In the latest market close, Pure Storage (PSTG) reached $60.31, with a +0.67% movement compared to the previous day. The stock outperformed the S&P 500, which registered a daily loss of 0.27%. Meanwhile, the Dow experienced a drop of 0.51%, and the technology-dominated Nasdaq saw a decrease of 0.19%.

Shares of the data storage company have appreciated by 15.66% over the course of the past month, outperforming the Computer and Technology sector’s gain of 11.82% and the S&P 500’s gain of 7.34%.

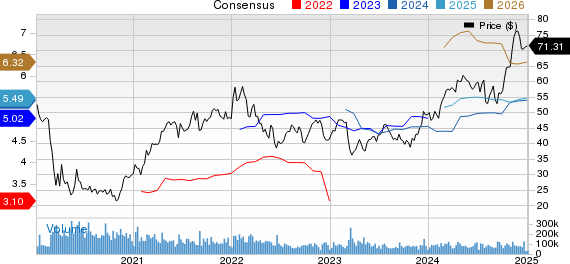

The investment community will be closely monitoring the performance of Pure Storage in its forthcoming earnings report. The company is scheduled to release its earnings on May 29, 2024. On that day, Pure Storage is projected to report earnings of $0.22 per share, which would represent year-over-year growth of 175%. Meanwhile, the Zacks Consensus Estimate for revenue is projecting net sales of $681.37 million, up 15.62% from the year-ago period.

For the entire fiscal year, the Zacks Consensus Estimates are projecting earnings of $1.59 per share and a revenue of $3.13 billion, representing changes of +11.97% and +10.5%, respectively, from the prior year.

Additionally, investors should keep an eye on any recent revisions to analyst forecasts for Pure Storage. These revisions help to show the ever-changing nature of near-term business trends. With this in mind, we can consider positive estimate revisions a sign of optimism about the company’s business outlook.

Empirical research indicates that these revisions in estimates have a direct correlation with impending stock price performance. To benefit from this, we have developed the Zacks Rank, a proprietary model which takes these estimate changes into account and provides an actionable rating system.

The Zacks Rank system, which ranges from #1 (Strong Buy) to #5 (Strong Sell), has an impressive outside-audited track record of outperformance, with #1 stocks generating an average annual return of +25% since 1988. Over the last 30 days, the Zacks Consensus EPS estimate has remained unchanged. As of now, Pure Storage holds a Zacks Rank of #3 (Hold).

In terms of valuation, Pure Storage is currently trading at a Forward P/E ratio of 37.74. This valuation marks a premium compared to its industry’s average Forward P/E of 27.37.

We can additionally observe that PSTG currently boasts a PEG ratio of 1.94. The PEG ratio is similar to the widely-used P/E ratio, but this metric also takes the company’s expected earnings growth rate into account. The Computer- Storage Devices industry had an average PEG ratio of 1.57 as trading concluded yesterday.

The Computer- Storage Devices industry is part of the Computer and Technology sector. This industry currently has a Zacks Industry Rank of 29, which puts it in the top 12% of all 250+ industries.

The Zacks Industry Rank gauges the strength of our individual industry groups by measuring the average Zacks Rank of the individual stocks within the groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

You can find more information on all of these metrics, and much more, on Zacks.com.

Free – 5 Dividend Stocks to Fund Your Retirement

Zacks Investment Research has released a Special Report to help you prepare for retirement with 5 diverse stocks that pay whopping dividends. They cut across property management, upscale outlets, financial institutions, and a couple of strong energy producers.

5 Dividend Stocks to Include in Your Retirement Strategy is packed with unconventional wisdom and insights you won’t get from your neighborhood financial planner.

Download Now – Today It’s FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.