[Note: Costco’s fiscal year ends in August]

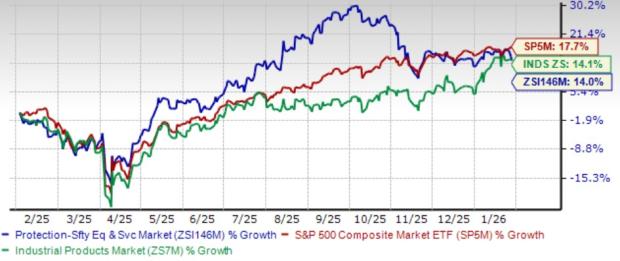

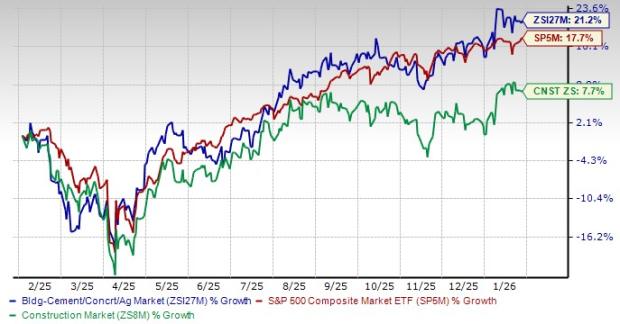

Costco (NASDAQ: COST) is scheduled to report its fiscal third-quarter results on Thursday, May 30. We expect Costco stock to trade lower with revenues and earnings likely missing expectations. Costco’s stock has rallied 23% since the beginning of this year, outperforming the S&P index which grew 11% during this period. In comparison, Costco’s peer Walmart’s (NYSE: WMT) stock also grew a similar 24% over the same period. Costco has shown a consistent performance at driving revenue, coupled with its dedication to enhancing customer experience, reflecting its ability to thrive in the ever-changing retail landscape. Several club stores have been opened in the U.S. and the company is well-positioned for continued growth overseas, including in China. In Q2’24 (ended February 18, 2024), Costco repurchased 240k shares for $160 million. The retailer paid out their $15/share special dividend in Jan 2024. In addition, the company’s management also increased the recurring quarterly dividend by 13% (from the prior dividend of $1.02) to $1.16/share. The stock’s current valuation at 53 times earnings is much higher than the 25 to 30 P/E range before the pandemic.

Our forecast indicates that Costco’s valuation is $726 a share, which is 11% lower than the current market price. Look at our interactive dashboard analysis on Costco‘s Earnings Preview: What To Expect in Fiscal Q3? for more details.

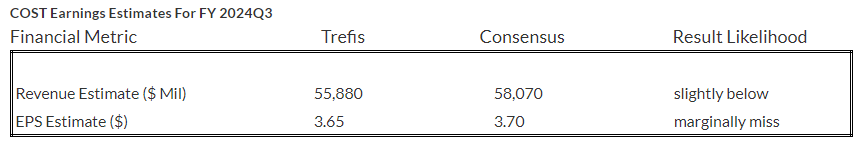

(1) Revenues expected to be slightly below consensus estimates

Trefis estimates COST’s FQ3 2024 revenues to be $55.9 Bil, marginally lower than the consensus estimate. In its most recent Q2, the company’s revenues grew by 6% year-over-year (y-o-y) to $57 billion, driven by a 4.8% increase in comparable sales, adjusted for gas prices and currency exchange, and 28% growth in eCommerce. It should be noted that Costco makes most of its profits from its membership income, so comparable sales growth isn’t as important for it as it is for other retailers. In Q2, membership fee income was 8% higher than the prior-year period. The retailer ended the second quarter with 73.4 million paid household members, up 8% y-o-y, and 132 million cardholders, up 7%, with continuing growth throughout the previous quarters. The renewal rate remained strong, at 92.9% in the U.S. and Canada, while the worldwide rate came in at 90.5%. This high renewal rate not only ensures a steady stream of revenue from membership fees but also increases the lifetime value of each customer, thereby boosting overall profitability. We need to monitor this metric when calculating Costco’s long-term growth potential. We forecast COST’s Revenues to be around $254 billion for the fiscal year 2024, up 5% y-o-y.

2) EPS likely to miss consensus estimates marginally

COST’s FQ3 2024 earnings per share (EPS) is expected to be $3.65 per Trefis analysis, marginally below the consensus estimate. The company’s net income for the second quarter was $1.7 billion, or $3.92/share compared to $1.5 billion, or $3.30/share a year ago. Also, Costco currently boasts nearly $10.3 billion in cash, cash equivalents, and short-term investments. Its long-term debt is only $7 billion, so Costco has a net cash position on its balance sheet.

(3) Stock price estimate lower than the current market price

Going by Costco’s valuation, with an EPS estimate of around $16.20 and a P/E multiple of 44.8x in fiscal 2024, this translates into a price of $726, which is almost 11% lower than the current market price.

It is helpful to see how its peers stack up. COST Peers shows how Costco’s stock compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | May 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| COST Return | 12% | 23% | 408% |

| S&P 500 Return | 5% | 11% | 136% |

| Trefis Reinforced Value Portfolio | 7% | 6% | 656% |

[1] Returns as of 5/29/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.