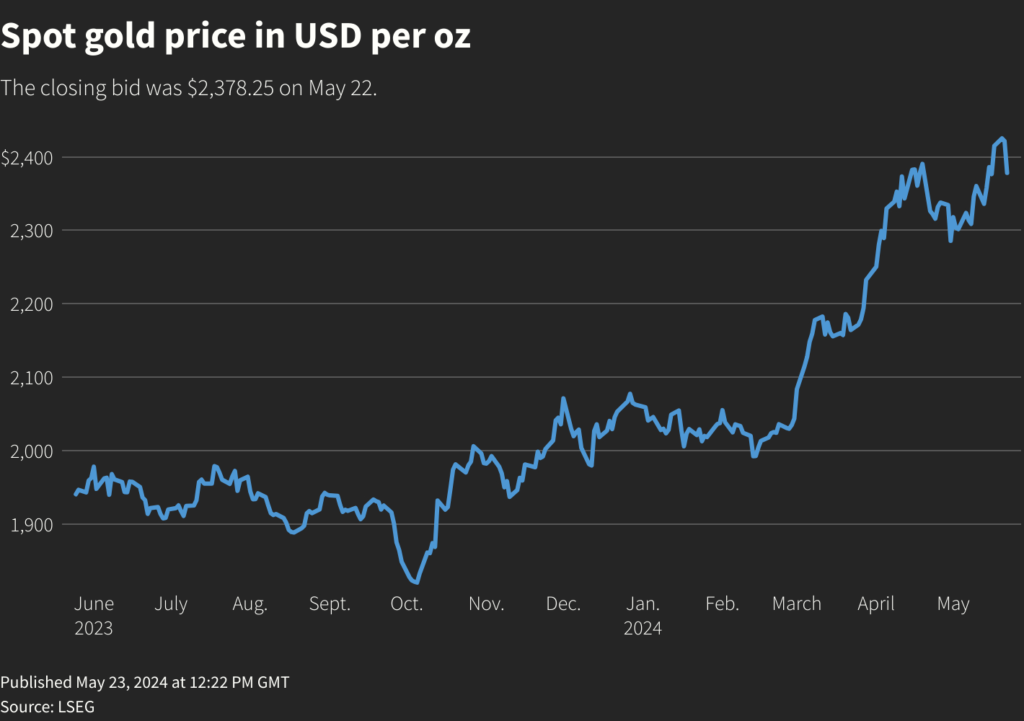

The decline comes days after the spot price hit a record high of $2,449.89 on optimism over the Federal Reserve’s monetary policy.

Making bullion less attractive, US business activity accelerated to its highest level in over two years in May, suggesting an uptick in economic growth during the second quarter.

Still, the metal has gained 14% so far this year on anticipation of a Fed rate cut coupled with rising geopolitical tensions around the globe.

Advancing dollar and a weakening US rate cut outlook have catalyzed a round of profit-taking in gold, but the downside will be limited, said Daniel Ghali, commodity strategist at TD Securities, in a Reuters note.

While the policy response for now would “involve maintaining” interest rates at current levels, latest Fed minutes reflected discussions of possible hikes.

“Investors that care about the Fed outlook actually aren’t all that long in gold. They’ve missed the rally and in turn don’t have that much gold to sell. So while we do think the gold prices are staging a correction here, but that will be relatively shallow,” Ghali added.

UBS recently raised its gold price forecast to $2,600 for the end of 2024, citing a series of softer US data for April, an upwardly revised central bank demand for gold and ongoing geopolitical uncertainties.

Meanwhile, imports to India, the world’s second-biggest gold consumer, could fall by nearly a fifth this year as high prices spur retail consumers to exchange old jewelry for new items, according to an industry body.

(With files from Reuters)