TriCo Bancshares Generating Heat in the Market

Riding the waves of market fervor, TriCo Bancshares (TCBK) has captured the spotlight with a remarkable options trading volume. Today, a total of 521 contracts swapped hands, equivalent to 52,100 underlying shares. This flurry represents a staggering 54.6% of TCBK’s typical daily trading volume over the past month—a surge not to be taken lightly. At the core of this excitement lies the $35 strike call option expiring May 17, 2024, with 501 contracts traded, reflecting about 50,100 underlying shares of TCBK. The charts tell a story—one where TCBK’s trailing twelve-month trading history reveals the $35 strike glowing like a supernova in orange.

Chevron Corporation Exploring New Heights

In the high-octane landscape of options, Chevron Corporation (CVX) is making waves with a jaw-dropping volume of 38,598 contracts traded today. This robust figure translates to about 3.9 million underlying shares, a significant 52.7% of CVX’s average daily trading volume over the past month. Zooming in on the $160 strike call option expiring April 19, 2024, the action escalates, with 6,067 contracts changing hands—a monumental 606,700 underlying shares of CVX. The charts reveal CVX’s trading saga, with the $160 strike shining brightly in orange.

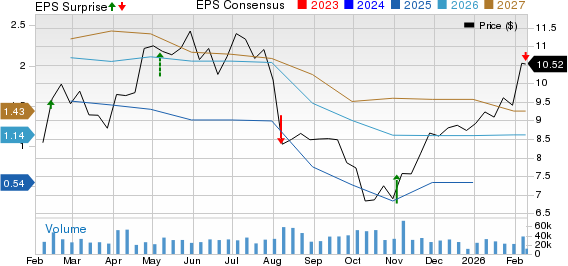

Customers Bancorp Inc Sees Swell in Options Trading

Customers Bancorp Inc (CUBI) is not one to be left behind in this flurry, witnessing options trading volume of 1,228 contracts today. This figure represents approximately 122,800 underlying shares, about 52.6% of CUBI’s average daily trading volume over the past month. Noteworthy action is observed for the $45 strike put option expiring May 17, 2024, with 1,216 contracts in play today, signifying roughly 121,600 underlying shares of CUBI. Dive into CUBI’s trading history as the $45 strike stands out like a beacon in the night.

For a broader exploration of the array of expirations available for TCBK options, CVX options, or CUBI options, a visit to StockOptionsChannel.com might just be the next best move.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also Explore:

Funds Holding SB

Funds Holding FUND

IEI Historical Stock Prices

The author’s views and opinions are solely theirs and do not necessarily mirror those of Nasdaq, Inc.