Google parent company Alphabet GOOGL, reported strong quarterly earnings several weeks ago, crushing estimates and gapping significantly higher.

Continued strong growth in key segments like search, YouTube, and cloud computing propelled YoY sales growth back into double digits (13%). Management at Alphabet is extremely excited about the prospects of the AI revolution as it will both enhance productivity at the company and drive continued growth as other companies utilize Alphabet’s products and services.

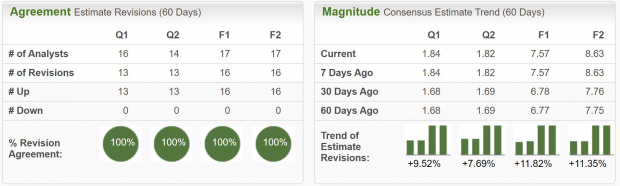

Thanks to the prospects of AI and the reacceleration of growth at the technology giant, analysts have begun revising earnings estimates higher. Earnings expectations have increased by as much as 11% in the last week, giving Alphabet a Zacks Rank #1 (Strong Buy) ranking.

Furthermore, based on a compelling technical setup forming in the stock’s price action a highly asymmetric options trade has presented itself.

Because of the immense leverage in options as well as the precise risk management characteristics of the product, discerning traders might consider this favorable trading setup.

Image Source: Zacks Investment Research

Trade Setup

We can see in the last week of April, GOOGL stock gapped to a new yearly high following itsearnings call Since then, the stock has built out a convincing bull flag, setting a clear breakout level.

This earnings gap, bull flag pattern is one of my favorite technical chart patterns and is driven by huge institutional buying.

If the stock can clear the $170 level, it should begin a powerful bull run to new highs.

I also want to note the indicator below the chart, which measures the Average True Range (ATR). This shows the expected daily range for the stock. Today the ATR measures 4, meaning on average the stock moves about 4 points per day.

A typical momentum breakout trade like the one forming on GOOGL should typically offer a 2 ATR move if it successfully breaks out, making the first target for the trade ~$178. This is where traders can expect to take a profit.

Below, I will cover the best way to manage this trade through the options market.

Image Source: TradingView

Implied Volatility

Probably the most important consideration when trading options is the implied volatility. The process for determining when the market favors buying versus selling an option is pretty straightforward.

Traders should buy an option when implied volatility is relatively low and look to sell options when the implied volatility is relatively high, when it fits with a trading thesis.

If you are looking to buy an option, but the IV is already relatively high, you are severely limiting the upside potential, and buying the underlying stock is likely to be the better expression of the trade.

Whereas if you are an option seller, you want to see high IV priced into the options, because it gives you a juicier premium to collect if you sell the option.

In the case of Alphabet stock, implied volatility is currently relatively low. The quarterly earnings report has been released, a big move has happened, and the price has consolidated in recent weeks, lowering the recent range and IV.

Of course, determining whether implied volatility is high or low is a nuanced activity, but as of this writing, IV on Alphabet stock is 26%. Additionally, the IV Percentile is 38%, meaning the stocks implied volatility is higher than it has been only 38% of the time in the last year.

Based on these metrics, I would say that call options are relatively cheap in GOOGL stock, and favor buying, although they are not a bargain. However, based on the momentum trade setup, there is still considerable asymmetry in the trade.

Strike Selection

After trading options for the last ten years, I have found an extremely simple and effective method for structuring these trades.

While many traders like using spreads and advanced multi-leg strategies, I am a fan of simply buying 30 delta calls (puts). This way I can risk the trade to $0, and the only trade management necessary is selling the option to take profit. If your trade is wrong, you can just let the option expire worthless.

I prefer risking the full premium in the option because it gives me very explicit risk management.

Additionally, the 30-delta option gives a perfect mix of lower priced options, medium distance to being in-the-money, and high asymmetry. Lower delta and the strikes are too far from the current price, and higher delta lowers the asymmetry.

Image Source: Barchart

GOOGL May 31 Long Call

Buy $175 Call @ $1.81

Upfront trade cost: $181 per contract

Maximum risk: $181.00

Maximum return: infinite (on upside)

P.S. remember that each contract is quoted at the per-share rate but represents 100 shares of the underlying security.

In the table below, we can see a range of potential outcomes from the trade. My base expectation is that GOOGL stock breaks out within the next week and trades to the target of ~$177.50. In the table we can see highlighted the profit if the stock gets to $177.50 by May 22, which shows +123% profit or $244 per contract.

This would be a tidy return for just a week of trading!

Of course, the stock may move differently, getting to the target sooner, later or not at all, with returns ranging from +299% returns, to -100%. But most importantly, we know the maximum amount of risk built into the trade, allowing us to properly fit it into a portfolio.

Image Source: Options Profit Calculator

Bottom Line

For investors looking for active trading opportunities and enjoy the added complexity and potential returns of options, this is a trade worth considering.

Momentum is a powerful and well-proven market phenomenon that allows privy investors the opportunity to profit. And for those who understand the power of options, the returns can be even further enhanced if structured properly.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.