Universal Health Services, Inc.—commonly known as UHS—is gearing up to unveil its first-quarter 2024 financial results on April 24, after the markets have closed.

Performance Expectations for Q1

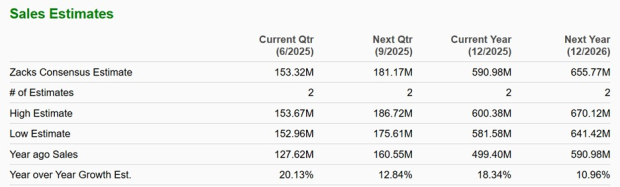

Analysts project a bright future for UHS in the first quarter of this fiscal year. The Zacks Consensus Estimate foresees earnings per share of $3.14, marking a 34.2% improvement from the same period last year. Revenues are expected to hit $3.8 billion, an 8.7% increase compared to the previous year.

Earnings Track Record

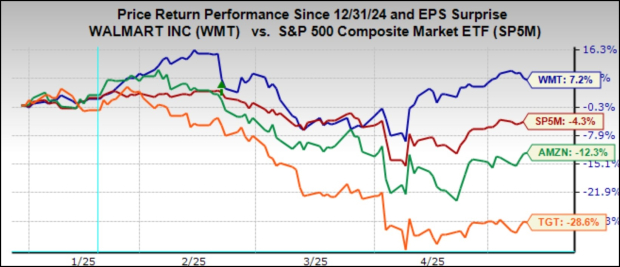

Universal Health boasts an impressive track record when it comes to surpassing earnings estimates. The company has outperformed expectations in each of the past four quarters, with an average surprise margin of 5.87%. This consistent growth trajectory is evident in the chart below:

Insights from the Quantitative Model

A promising blend of positive indicators—such as a favorable Earnings ESP and a Zacks Rank of 1 (Strong Buy), 2 (Buy), or 3 (Hold)—suggests Universal Health is positioned to exceed earnings projections this quarter.

Earnings ESP: Universal Health boasts an Earnings ESP of +8.56%, projecting a promising outlook with a Most Accurate Estimate of $3.41 compared to the Consensus Estimate of $3.14.

Zacks Rank: With a current Zacks Rank of 2, UHS appears to be in a robust position heading into the quarterly report.

Focus on Acute Care and Behavioral Health Services

One of the key drivers of Universal Health’s revenue growth is the Acute Care Hospital Services segment, which is expected to see significant contributions this quarter. Strong patient volumes and enhanced operational metrics are likely to bolster the unit’s performance, offsetting potential challenges from rising physician costs.

The Acute Care Hospital Services segment is anticipated to report a year-over-year revenue growth of 8.7% and a 5.9% increase in same-facility adjusted admissions—painting a positive picture for UHS in this crucial area.

Meanwhile, the Behavioral Health Care Services segment is also primed for growth due to sustained demand for its services, with an estimated revenue increase of 7.7% year over year.

Challenges and Outlook

Though Universal Health is set for a promising quarter, challenges loom on the horizon. Elevated expenses, particularly in salaries, wages, and supplies, are likely to impact the company’s profit margins. Cost control measures will be essential in navigating these hurdles for sustained growth.

Exploring Investment Opportunities

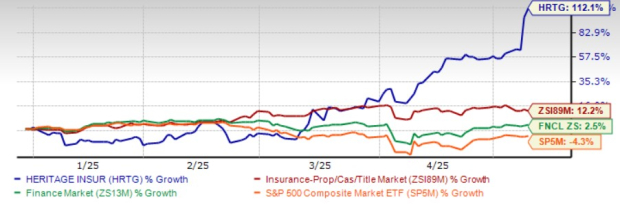

For investors seeking potential winners in the healthcare sector, other noteworthy options include HCA Healthcare, Inc., Insulet Corporation, and Edwards Lifesciences Corporation. Each company showcases a strong Earnings ESP and a favorable Zacks Rank, setting the stage for potential earnings beats in the upcoming quarter.

Top 5 Dividend Stocks for Your Retirement

Unlock insights on well-established companies with a history of dividend growth. Access a Special Report to make informed investment decisions.

Explore the Top 5 picks for FREE >>

Stay informed about earnings announcements with the Zacks Earnings Calendar.

Read the original article on Zacks.com here.

Follow Zacks Investment Research for the latest updates on market trends and investment analysis.