NVIDIA Corporation has been a financial rollercoaster in recent times. Once riding the waves of artificial intelligence (AI) success, the company faced a sudden downhill spiral last week due to antitrust woes. However, the tides seem to be turning as the possibility of a lucrative U.S.-Saudi Arabia deal involving NVIDIA’s chips and glowing remarks by CEO Jensen Huang on Blackwell chip production sparked an 8.2% surge in the semiconductor giant’s stock during Wednesday’s trading session.

Optimism on the Horizon: U.S. Considers NVIDIA Chips for Saudi Arabia

Rumors have surfaced suggesting that the U.S. government might green-light NVIDIA to export its cutting-edge chips to Saudi Arabia. This potential deal could empower the Middle Eastern nation with advanced AI capabilities, particularly through NVIDIA’s H200 chips utilized in OpenAI’s GPT-40. If restrictions on semiconductor sales are relaxed, NVIDIA stands to gain significantly amidst a global surge in semiconductor demand, which hit $51.3 billion in July.

Exciting Developments: Huang’s Encouraging Blackwell Update

During a technology conference hosted by The Goldman Sachs Group, Inc., CEO Huang unveiled that NVIDIA has scaled up production of the eagerly awaited next-gen Blackwell chips. These high-end chips are set to be shipped in large quantities in the fourth quarter to meet soaring demands from tech giants like Alphabet Inc., Microsoft Corporation, and Meta Platforms, Inc., with Amazon.com, Inc. also eyeing a potential shift to Blackwell for its enhanced AI capabilities.

Amidst the Clouds: NVIDIA’s Dominance in GPU Realm

Huang’s recent declaration about data transfers from CPUs to GPUs spells good fortune for NVIDIA, holding over 80% of the GPU market share projected to skyrocket to $1,414.39 billion by 2034. This supremacy in GPUs has propelled NVIDIA’s data center GPU revenue to a staggering $26.2 billion in the second quarter, eclipsing its rival Advanced Micro Devices, Inc. NVIDIA’s CUDA software platform’s superior efficiency compared to AMD’s ROCm platform further solidifies its competitive advantage.

Riding the Wave: NVIDIA’s Bullish Outlook

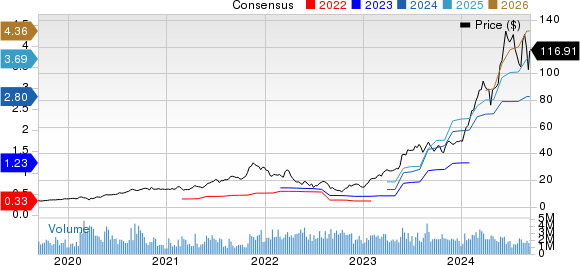

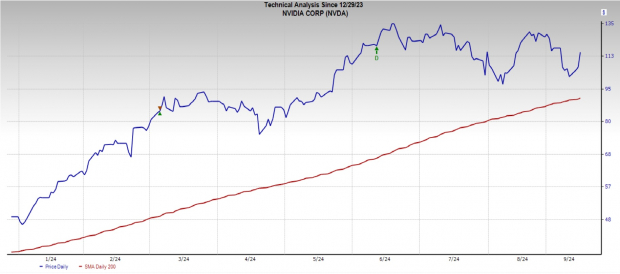

With potential chip export relaxations, Blackwell production gains, and GPU dominance, NVIDIA’s shares are poised for an upswing. Analysts have significantly raised short-term price targets, with the highest forecast at $200, indicating an 85% upside potential. Additionally, NVIDIA’s shares have consistently traded above the 200-day moving average this year, indicating a prolonged uptrend.

Image Source: Zacks Investment Research

NVIDIA’s stock currently holds a Zacks Rank #3 (Hold), signifying a cautiously optimistic outlook for potential investors eyeing a slice of the tech giant. The horizon seems bright for NVIDIA as it navigates through the choppy waters of the semiconductor industry.

Upcoming Infrastructure Stock Surge in the U.S.

A massive initiative to revamp the crumbling U.S. infrastructure is on the horizon. It’s a bipartisan, urgent venture that will see trillions being spent, paving the way for substantial financial gains. The key question remains: “Are you prepared to invest in the right stocks early on to maximize growth potential?”

Zacks has released a Special Report that delves into this infrastructure upheaval, pinpointing 5 companies set to reap significant benefits from this monumental construction and restoration effort. Discover these potential winners today with Zacks’ free report.

Looking for insights from Zacks Investment Research? Download their free report “5 Stocks Set to Double” for the latest stock recommendations and market analysis.

The insights and opinions presented in this article reflect the views of the author and not necessarily those of Nasdaq, Inc.