Nvidia’s earnings top sky-high expectations … the latest way that Louis Navellier is playing AI’s growth … a specific stock to keep on your radar … Eric Fry’s biotech play

The stakes were incredibly high coming into yesterday afternoon, with all eyes on one company – Nvidia.

Would its earnings wow Wall Street yet again, fueling fresh optimism about AI and potentially more market gains? Or would the sky-high expectations prove too lofty, resulting in a disappointed market pullback?

As you’re likely aware, Nvidia has become the poster child for artificial intelligence (AI) as it’s the most dominant supplier of AI semiconductor chips.

Its earnings health is viewed as a proxy for AI momentum and growth, which investors are watching to gauge how much higher leading AI stocks can go in the short – to medium term.

Fortunately, Nvidia came through yet again, and then some

Let’s go to legendary investor Louis Navellier. His Growth Investor quant system flagged Nvidia back in 2019 (subscribers are sitting on gains of 2,328%). He’s been a huge Nvidia bull all year:

Persistent demand for NVIDIA Corporation’s (NVDA) artificial intelligence chips produced record results for the company in the most recent quarter.

Following the closing bell on Wednesday, NVIDIA reported first-quarter revenue soared 262% year-over-year to a record $26.0 billion, while earnings surged 462% year-over-year to $15.24 billion, or $6.12 per share. These results crushed analysts’ estimates for revenue of $24.65 billion and earnings of $5.59 per share.

Prior to NVIDIA’s earnings announcement, I had noted that NVIDIA was priced for perfection – and clearly, the company delivered.

As a result, shares shot above the $1,000 price target that I set for the stock last year, and I have now raised my price target to $1,400. So, the stock is now priced beyond perfection.

The good news is that more investors will have a shot at scooping up more shares of NVIDIA in June. The company announced a 10-for-one stock split that will go into effect on June 10.

As I write Thursday morning, Nvidia is up more than 9%. Congrats to all the Growth Investor subscribers out there on this monster win. Better still, it’s showing no signs of slowing down.

Nvidia’s extraordinary earnings performance shows that AI demand is accelerating, so how can investors be a part of this growth story?

One of our goals here in the Digest is to help you identify the most lucrative investment trends in the market. Clearly, “AI” is going to be (and has already been) an epic moneymaker, but how do we capitalize on that specifically?

We’ve been answering this question over the last several months. And today, let’s put another possibility in your radar – power generation.

AI is going to transform our world. But to make that transformation a reality, the demand on our global power infrastructure will be more stressful than anything we’ve seen before.

Here’s Scientific American:

Every online interaction relies on a scaffolding of information stored in remote servers—and those machines, stacked together in data centers worldwide, require a lot of energy.

Around the globe, data centers currently account for about 1 to 1.5 percent of global electricity use, according to the International Energy Agency. And the world’s still-exploding boom in artificial intelligence could drive that number up a lot—and fast.

Researchers have been raising general alarms about AI’s hefty energy requirements over the past few months. But a peer-reviewed analysis published this week in Joule is one of the first to quantify the demand that is quickly materializing.

A continuation of the current trends in AI capacity and adoption are set to lead to NVIDIA shipping 1.5 million AI server units per year by 2027. These 1.5 million servers, running at full capacity, would consume at least 85.4 terawatt-hours of electricity annually—more than what many small countries use in a year, according to the new assessment.

Bottom line: Tomorrow’s leading AI technologies demand more energy, and this puts one sector in our crosshairs…

Utilities.

From worst to first (almost)

If “utilities” hasn’t been on your investment radar, it’s for good reason. This “widow and orphan” sector was a huge stinker last year, earning the ignominious title of worst-performing sector of 2023 (dropping 10%).

But this is changing – quickly. And the potential growth here means it needs to be on your radar.

Let’ s go to Louis for more:

