Maximus, Inc. MMS stock has appreciated 9% in the past month, outperforming the S&P 500 composite’s 5.9% growth.

Reasons Why MMS is an Attractive Pick Now

Solid Rank: MMS currently carries a Zacks Rank #2 (Buy) and a VGM Score of A. Our research shows that stocks with a Zacks Rank #1 (Strong Buy) or 2, when combined with a VGM Score of A or B, offer the best investment opportunities. Thus, the company appears to be a compelling investment proposition at the moment.

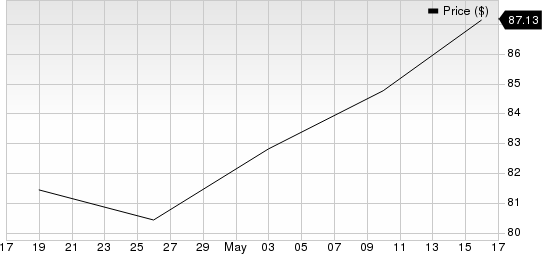

Maximus, Inc. Price

Maximus, Inc. price | Maximus, Inc. Quote

Northward Estimate Revisions: Three estimates for fiscal 2024 moved north in the past 30 days versus no southward revision, reflecting analysts’ confidence in the company. The Zacks Consensus Estimate for fiscal 2024 earnings has moved up 5.2% in the past 30 days.

Strong Growth Prospects: The Zacks Consensus Estimate for MMS’ fiscal 2024 earnings is pegged at $5.69, indicating 48.6% growth from the year-ago level. Earnings in fiscal 2025 are expected to increase 4.3% from the prior-year actuals.

Bullish Industry Rank: The industry to which Maximus belongs currently has a Zacks Industry Rank of 18 (of 250 groups). Such a solid rank places the industry in the top 7% of the Zacks industries. Studies show that 50% of a stock price movement is directly tied to the performance of the industry group that it hails from.

Growth Factors: Maximus is a leading operator of government health and human services programs globally. The company maintains solid relationships and a strong reputation with governments. Long-term contracts provide it with a steady flow of revenues that increased 11.7% year over year in the second quarter of fiscal 2024.

Increased longevity and more complex health needs have increased the need for government social benefits and safety-net programs. This is likely to continue driving demand for MMS’s services.

Commitment to shareholder returns makes Maximus a reliable way for investors to compound wealth over the long term. During fiscal 2023, 2022 and 2021, Maximus paid cash dividends of $68.1 million, $68.7 million and $68.8 million, respectively.

Other Stocks to Consider

Here are some other top-ranked stocks from the broader Business Service sector that investors may consider:

Conduent CNDT: The company is a global provider of digital business solutions and services to commercial, government and transportation clients. It is currently focused on rationalizing its portfolio to increase revenue generation opportunities. The approach should help CNDT free up capital for the purpose of reducing debt, buying back shares and pursuing other opportunities that promise growth.

The Zacks Consensus Estimate for CNDT’s 2024 earnings has been revised 56.6% northward in the past 60 days to $1.66. CNDT currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Barrett Business Services BBSI: The company offers business management solutions tailored for small and mid-sized enterprises across the United States.

With a growing client base, it is experiencing an expansion in gross billings. The company remains buoyed by successful marketing efforts, the introduction of new products and the implementation of BBSI Benefits. With these factors driving momentum, the outlook for 2024 is optimistic, positioning the company for a robust performance.

The Zacks Consensus Estimate for the company’s 2024 earnings has been revised 2.2% northward in the past 60 days to $7.95. BBSI also currently carries a Zacks Rank #2.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

Conduent Inc. (CNDT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.