Market Outlook: Can Bulls Overcome Recent Downturn?

After a two-day rally on Friday and Monday, bears regained control, pushing stocks lower on Tuesday. The volatility in U.S. equities remains significant, which is expected to intensify with the Federal Reserve’s interest rate decision scheduled for Wednesday afternoon. Tariff news was minimal this time; however, the Trump administration has confirmed new tariffs set to take effect in early April. In an effort to broker peace between Ukraine and Russia, President Donald Trump had a lengthy conversation—over 90 minutes—with Russian President Vladimir Putin, though details of the discussion were not available at the time of this writing.

Despite the challenging trading environment, bulls have three significant advantages:

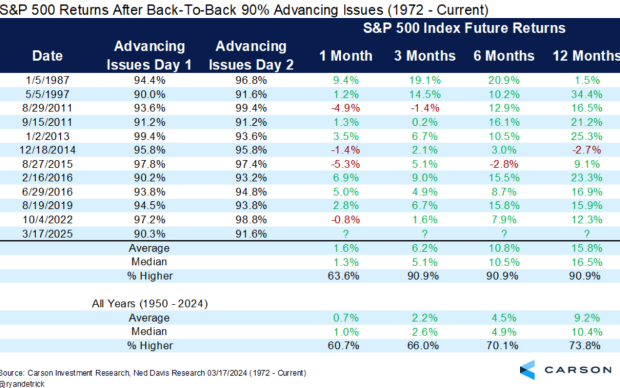

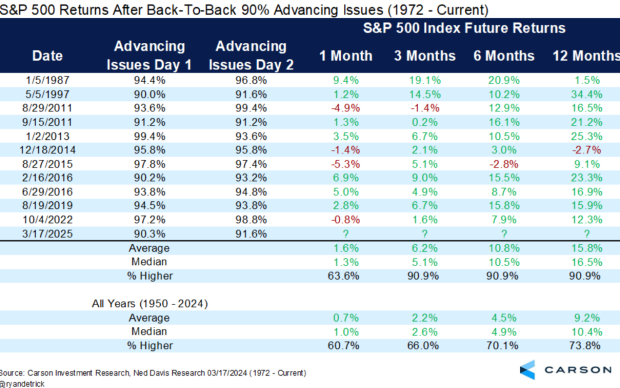

Back-to-Back 90% Advancing Days

One indicator signaling a potential market bottom is breadth, or market participation. Notably, on Friday and Monday, the market recorded consecutive days with 90% of S&P 500 Index stocks advancing. Historical analysis by Jason Goepfert (@jasongoepfert) reveals that after two straight 90% advancing days following a six-month low, the S&P 500 Index has shown an increase two months later in every instance (17 occurrences). Furthermore, the market has risen in ten of the last twelve instances observed over six-month and twelve-month periods.

Image Source: Carson Investment Research, Ned Davis Research, @RyanDetrick

Post-Election Seasonal Pattern

Historical seasonality patterns indicated a weak first quarter; however, they also suggest that stocks typically bottom around late March and begin a rally into the summer months.

Image Source: Hirsch Holdings, StockTradersAlmanac.com

Bullish Sentiment Craters

The AAII Bull/Bear sentiment survey shows bullish sentiment has recently dropped to 17.7%, the lowest level since September 2022. Notably, bullish sentiment has remained below 20% for three consecutive weeks for the first time in history.

Image Source: Investors Intelligence, Subu Trade

Looking ahead, a critical market area to monitor is the “Magnificent 7” stocks, which some Wall Street investors have dubbed the “Lag7” due to their recent underperformance. Despite this, these mega-cap technology stocks contribute significantly to the market and are often considered “hedge fund” holdings. Tesla (TSLA), the most affected among them, is showing signs of recovery following an analyst upgrade and a survey indicating that about 70% of participants in a German poll expressed willingness to purchase a Tesla. Both Meta Platforms (META) and Amazon (AMZN) are currently testing their rising 200-day moving averages for potential support. Meanwhile, Apple (AAPL) and Nvidia (NVDA) remain below this moving average; however, NVDA experienced an uptick in early trading following CEO Jensen Huang’s keynote speech at the GTC global artificial intelligence conference.

Bottom Line

As the market navigates through geopolitical uncertainty, tariffs, and fluctuating interest rates, a combination of strong market breadth signals, historically favorable seasonal trends, and low bullish sentiment creates a case for potential market gains in the near future.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys. These stocks are deemed “Most Likely for Early Price Pops.”

Historically, this comprehensive list has outperformed the market by more than double since 1988, with an average yearly gain of +24.3%. It is advisable to give these hand-picked stocks your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? You can download the 7 Best Stocks for the Next 30 Days report for free. Click to access it now.

Amazon.com, Inc. (AMZN) : Free Stock Analysis report

Apple Inc. (AAPL) : Free Stock Analysis report

NVIDIA Corporation (NVDA) : Free Stock Analysis report

Tesla, Inc. (TSLA) : Free Stock Analysis report

Meta Platforms, Inc. (META) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.