Existing home sales, the backbone of the United States housing market, experienced a significant downturn in March 2024. The decline, both month-over-month and year-over-year, has set the market abuzz. The culprit? Escalating mortgage rates have seemingly spooked potential buyers, leaving them hesitant to dive into real estate investments.

Decoding the Figures

The National Association of Realtors (“NAR”) revealed on Apr 18, 2024, that existing home sales plummeted by 4.3% to a seasonally adjusted annual rate of 4.19 million units in March compared to February. This decline also echoes a 3.7% dip from March 2023 figures, indicating a cautious sentiment among buyers following a surge in sales in February 2024.

The drop in home sales was evident across the United States, with three out of four regions witnessing a decline. Sales in the Midwest, South, and West plunged by 1.9%, 5.9%, and 8.2%, respectively, in March 2024 compared to February 2024. Conversely, the Northeast saw a 4.2% uptick, emerging as the sole region to experience an increase in existing home sales.

While sales dwindled year over year in all regions, the total housing inventory showed improvement in March at 1.11 million units – a 4.7% surge from February and a notable 14.4% increase from the same period last year. Despite the somber market conditions, the supply of existing homes witnessed a boost. NAR highlights that at the current pace, it would take 3.2 months to deplete the existing inventory, up from 2.9 months in February and 2.7 months in the previous year.

The median price of existing homes in March soared to a record high of $393,500, marking a 4.8% increase from the year-ago period. This surge in sales prices across all regions illustrates the resilience of the market in the face of mounting inventory.

Impact of Rising Mortgage Rates

Freddie Mac’s data indicates a 6 basis points hike in the 30-year fixed-rate mortgage to 6.88% for the week ending Apr 11, 2024. This figure further escalated by 22 bps for the week closing on Apr 18, 2024, marking the third consecutive weekly surge in April. The relentless increase in mortgage rates amid a recovering market and diminishing hopes for rate cuts in 2024, given the prevailing high inflation, have deterred potential homebuyers.

Despite the challenging environment posed by high mortgage rates, first-time buyers accounted for 32% of sales in March, reflecting a 26% increase from the previous month and a 28% rise year over year. Lawrence Yun, NAR’s chief economist, noted that the sluggish home sales can be attributed to the stagnant interest rates, despite a considerable uptick in job numbers post-COVID.

Insights on Leading Homebuilders

Although the homebuilding industry faces a myriad of challenges, certain factors have propelled growth prospects for key players. Notably, Dream Finders Homes, Inc., KB Home, NVR, Inc., Toll Brothers, Inc., and PulteGroup, Inc. have navigated the market headwinds to exhibit commendable performance.

A Look at Some Prominent Homebuilders

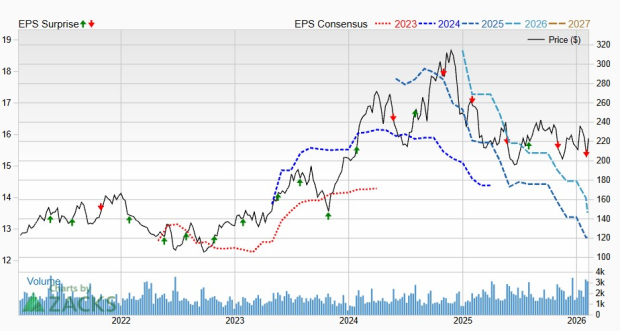

Dream Finders: This Florida-based firm boasting a Zacks Rank #1 (Strong Buy) has witnessed a staggering 137.3% surge in its shares over the past year. Earnings per share for 2024 are expected to grow by 23.7% year over year.

KB Home: Headquartered in Los Angeles, this homebuilder, also holding a Zacks Rank #1, registered a 48.3% surge in its stock over the past year. Earnings for 2024 are projected to grow by 13.9%.

NVR: Based in Reston, VA, NVR, Inc., carrying a Zacks Rank #1, saw a 32% increase in its stock over the previous year. Earnings in 2024 are anticipated to grow by 7.8%.

Toll Brothers: This Pennsylvania-headquartered company, flaunting a Zacks Rank #1, witnessed an 82.1% increase in its shares over the past year. Earnings for 2024 are projected to grow by 10.9%.

PulteGroup: With its headquarters in Atlanta, GA, PulteGroup secured a Zacks Rank #2 (Buy), with shares rising by 70.9% over the previous year. Earnings for 2024 are poised to grow by 0.6%.

Top 5 Dividend Stocks for Your Retirement

Zacks identifies five established companies with robust fundamentals and a track record of dividend growth. These companies are well-positioned to sustain dividend payments in the future. Access an exclusive Special Report filled with unconventional insights you won’t find from your local financial advisor.

Explore our top 5 picks for FREE now