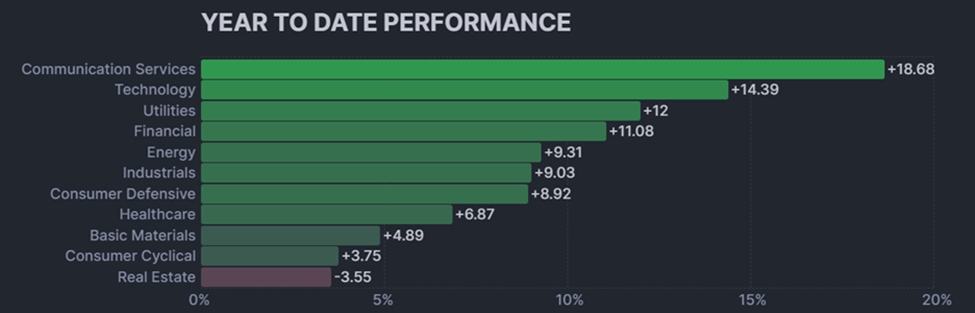

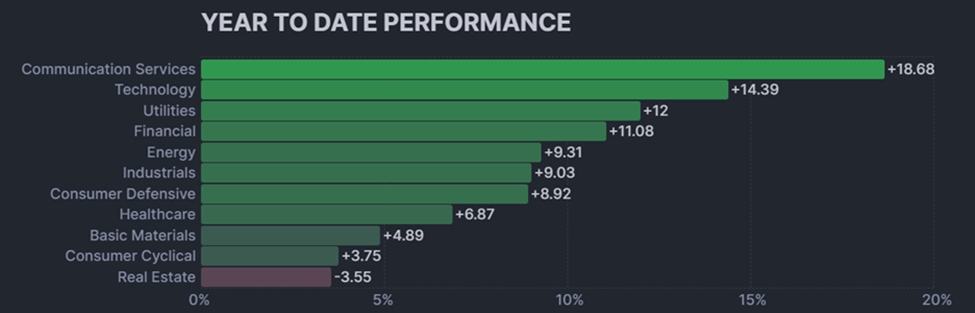

This may come as a surprise to you: The utility sector is one of the best-performing sectors of the year.

Now, utilities were one of the worst-performing sectors to start the year, primarily due to rising interest rates. But that all changed recently.

While the recent moderation in interest rates has aided utilities’ incredible turnaround, the real reason why utilities are outperforming is simple.

I’m talking about AI.

Louis provides data that mirror what we highlighted above – namely, the tsunami of demand coming for electricity, ultimately concluding:

The U.S. power grid is stretched, and we do not have enough electricity to keep up with the increased demand for AI, data centers and cloud service centers.

Wall Street is starting to catch on to this fact, which is why the utility sector has been the best-performing sector in May so far.

How do you invest?

Louis recommends investors look for top-tier companies that build the infrastructure for utilities (as well as data and cloud centers).

Let’s look at one business that Louis’ Growth Investor subscribers already own – EMCOR Group (EME).

Louis recommended EME last August. Subscribers who acted on his official recommendation are sitting on 79% gains and counting.

Source: StockCharts.com

But given the extraordinary demand for energy over the next decade, EME’s earnings potential appears plenty strong to continue driving its stock price higher.

Here’s Louis’ EME profile to Growth Investor subscribers last week:

EMCOR Group, Inc. is another AI infrastructure play. It provides electrical and mechanical construction, energy and industrial infrastructure and building services.

The company provides everything from data center services to electrical maintenance, from new construction to energy services and upgrades.

With the U.S. looking to upgrade to more energy-efficient systems, as well as to onshore more chip production, EMCOR stands directly in line to benefit.

EMCOR upped its outlook for fiscal year 2024 due to increased demand. The company now expects 11.3% to 15.3% annual revenue growth and 16.5% to 24% annual earnings growth.

Louis’ buy-up-to price for EME is $391. As I write Thursday, it trades at $393. So, keep this on your radar and look for pullbacks.

If you’re a Growth Investor subscriber, don’t miss Louis’ Weekly Update from last Friday. He highlights a second infrastructure company that’s been in the Growth Investor portfolio since 2021. It’s up 186% yet remains Louis’ “top infrastructure stock.”

There’s also your latest infrastructure play, which Louis recommended last month. It just notched record earnings and sales growth, and in turn, increased its outlook for fiscal year 2024.

Click here to log in. And if you’re not a subscriber but would like to learn more about joining Louis in Growth Investor, click here.

Finally, for another way to capitalize on AI, look to the “AI Appliers”

This is Eric Fry’s name for the companies that are now implementing AI technology within their own products and services.

These “appliers” span multiple sectors. Here are a few examples that Eric has highlighted:

- Coty (COTY) – beauty products

- Ivanhoe Electric (IE) – mineral and precious metals exploration

- Rockwell Automation (ROK) – industrial solutions

- Genius Sports (GENI) – sports technology

Even though AI appliers are found throughout the entire stock market, there’s one sector that Eric’s research has flagged due to the heightened volume of “enablers” that stand to push the sector higher.

Biotech.

On Tuesday, Eric held a live event profiling the opportunity in the sector, as well as the biotech he believes will become the next company worth $1 trillion. It’s using a new application of AI to revolutionize its $13.1 trillion industry.

During the presentation, Eric also walked through a way to play this stock that he believes could generate about 40 years’ worth of Nvidia-type gains over the coming months.

If you missed the presentation, you can catch a free replay right here.

Wrapping up, Nvidia knocked it out of the park, suggesting the AI trend has plenty of runway left. Make sure you’ve hitched your wealth to this juggernaut, with one strong option being utility infrastructure companies.

We’ll keep you updated.

Have a good evening,

Jeff Remsburg