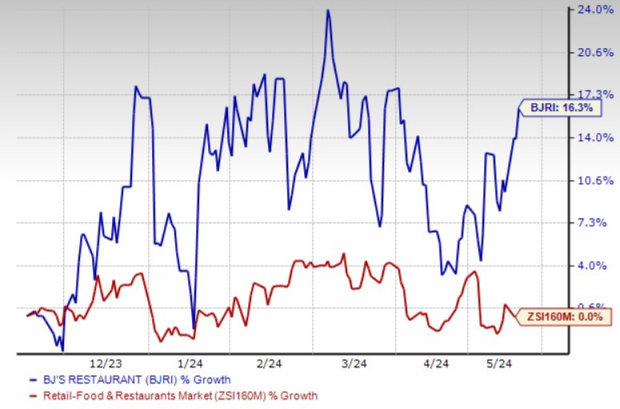

BJ’s Restaurants, Inc. BJRI has seen a 16.3% increase in its shares over the past six months, outperforming the industry‘s stagnant growth, thanks to its focus on menu innovation, expansion initiatives, remodeling projects and strong digitalization efforts.

Recently, the company reported first-quarter fiscal 2024 results, wherein both earnings and revenues beat the Zacks Consensus Estimate. Greg Levin, BJ’s Restaurants’ CEO and president, noted that the company’s impressive quarterly performance reflects positive trajectory of its business. He highlighted the impact of BJRI’s growth strategies and productivity efforts, which have helped to offset challenges such as adverse weather conditions at the beginning of the quarter.

However, increased marketing spend and commodity inflation are concerns. Management anticipates fiscal second-quarter comps to be negative.

Let’s delve deeper.

Growth Drivers

BJ’s Restaurants’ extensive focus on refining and streamlining its menu is the key driver for improved traffic. Its menu and pricing strategy includes daily Brewhouse Specials, like Slow-Roasted Thursdays, offering guests great value. Customers can enjoy a rack of ribs, two sides, a starter salad and a full Pizookie dessert.

BJRI is benefiting from expansion efforts. It maintains a balanced approach to opening new restaurants while ensuring the portfolio is optimized for maximum shareholder returns. In 2023, it unveiled five new restaurants, including the relocation of the Chandler, AZ establishment.

During first-quarter fiscal 2024, it opened one new restaurant in Brookfield, WI, and reported solid feedback with respect to the same. It stated plans to open three new restaurants in fiscal 2024. The company is steadfast in its commitment to expand its presence to more than 425 restaurants domestically.

BJ’s Restaurants is focusing on remodeling to drive sales. Based on data collected over several quarters after previous remodels, it is optimistic and anticipates the strategy to pave a path for increased sales and foot traffic in the upcoming periods. Year to date (as of first-quarter fiscal 2024) the company completed 13 remodels and expects to initiate 10 additional remodels in fiscal 2024.

This Zacks Rank #3 (Hold) company is also investing heavily in technology-driven initiatives, like digital ordering, to boost sales. Its app and digital platforms are allowing it to more effectively and efficiently offer promotions. Apart from partnerships, it has rolled out several digital initiatives like digital check-ins, digital menus and digital payment options to attract more customers. Additionally, BJRI’s loyalty guest database continues to grow well with steady increase in transactions.

Image Source: Zacks Investment Research

Concerns

Dismal comps performance continues to hurt the company. During the fiscal first quarter, comparable restaurant sales decreased 1.7% year over year against a rise of 9% reported in the prior-year quarter. During the quarter, sales trends were negatively influenced by unusual winter storms, leading to lower industry-wide traffic in January. It reported a decline in comparable restaurant traffic of approximately 9% in January, followed by negative mid-single digits in February and March.

Inflation has affected its operations, new restaurant development and the corresponding return on invested capital. Although management has initiated efforts to mitigate inflation and fluctuations in key operational costs by gradually raising menu prices and implementing cost-saving measures, improved purchasing practices, productivity enhancements and leveraging economies of scale, uncertainty persists regarding sustainment.

For the fiscal second quarter, BJRI anticipates a slight increase in total operating and occupancy costs due to the supplementary marketing spend. Also, commodity inflation pressures cannot be ruled out. The company is cautious of the uncertain macroeconomic conditions.

It’s advisable for investors to avoid entering new positions in the stock since it is still being negatively impacted by poor comparable sales performance.

Key Picks

Wingstop Inc. WING sports a Zacks Rank #1 (Strong Buy) at present. It has a trailing four-quarter negative earnings surprise of 21.4%, on average. The stock has gained 93.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for WING’s 2024 sales and earnings per share (EPS) suggests a rise of 27.5% and 36.7%, respectively, from the year-ago levels.

Brinker International, Inc. EAT currently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 213.4%, on average. Shares of EAT have gained 25.6% in the past year.

The Zacks Consensus Estimate for EAT’s 2024 sales and EPS indicates 5% and 39.2% growth, respectively, from the year-earlier actuals.

Carrols Restaurant Group, Inc. TAST carries a Zacks Rank #2 at present. It has a trailing four-quarter earnings surprise of 114.3%, on average. TAST’s shares have gained 75.7% in the past year.

The Zacks Consensus Estimate for TAST’s 2024 sales and EPS indicates 3.8% and 20.8% growth, respectively, from theprior- year levels.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

BJ’s Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Carrols Restaurant Group, Inc. (TAST) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.