Sun Life Financial Inc.’s SLF shares reached a closing price of $56.08 on Friday, hovering near its 52-week peak of $56.16. This close proximity illuminates investor faith like a lighthouse beaming on a stormy night. The stock’s trajectory hints at the promise of further ascension, perched above the 50-day and 200-day simple moving averages at $51.38 and $51.58, respectively. These technical tea leaves suggest a robust upward momentum, akin to a phoenix rising from the ashes.

The company’s earnings have basked in a 5.4% growth over the last five years, outshining the industry average of 4.6%. SLF boasts a resilient track record of earnings surprises, eclipsing estimates in three out of the last four quarters with a modest 1.76% average miss.

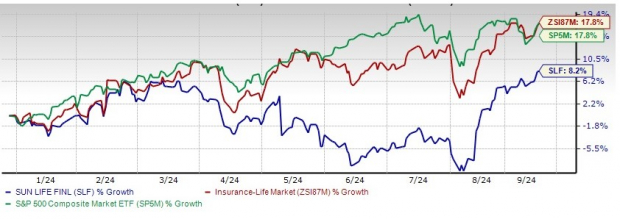

Year to date, shares of this Canadian juggernaut have soared by 8.2%, though slightly eclipsed by industry and Zacks S&P 500 composites boasting a stellar 17.8% return each.

TL;DR: SLF Price Performance

Image Source: Zacks Investment Research

Mixed Sentiment Twilight for SLF

Out of six analysts examining the stock, four have raised their 2025 estimates in the past 60 days, while two have cast a shadow by lowering them.

The 2025 earnings Zacks Consensus Estimate has nudged up 0.5% over the past 60 days, reflecting a glimmer of analyst optimism.

The 2024 outlook implies a 3.1% year-over-year boost, while the 2025 forecast suggests a more robust uptick at 10.3% year over year.

Sun Life’s Capital Sunshine

The return on equity for the past 12 months stands at a radiant 17.4%, shining brighter than the industry’s average of 15.5%. This grandeur underscores the company’s prowess in leveraging shareholder funds efficiently.

Furthermore, the return on invested capital (ROIC) has ascended in recent quarters as the firm amplified capital investment. This glow-up illuminates SLF’s adeptness in capital utilization for income generation, with ROIC for the trailing 12 months standing at 0.7%, surpassing the industry average of 0.6%.

Crucial Highlights for SLF’s Future

Sun Life’s strategic focus on burgeoning Asian markets, poised to yield superior returns, and the North American arena herald a promising future. The company boasts a robust presence across various Asian economies, including China, the Philippines, India, Hong Kong, and Indonesia, with recent forays into Malaysia and Vietnam. The contribution from its Asian arm to overall earnings has burgeoned to a remarkable 21% in recent years.

Sun Life has set its sights on solidifying its position among the top five players while diligently nurturing its voluntary benefits segment. By optimizing its business mix to favor products requiring lower capital and offering predictable earnings, this financial titan is charting an exciting growth trajectory.

Venturing into investments in private fixed-income mortgages and real estate through Sun Life Investment Management, the company is proactively bolstering its Asset Management arm. This focused effort promises higher return on equity, lower capital requirements, reduced volatility, and the potential for earning upswings.

Efficient operations have bolstered Sun Life’s capital foundation, with the company targeting a 40-50% dividend payout over the medium term.

Navigating SLF’s Risky Waters

Expenses at Sun Life have swelled in recent years due to escalating employee costs, premises overhead, service fees, intangible asset amortization, and other expenditures. These surges, akin to turbulent waves, could impede margin expansion. The company remains steadfast in its commitment to striking a balance, foreseeing $60 million in run-rate cost savings from integration activities by 2024.

SLF’s Pricy Valuation Odyssey

Current valuations for Sun Life teeter on the edge of opulence, surpassing industry norms. With a price-to-earnings multiple of 10.74, SLF stands regally higher than the industry average of 8.33.

Peer insurers like Reinsurance Group of America, Incorporated and Manulife Financial Corp also flaunt multiples above industry averages. In stark contrast, shares of Brighthouse Financial, Inc. beckon with a more modest multiple below the industry benchmark.

Closing Thoughts: Embrace the Sun Life Glow

Sun Life Financial’s promising growth forecasts, solid financial foundations, and robust returns on capital cast a radiant halo over this stock, beckoning current investors to hold on. Despite its lofty valuation, SLF stands to reap rewards from its Asian ventures, expanding asset management arm, and scaled U.S. operations integration. Thus, wisdom whispers, holding onto this Zacks Rank #3 (Hold) stock is akin to nurturing a budding phoenix in the financial realm.

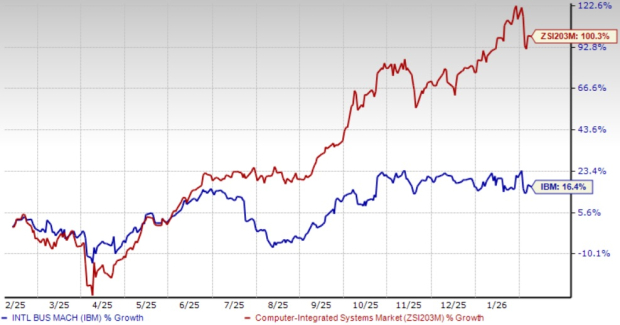

5 Stocks Set to Double

Handpicked by a Zacks expert, each stock is poised to skyrocket by over 100% in 2024. While not every pick may shine, past recommendations have soared by +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks in this list fly under Wall Street’s radar, offering a rare opportunity to dive in early.

Discover These 5 Potential Home Runs Today >>

For expert insights from Zacks Investment Research, Download 5 Stocks Set to Double: a Free Report.

Comprehensive Analysis for Manulife Financial Corp (MFC)

In-depth Analysis for Reinsurance Group of America, Incorporated (RGA)

Detailed Analysis for Sun Life Financial Inc. (SLF)

In-depth Analysis for Brighthouse Financial, Inc. (BHF)

For further insights, check out this article on Zacks.com.

Explore more with Zacks Investment Research

The thoughts and opinions articulated herein belong to the author and do not necessarily align with those of Nasdaq, Inc.