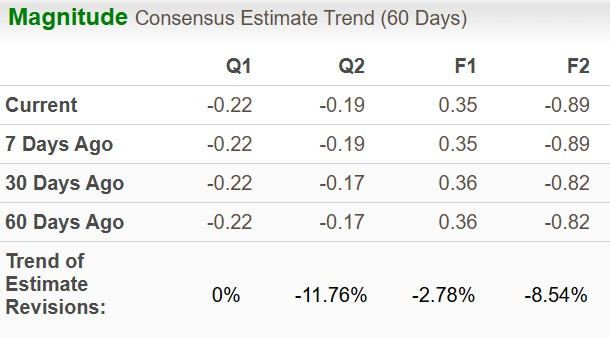

BP plc BP has witnessed upward earnings estimate revisions for 2024 and 2025 in the past 30 days.

The Zacks Consensus Estimate for the Zacks Rank #3 (Hold) company’s 2024 and 2025 earnings is pegged at $4.78 and $5.44 per share, respectively.

What’s Favoring the Stock?

BP’s robust financial results in the first quarter of 2024 provide a strong foundation for investment consideration. The company reported an underlying replacement cost profit of $2.7 billion, even amid challenging market conditions characterized by lower oil and gas realizations, and the impacts of refinery outages. This performance demonstrates BP’s ability to maintain profitability and operational resilience, which is crucial for long-term stability and growth potential in the volatile energy sector.

BP’s commitment to shareholder returns is evident from its aggressive buyback program and stable dividends. In the first quarter of 2024 alone, BP announced a $1.75-billion share buyback and maintained a dividend of 7.270 cents per share. This policy reflects not only the company’s financial health but also its priority to deliver value to shareholders.

BP is actively investing in strategic growth areas, particularly in the transition toward low-carbon energy sources. The company’s investment in projects like the Azeri Central East platform and the expansion of its renewable energy portfolio, with a reported 58.5 GW in the renewables pipeline, positions it well to capitalize on the global shift toward sustainable energy. These initiatives likely enhance BP’s revenue streams and diversify its portfolio away from traditional fossil fuels.

BP’s focus on operational efficiency and cost management is set to yield at least $2 billion in cash cost savings by the end of 2026. Such strategic cost reductions are essential for maintaining competitive margins and improving the company’s bottom line. These savings stem from digital transformations, supply-chain efficiencies and other operational improvements, contributing to BP’s attractiveness as a resilient investment in a cost-sensitive industry.

Risks

BP’s balance sheet has significant debt exposure compared with the composite stocks belonging to the industry, which can affect its financial flexibility.

Stocks to Consider

Investors interested in the energy sector may look at some better-ranked stocks like SM Energy Company SM, Ecopetrol S.A. EC and Hess Corporation HES. SM Energy and Ecopetrol sport a Zacks Rank #1 (Strong Buy), and Hess carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

SM Energy is an independent oil and gas company engaged in the exploration, exploitation, development, acquisition, and production of oil and gas in North America.

The Zacks Consensus Estimate for SM’s 2024 and 2025 EPS is pegged at $6.60 and $7.46, respectively. The stock has witnessed upward earnings estimate revisions for 2024 and 2025 in the past seven days.

Ecopetrol operates across various sections of the oil and gas industry, including the exploration, development, and production of oil and gas, refining, transportation, and the sale of petroleum products.

Ecopetrol has witnessed upward earnings estimate revisions for 2024 and 2025 in the past seven days. The Zacks Consensus Estimate for EC’s 2024 and 2025 EPS is pegged at $2.55 and $2.63, respectively.

Hess is a leading oil and natural gas exploration and production company. The company’s oil and gas proved reserves increased more than 8% year over year last year.

The Zacks Consensus Estimate for HES’s 2024 and 2025 EPS is pegged at $9.17 and $11.15, respectively. The stock has witnessed upward earnings estimate revisions for 2024 and 2025 in the past 30 days.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

Ecopetrol S.A. (EC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.