SenesTech, Inc. SNES, a player in the field of fertility control for managing animal pest populations, has announced the launch of its Evolve fertility control solution for rats on Amazon AMZN. This strategic move marks a significant advancement in the distribution of Evolve, the company’s innovative minimum-risk soft bait designed for proactive rat control.

More on Evolve

Unlike traditional methods that rely heavily on poisons, Evolve targets the root cause of rodent overpopulation by reducing fertility rates.

This approach addresses the rapid reproduction of rodents, which can lead to severe infestations. The active ingredient in Evolve has been scientifically proven to reduce rodent fertility, making it a safer and more effective alternative to conventional poisons.

Accessibility and Market Growth

The launch on Amazon, the world’s largest online retailer, significantly enhances the accessibility of Evolve to everyday consumers. The product was previously available primarily to professionals. Evolve’s presence on Amazon allows a broader audience to adopt this effective pest control solution.

This move is expected to drive substantial growth in SenesTech’s market share, leveraging the convenience and reach of e-commerce.

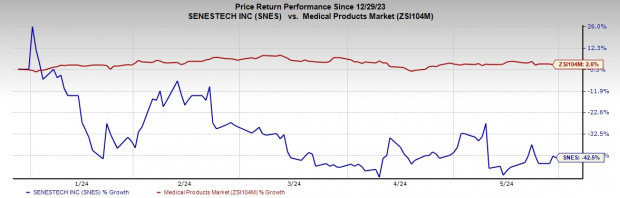

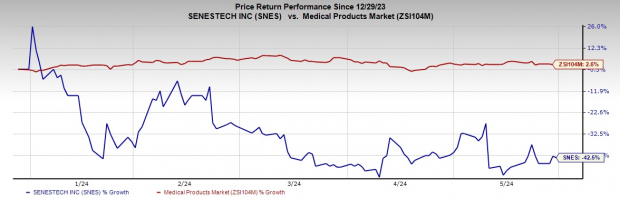

Image Source: Zacks Investment Research

Adapting to Regulatory Changes

With increasing regulations on the use of traditional rodenticides, particularly in states like California, consumers and pest managers are actively seeking safer and more sustainable alternatives. Evolve’s availability on Amazon is well-timed, providing a viable solution that complies with stricter regulatory standards while maintaining efficacy in pest management.

Market Prospects

Per SenesTech, the U.S. rodent pest management market is valued at more than $1 billion annually, with a significant portion of sales occurring online. By tapping into this growing e-commerce segment, SenesTech is well-positioned to capitalize on the increasing demand for innovative pest control solutions. The strategic placement of Evolve on Amazon is expected to drive sustained growth for SenesTech.

Share Price Performance

Year to date, shares of SNES have plunged 42.5% against the industry’s 2.6% growth.

Zacks Rank and Key Picks

Senestech currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS and Medpace MEDP. Each of them sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

Hims & Hers Heath stock has rallied 119.1% in the past year. Earnings estimates for the company have risen from 11 cents to 18 cents for 2024 and from 25 cents to 33 cents for 2025 in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for Medpace’s 2024 earnings per share have moved up to $11.29 from $11.23 in the past 30 days. Shares of the company have surged 87.5% in the past year compared with the industry’s 6.1% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an average earnings surprise of 30.6%.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Senestech, Inc. (SNES) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.