In the current market landscape, a notable shift has emerged, steering investors towards defensive, value-centric stocks to weather potential economic headwinds and interest rate adjustments.

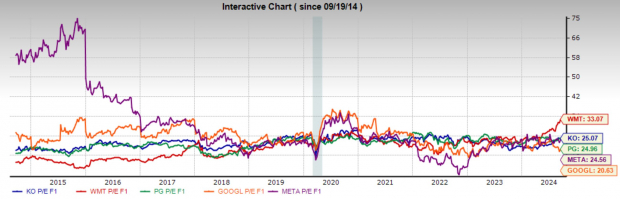

This flight to safety has propelled the prices of traditionally stable yet slow-growing value stocks like Walmart (WMT), Procter & Gamble (PG), and Coca-Cola (KO) to new heights. On the flip side, tech industry behemoths such as Alphabet (GOOGL) and Meta Platforms (META) have seen their prices dwindle, creating an unconventional scenario where pioneering tech firms are trading at relatively lower valuations.

This presents a unique chance for investors. While value stocks have surged due to their perceived stability, the decreased prices of tech giants with their commendable growth potential indicate a rare opportunity. Investors can now access high-growth stocks at bargain prices, while defensive stocks have become comparatively expensive.

Venturing into this market anomaly could prove fruitful. Let’s delve into how this market shift unfolded and why the current allure of tech stocks might be a golden ticket for investors.

Image Source: Zacks Investment Research

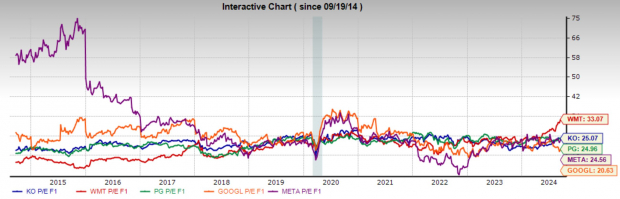

A Shift Towards Defensive Stocks

The trend of investors flocking towards defensive stocks has been on the rise, evident in the performance of ETFs focused on Value, Healthcare, and Utilities, which have outshone the Tech sector and broader market in recent months.

While early adopters have reaped rewards from this trend, the future trajectory remains uncertain. Comparative valuations now starkly highlight the appeal of tech stocks, which are trading at lower forward multiples than their value counterparts, signaling a potential turnaround in the market sentiment.

However, the narrative has started to pivot. After a period of consolidation, tech stocks seem poised for an upward swing. Alongside attractive valuations, the resurgence of interest in Artificial Intelligence, exemplified by recent product launches like AI-enabled iPhones from Apple (AAPL) and ambitious data center plans by Oracle’s (ORCL) Larry Ellison, points towards a revitalized enthusiasm for tech stocks. Ellison’s anecdotes of engaging with tech luminaries like Elon Musk and Nvidia’s (NVDA) Jensen Huang underscore the tech industry’s momentum.

Image Source: Zacks Investment Research

Growth Prospects: Tech vs. Value

Comparing the earnings growth forecasts of tech and value stocks reveals a glaring difference. Over the next 3-5 years, tech stocks are poised to deliver significantly superior earnings growth rates.

- Alphabet (GOOGL): Analysts anticipate a 17.5% annual EPS growth for GOOGL, propelled by its digital advertising dominance, AI technologies, and thriving Google Cloud services.

- Meta Platforms (META): META is expected to achieve an impressive 19% annual earnings growth, bolstered by its supremacy in social media advertising and AI-driven tools.

- Walmart (WMT): In contrast, retail giant Walmart foresees a more modest 8.2% EPS growth, reflecting its mature market challenges despite investments in e-commerce and technology.

- Procter & Gamble (PG): PG, known for household consumer products, anticipates an EPS growth of 6.6%, portraying steady earnings albeit constrained by market maturity.

- Coca-Cola (KO): Lastly, Coca-Cola projects a 6.3% growth rate, sustained by its consumer staples niche but lacking the explosive growth potential of tech innovators.

Is it Time to Invest in GOOGL and META Stocks?

The growth forecast heavily favors tech stocks like GOOGL and META, with their earnings expected to surge at rates surpassing traditional value stocks like WMT, PG, and KO.

The Intriguing Dichotomy: Tech Stocks vs. Value Stocks in Today’s Market

Investors often find themselves at a crossroads, torn between the allure of steady value stocks and the tantalizing promise of high-growth tech stocks. The recent market dynamics have only heightened this internal conflict, with a notable shift towards defensive stocks creating an interesting landscape for investment decisions.

The Lure of High Growth vs. Stability

In the realm of investments, the eternal debate rages on: should investors prioritize stability or reach for the stars with high-growth stocks? Value stocks, known for their reliability, offer a safe haven during turbulent times. Yet, their limited growth potential can leave adventurous investors yearning for more.

On the other hand, tech stocks, often associated with volatility, have emerged as enticing options following a recent surge in defensive stock investments. This unexpected trend has not only bolstered the appeal of tech stocks but also improved their relative valuations, presenting a golden opportunity for those seeking a blend of growth and stability.

The Momentum Shift in Valuations

Consider tech giants like GOOGL and META, with their sky-high growth prospects. Despite their potential, these market darlings are currently trading at forward P/E multiples lower than their historical averages. This anomaly can be attributed to the cautious stance investors have adopted towards the tech sector.

In contrast, stalwarts like WMT, PG, and KO, while offering slower growth trajectories, are commanding elevated P/E ratios compared to their historical benchmarks. The reason? Investors flocking to these defensive juggernauts amidst the prevailing economic uncertainties.

Finding the Sweet Spot: Balancing Growth and Value

For astute investors, the current market scenario presents a rare conundrum. Tech stocks, with their promise of exponential growth at appealing valuations, provide a unique blend of growth and value. Conversely, while value stocks offer immediate solace, their potential may already be factored into their price, leaving little room for substantial upside.

Evaluating the Investment Landscape

The key takeaway for investors lies in recognizing the delicate equilibrium between growth potential and reasonable valuations that tech stocks currently offer. In contrast, the recent surge in popularity of value stocks may signal a looming saturation point in their growth trajectory.

Unlocking Hidden Opportunities for Growth

With the tug-of-war between tech and value stocks intensifying, investors must tread carefully to navigate the evolving market dynamics. Finding the right balance between stability and growth is paramount in seizing the opportunities presented by this unique market landscape.

Investing is akin to surfing unpredictable waves, requiring a delicate balance of skill, intuition, and timing. As the market ebbs and flows, astute investors must adapt their strategies to ride the currents of change and emerge victorious in the ever-evolving financial seas.