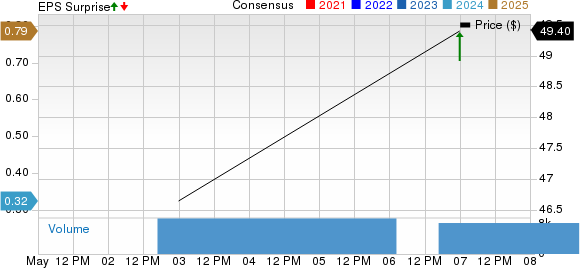

Reddit RDDT reported first-quarter 2024 adjusted earnings of 29 cents per share, which beat the Zacks Consensus Estimate by 2.63%.

Including stock-based compensation of $595.5 million, the GAAP loss was $8.19 per share, much wider than the $1.05 reported in the year-ago quarter.

Revenues of $243 million surpassed the Zacks Consensus Estimate by 14.62%. The figure jumped 48.4% year over year. Ad revenues increased 39% year over year to $222.7 million. Other revenues surged 454% year over year to $20 million, driven by new data licensing agreements, including Google.

Daily Active Uniques (“DAUq”) increased 37% year over year to 82.7 million. U.S. DAUq jumped 45% year over year to 41.5 million, while International DAUq increased 30% year over year to 41.2 million.

Weekly Active Uniques (“WAUq”) surged 40% year over year to 306.2 million. U.S. WAUq jumped 53% year over year to 151.3 million, while International WAUq increased 30% year over year to 154.9 million.

Reddit Inc. Price, Consensus and EPS Surprise

Reddit Inc. price-consensus-eps-surprise-chart | Reddit Inc. Quote

Average Revenue Per User (ARPU) increased 8% year over year to $2.94. U.S. ARPU increased 3% to $4.77 while International climbed 10% on a year-over-year basis to $1.10.

Quarter Details

First-quarter 2024 U.S. revenues (contributed 82% to revenues) jumped 53% year over year to $199.8 million. International revenues (18% of revenues) increased 30.5% year over year to $43.2 million.

The gross margin on a non-GAAP basis was 88.7%, expanding 500 basis points year over year.

Adjusted EBITDA was $10 million in the reported quarter against adjusted EBITDA loss of $50.2 million in the year-ago quarter.

Sales & Marketing expenses surged 114.3% year over year to $124.1 million. Research & development expenses soared to $437 million from the year-ago quarter’s figure of $108.8 million. General & Administrative expenses surged to $243.5 million from the year-ago quarter’s figure of $40.8 million.

Balance Sheet

As of Mar 31, 2024, Reddit had cash and cash equivalents, including marketable securities of $1.67 billion compared with $1.21 billion as of Dec 31, 2023.

In the first quarter, Reddit generated $32.1 million of cash from operating activities and a free cash flow of $29.2 million.

Guidance

For the second quarter of 2024, Reddit expects revenues between $240 million and $255 million.

Adjusted EBITDA is expected between $0 million and $15 million.

Zacks Rank & Stocks to Consider

Currently, Reddit carries a Zacks Rank #3 (Hold).

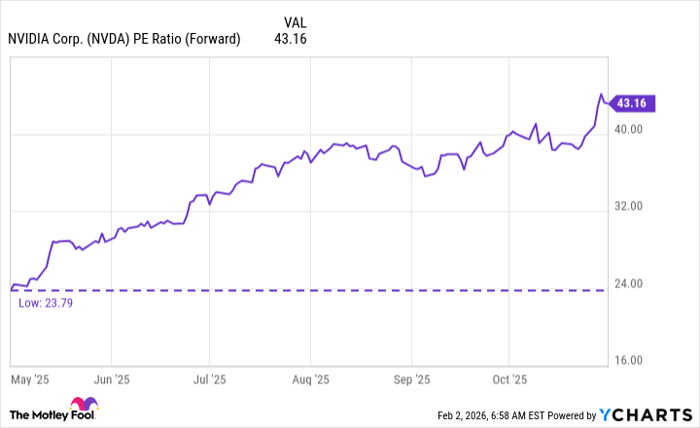

Babcock & Wilcox BW, Dropbox DBX and NVIDIA NVDA are some better-ranked stocks that investors can consider in the Zacks Computer and Technology sector, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Babcock shares have declined 21.9% in the year-to-date period. BW is set to report its first-quarter 2024 results on May 9.

Dropbox shares have declined 19.9% year to date. DBX is set to report its first-quarter 2024 results on May 9.

NVIDIA shares have gained 82.9% year to date. NVDA is set to report its first-quarter fiscal 2025 results on May 22.

Top 5 Dividend Stocks for Your Retirement

Zacks targets 5 well-established companies with solid fundamentals and a history of raising dividends. More importantly, they have the resources and will to likely pay them in the future.

Click now for a Special Report packed with unconventional wisdom and insights you simply won’t get from your neighborhood financial planner.

See our Top 5 now – the report is FREE >>

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Babcock (BW) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Reddit Inc. (RDDT): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.