The Zacks Transportation-Services industry faces challenges, ranging from inflation-induced elevated interest rates, weak freight rates and supply-chain disruptions.

Despite the challenges, we believe that stocks like Expeditors International of Washington EXPD, Matson MATX and Despegar.com, Corporation DESP are worth betting on.

About the Industry

The companies housed in the Zacks Transportation-Services industry offer transporters logistics, leasing and maintenance services. Some industry players focus on the business of global logistics management, including international freight forwarding. Third-party logistics entities provide innovative supply-chain solutions. They also focus on services like product sourcing, warehousing and freight shipping. These companies have expertise in trucking, air and ocean transportation. Some players in this industry deliver domestic and international express delivery services. The well-being of the companies in this industrial cohort is directly proportional to the health of the economy. An uptick in manufactured and retail goods, favorable pricing and improvement in global economic conditions bode well for industry participants.

3 Trends Shaping the Future of the Transportation-Services Industry

Supply-Chain Disruptions & Weak Freight Rates: Although economic activities picked up from the pandemic gloom, supply-chain disruptions continue to dent stocks in the industry. Below-par freight rates are also hurting the industry’s prospects. Highlighting the weak freight demand, Cass Freight Shipments Index declined 1.3% month on month in April. This measure has deteriorated month on month in five of the last six months, which confirms the overall declining trend.

Strong Financial Returns for Shareholders: More and more companies are allocating their increasing cash pile by way of dividends and buybacks. This underlines their financial strength and confidence in business. Among the Transportation – Services industry players, Expeditors announced a 5.8% increase in its quarterly dividend in May 2024.

Focus on Cost Cuts to Drive the Bottom Line: Despite signs of cooling inflation, we are by no means out of the woods. In fact, inflation is still well above the Fed’s 2% target. We note that the industry has been experiencing significant levels of inflation, including higher prices for labor, freight and fuel. The industry players are focusing on cost-cutting measures and making efforts to improve productivity and efficiency to mitigate high expenses amid a weaker-than-expected demand scenario.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Transportation – Services industry is a 24-stock group within the broader Zacks Transportation sector. The industry currently carries a Zacks Industry Rank #213, which places it in the bottom 15% of 250 plus Zacks industries.

The group’s Zacks Industry Rank, the average of the Zacks Rank of all member stocks, indicates dismal near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. The industry’s earnings estimate for 2024 has decreased 36.4% on a year-over-year basis.

Before we present a few stocks from the industry that you may want to buy, let’s take a look at the industry’s recent stock market performance and the valuation picture.

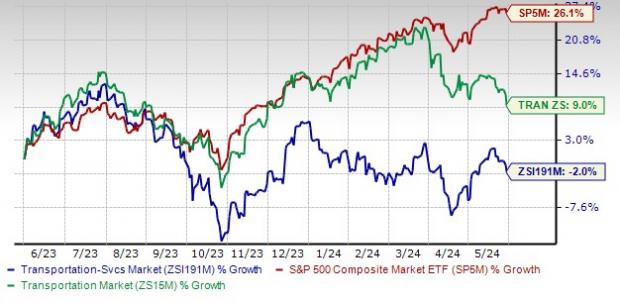

Industry Lags Sector and S&P 500

The Zacks Transportation-Services industry has underperformed the Zacks S&P 500 composite and the broader Transportation sector in a year’s time.

The industry has declined 2% over this period against the S&P 500’s appreciation of 26.1% and the broader sector’s uptick of 9%.

One-Year Price Performance

Industry’s Current Valuation

Based on the trailing 12-month price-to-sales, a commonly used multiple for valuing Transportation-services stocks, the industry is currently trading at 1.89X compared with the S&P 500’s 3.93X. The value is, however, higher than the sector’s trailing 12-month P/S of 1.79X.

Over the past five years, the industry has traded as high as 2.5X, as low as 1.57X and at the median of 2.01X.

Price-to-Sales Ratio (TTM)

.jpg)

.jpg)

3 Transport Services Stocks to Buy

Matson: This Honolulu, Hawaii-based provider of ocean transportation and logistics services currently sports a Zacks Rank #1 (Strong Buy). We are impressed by the cost-management actions taken by the company to drive its bottom line. Efforts to reward its shareholders are commendable as well.

Over the past 60 days, the Zacks Consensus Estimate for 2024 earnings has risen 6.7%. The stock has gained 23.4% over the past six months.

Price and Consensus: MATX

.jpg)

Expeditors currently carries a Zacks Rank #2 (Buy). This Seattle, WA-based freight forwarder’s efforts to reward its shareholders are commendable. EXPD’s liquidity position is encouraging, too.

EXPD has outshined the Zacks Consensus Estimate in only one of the last four quarters (missing the mark in the other three). In the past 60 days, the Zacks Consensus Estimate for 2024 earnings has moved 3.6% north.

Price and Consensus: EXPD

.jpg)

Despegar.com currently carries a Zacks Rank #2 and is the leading travel technology company in Latin America. Driven by upbeat operational efficiencies, the company believes that it will be able to maintain above-market revenue growth in the foreseeable future.

Over the past 60 days, the Zacks Consensus Estimate for 2024 earnings has moved 10.1% north. The stock has surged 85.1% in the past six months.

Price and Consensus: DESP

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

Matson, Inc. (MATX) : Free Stock Analysis Report

Despegar.com Corp. (DESP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

.jpg)