Hyatt Hotels Corporation H announced the upcoming debut of its reportable brand, Hyatt Centric, in Puerto Rico, in partnership with Interlink and Vivo Beach Club.

The former Verdanza Hotel is currently undergoing a $25 million-dollar worth enhancement, which is inspired by Puerto Rico’s enchanted landscape including the amalgamation of the island’s captivating land and sea elements. The refurbished property will join the Hyatt portfolio under the name Hyatt Centric San Juan Isla Verde and is expected to open in 2025.

Takeaways From the New Property

The 223-guestroom hotel houses a communal space highlighted by a signature restaurant & bar, an open-air beer garden, a coffee shop, a resort-style pool deck surrounded by tropical landscape and a locally inspired restaurant and pool bar. Also, it will offer a 16,000 sq. ft. modern fitness center.

Furthermore, the guests of the new hotel will enjoy complimentary access to the prime facilities of the Vivo Beach Club. With the Isla Verde Beach being nearby, the hotel under the Hyatt Centric brand is likely to thrive in the current market after the successful launches of the preceding five Hyatt-branded hotels.

The Hyatt Centric San Juan Isla Verde will be managed by the hotel management firm, Highgate Hotels.

Hyatt on an Expansion Spree

Hyatt is consistently trying to expand its presence worldwide and has further expansion plans in Asia-Pacific, Europe, Africa, the Middle East and Latin America. Expansion in these markets would help the company gain market share in the hospitality industry, thus boosting business.

During the first quarter of 2024, 12 new hotels (or 2,425 rooms) joined Hyatt’s system, thus taking the total hotel count to 1,341 hotels (or 323,405 rooms). Notable openings during the quarter include Thompson Houston, Secrets Tides Punta Cana, Secrets Playa Blanca, Costa Mujeres and multiple UrCove properties in China accompanied by Hyatt Regency Nairobi Westlands, its first hotel in Kenya.

As of Mar 31, 2024, Hyatt had a pipeline of executed management or franchise contracts for approximately 670 hotels (or about 129,000 rooms). The company seems optimistic about enhancing its network by expanding its diversified offerings into new markets and across more price points for its guests and customers.

On the digital front, as of the first quarter, Hyatt boasted more than 700 Mr & Mrs Smith boutique and luxury hotels and villas across the globe through its channels, which include World of Hyatt. The company expects to have approximately 1,000 Mr & Mrs Smith properties available through Hyatt’s channels and World of Hyatt by the end of 2024.

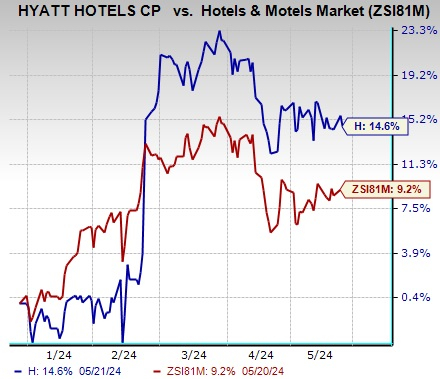

Image Source: Zacks Investment Research

Shares of this current Zacks Rank #3 (Hold) company grew 14.6% in the year-to-date period, outperforming the Zacks Hotels and Motels industry’s 9.2% growth.

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has increased 47.9% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has hiked 76.8% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has surged 84.8% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS implies growth of 16.6% and 61.9%, respectively, from the year-ago levels.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.