Falling Stocks and Unraveled Trades

Have you ever wondered why stock prices plummet when the Fed plans to lower interest rates? The answer, as of late, lies in the ongoing unwinding of the yen carry trade. This unraveling, as highlighted by economists like Ed Yardeni and Steve Barrow, poses a significant threat to the stability of risk assets in the market.

While the S&P 500 and Nasdaq experienced sharp declines in early August, the yen carry trade played a pivotal role in fueling this downturn.

The Art of the Yen Carry Trade

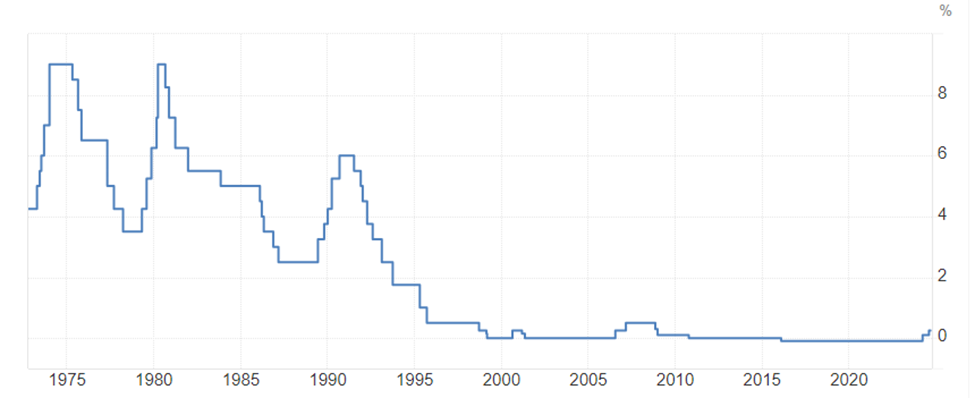

The yen carry trade, a favored strategy among investors, is rooted in the art of arbitrage. By borrowing at negligible rates in yen and investing in higher-yielding assets like U.S. equities, investors have long profited from this lucrative maneuver. The Bank of Japan’s historically low short-term interest rates have served as the linchpin of this trade, fostering a breeding ground for substantial capital inflows from across the globe.

The allure of the yen carry trade has transcended borders, drawing investors worldwide into its realm. Although the exact scale of this trade remains elusive, estimates ranging from $1 trillion to $4 trillion underscore its massive influence on global finance.

From Japanese Bubble to Carry Trade Craze

The origins of the yen carry trade can be traced back to Japan’s infamous market bubble of the late 1980s. The subsequent collapse ushered in a prolonged period of deflation, prompting the Bank of Japan to maintain interest rates at rock-bottom levels to revive the economy. This climate of near-zero inflation provided fertile ground for the sustained profitability of the yen carry trade, attracting a deluge of international investors.

The Changing Tides and BOJ’s Response

After decades of stagnant inflation, Japan witnessed a shift in economic dynamics post-pandemic. Rising global commodity prices, aggravated by geopolitical tensions, spurred inflationary pressures in Japan. To counter these challenges, the Bank of Japan initiated rate hikes in 2024, marking a departure from its long-standing policy of ultra-low interest rates. This move sent shockwaves through the yen carry trade, causing the yen to surge against major currencies.

The ensuing volatility in currency markets served as a stern reminder of the inherent risks associated with carry trades dependent on a perpetually undervalued yen.

Unraveling the Impact of Yen Appreciation on Market Dynamics

The Unforeseen Ripple Effect of the Yen Surge

As the yen embarked on a meteoric rise, triggered by the Bank of Japan’s long-awaited rate hike in July, market dynamics were abruptly altered. Investors caught in the web of the yen carry trade found themselves entangled in a web of escalating costs, leading to a hasty retreat. The repercussions were far-reaching, transcending Japanese equities to reverberate through U.S. tech stocks, notably the Nasdaq, which witnessed an 8% plummet immediately post-BOJ’s rate change.

Unwinding the Carry Trade Conundrum

But has the carry trade debacle truly abated? Speculative whispers suggest an ongoing unraveling process, with estimations marking it only halfway through. JPMorgan’s Arindam Sandilya hints at a lingering journey ahead, painting a picture of traders grappling with the consequences of their yen-funded ventures. While the exact extent of the trade’s unwinding remains an enigma, the yen’s steadfast ascent against the dollar since August 2023 signifies a pressing predicament for many traders.

The BOJ’s Delicate Balancing Act

In the backdrop of the market turmoil, the Bank of Japan finds itself treading cautiously, signaling a reluctance to exacerbate volatility by postponing rate hikes during turbulent market phases. Deputy Governor Shinichi Uchida’s reassurance of rate adjustments based on Japan’s economic trajectory echoes a tone of prudence amidst uncertainty. Such a stance, while aimed at maintaining stability, inadvertently fans the flames of yen-induced market turbulence, underscoring the fragility of the current financial ecosystem.

Charting a Course Amidst Market Fluctuations

As we traverse this landscape of market upheavals, it becomes imperative to refrain from knee-jerk reactions and instead cultivate a proactive stance. Embracing market awareness as a shield against fear-driven decisions fosters a resilient investment approach. While advocating for prudent risk management strategies, the narrative seeks to empower investors with a strategic edge, ensuring they navigate the volatile terrain with measured confidence.

Navigating the New Horizons in Tech Investments

In the realm of tech investments, the seismic shift induced by the yen’s ascent ushers in a new era of opportunities and challenges. Luke Lango’s discerning analysis foresees a divergence from the dominant Mag 7 paradigm towards a flourishing landscape of smaller AI stocks. Embracing this transformative phase, investors are urged to realign their strategies, unlocking potential avenues for growth amidst the evolving market narrative. Luke’s upcoming strategy session promises valuable insights, offering a compass to traverse the ever-shifting tech investment terrain.

In essence, the yen’s dominance underscores a pivotal moment in market history, signaling a call for strategic adaptation rather than reactionary retreat. As the market landscape metamorphoses, astute investors are poised to seize the reins of opportunity amidst the tide of uncertainty.