cut its dividend and maintain unsustainable payout ratios in its recent history, a troubling sign. The company did not increase its dividend in 2017 and 2018, followed by consecutive cuts from 2019 through 2023. Despite these cuts, GNL couldn’t achieve a conservative Adjusted Funds from Operations (AFFO) payout ratio. In 2023, the company’s AFFO payout ratio was estimated to be 100.65%, raising concerns about a potential dividend cut upon a deeper dive.

The company is currently trading at a steep discount, with a high yield of 15.91%. However, concerns loom over its high AFFO payout ratios, which could result in a troubled dividend path. The verdict – we rate Global Net Lease a Hold, urging investors to tread cautiously.

Curious Moves at AFCG

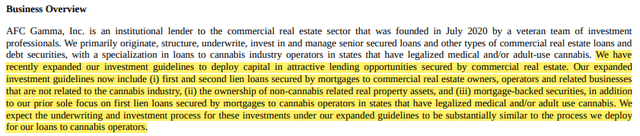

AFC Gamma (AFCG) is an externally managed mortgage Real Estate Investment Trust (mREIT) with a specialized focus on loans issued to state-licensed cannabis operators in the commercial real estate (“CRE”) sector. Established in 2020, AFCG mainly originates, underwrites, and invests in senior secured CRE loans and other types of debt securities, including direct and bridge loans ranging from $5 million to $100 million.

However, the company recently expanded its investment criteria to include multiple types of CRE outside of cannabis and ventured into additional loan types, deviating from its initial laser focus on loans to cannabis operators. Such abrupt alterations in the investment strategy raise concerns about the company’s direction and expertise outside its core domain.

Despite its short history, AFCG has already cut its dividend and is grappling with high dividend payout ratios, reaching 97.56% in 2023. The company’s recent earnings history has been less than stellar, with adjusted operating earnings per share falling by 18% from 2022 to 2023. While the company currently offers a 16.76% dividend yield, doubts linger about its sustainability and navigational clarity, urging investors to exercise caution.

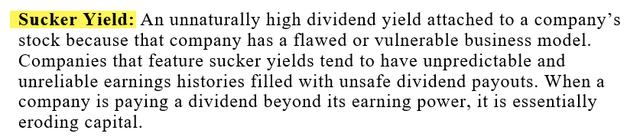

Avoiding the Sucker Yield

In his new book, the author defines a “sucker yield” as dividends from companies with erratic earnings history and unsafe payout ratios – a red flag for investors. It’s evident that a solid safety margin is paramount in the investment realm, reinforced by steering clear of “sucker yields” and opting for SWANs (Sleep Well at Night assets) – an apt approach to maintain a resilient portfolio. It’s crucial, especially in a time when uncertainties lurk around the financial landscape, triggering a dire need for a cautious, calculated investment approach.

Embracing “SWAN Investing” and steering clear of “sucker yields” is a prudent move in today’s financial climate. It’s an approach designed to ward off risks and safeguard investments against turbulent tides, offering a sense of assurance amidst the unpredictable journey through the financial maze.

Reflecting on Caution

The financial terrain, with GNL and AFCG as emblematic figures, is riddled with uncertainties, urging investors to exercise utmost caution. It’s a call to weigh each step carefully, holding onto robust principles and seeking refuge in investments that guarantee a tranquil night’s sleep. Only by maintaining a keen eye for detail and embracing calculated strategies can investors brave the storm and emerge unscathed.

Authored by Brad Thomas