Warren Buffett, also known as the Oracle of Omaha, is a legendary figure in the world of investing. His track record of consistently outperforming the stock market has made him a revered figure among investors worldwide. With a keen eye for value and quality, Buffett’s portfolio reveals insights into his investment philosophy that many seek to emulate.

Visa (V)

Source: Kikinunchi / Shutterstock.com

One of the shining stars in Buffett’s constellation of investments is Visa (NYSE:V). This credit and debit card giant not only boasts impressive financial growth but also delivers robust profit margins. In a world where plastic reigns supreme, Visa’s wide acceptance and convenience make it a prime choice for consumers.

In its recent quarterly report, Visa showed a 9% year-over-year revenue growth, with net income soaring by 17% over the same period. With a solid 56.64% net profit margin, the company continues to impress investors and analysts alike.

Despite already stellar performance, analysts project a 14% upside for Visa stock, indicating continued growth potential. With shares up 5% year-to-date and a 70% increase over the last five years, Visa remains a beacon of stability and success.

Amazon (AMZN)

Source: Daniel Fung / Shutterstock

Despite his late entry into the tech world, Buffett’s inclusion of Amazon (NASDAQ:AMZN) in his portfolio speaks volumes. This tech behemoth boasts a combination of competitive advantages, expanding profit margins, and diverse revenue streams that tick all the right boxes.

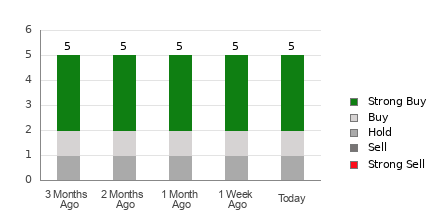

Amazon has not disappointed, with an impressive 18% year-to-date gain and a staggering 76% increase in shares over the last year. Analysts are bullish on the stock, projecting an 18% upside and unanimously rating it a Strong Buy – a rare stamp of approval in the analyst community.

With a recent 14% YoY revenue growth touching a record $170.0 billion and solid performance from Amazon Web Services, the company continues to demonstrate its prowess and potential for continued growth.

American Express (AXP)

Source: First Class Photography / Shutterstock.com

Another stalwart in Buffett’s portfolio is American Express (NYSE:AXP). With a history of consistent growth and a modest P/E ratio of 20, this financial giant has been a favorite of Buffett for decades.

Expectations remain high for American Express, with anticipated revenue growth in the range of 9% to 11% annually beyond 2026, accompanied by mid-teen EPS growth rates. The company’s Q4 2023 results bore fruit to these expectations, with revenue and net income climbing by 11% and 23% YoY, respectively.

Not to be outdone, American Express also pleased shareholders with a dividend hike of 17% in its recent announcement. This move underscores the company’s commitment to rewarding investors and maintaining its reputation as a sound investment.

On the day of publication, Marc Guberti held a long position in AMZN. The views expressed in this article belong to the author, in accordance with InvestorPlace.com Publishing Guidelines.