Comparing the Titans: META and GOOGL

When it comes to the Magnificent Seven stocks, Meta Platforms (META) and Alphabet (GOOGL) have both stood out in the limelight. While operating in different sectors, the historical ties of these tech giants to acronyms like FANG and FAAMG have prompted an intriguing comparison.

Meta Platforms, with a focus on social media properties like Facebook and Instagram, has been pushing boundaries to establish itself as a metaverse company. On the other hand, Alphabet, the force behind Google Search, Google Play, YouTube, and cloud services, boasts a diverse revenue stream from various digital avenues.

Despite Meta Platforms’ robust year-to-date stock performance, Alphabet edges ahead with a steadier growth trajectory in the long term. While Meta’s recent surge has caught investors’ attention, Alphabet’s resilience in the face of market volatility speaks volumes about its stability.

Meta Platforms: AI and Potential Upside

Meta Platforms has been navigating the shift to a metaverse-centric approach, while still leveraging its social media prowess to generate substantial revenue. Although the AI initiatives might not be fuelling significant revenue growth just yet, analysts like Deepak Mathivanan of Cantor see promise in Meta’s forward valuation.

Despite recent fluctuations in Meta’s P/E ratio, the company’s strategic focus on AI and digital advertising innovations could pave the way for future growth. As Meta continues to evolve, its position as a top contender in the internet stock arena remains undeniable.

Unlocking Potential: META Stock Price Target

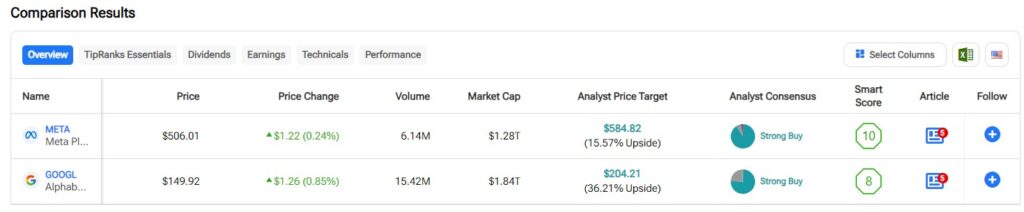

With a Strong Buy consensus rating and a bullish momentum, Meta Platforms has an average stock price target that suggests an upside potential of over 11%. This projection underscores the confidence analysts have in Meta’s ability to deliver value to investors in the coming period.

Alphabet: Resilience in Volatile Markets

As Alphabet positions itself as a technology powerhouse with a diverse business portfolio, its current valuation hints at a buying opportunity. The stock’s resilience to market turbulence, coupled with its potential for an upside correction, makes it an attractive prospect for investors seeking stability in uncertain times.

Alphabet’s consistent performance, coupled with its wider 52-week range compared to Meta Platforms, signifies a level of stability that investors crave in today’s volatile market landscape. The company’s Strong Buy consensus rating further solidifies its position as a formidable contender in the Big Tech arena.

Aiming High: GOOGL Stock Price Target

With an impressive upside potential of over 35% according to the average stock price target, Alphabet stands out as a compelling investment opportunity. Analyst sentiment remains overwhelmingly positive, underscoring the long-term growth prospects that Alphabet offers to investors.

Final Verdict: Alphabet Takes the Lead

While both Meta Platforms and Alphabet present appealing investment propositions, Alphabet emerges as the frontrunner with its resilient performance and promising valuation. Alphabet’s current standing as a buy-the-dip opportunity sets it apart as a beacon of stability in tumultuous market conditions, making it a prime candidate for long-term investment strategies.

Ultimately, the battle of META vs. GOOGL showcases the dynamic nature of the tech industry, where innovation, resilience, and strategic vision play pivotal roles in determining success. As investors navigate the ever-changing landscape of Big Tech, Alphabet shines as a beacon of stability and growth potential in a sea of uncertainties.

Remember, the views expressed are those of the author and not necessarily reflective of Nasdaq, Inc. Dive into the world of Big Tech with caution and strategic foresight to make the most of these captivating opportunities.