Amazon’s Rising Star

Amazon.com Inc. AMZN, known for its e-commerce prowess, is shaking up Hollywood with Amazon Prime Video, putting a spell on stalwarts like Walt Disney Co DIS.

While Amazon’s retail segment still dominates, Prime Video’s emergence as a force to reckon with within the comprehensive Amazon ecosystem cannot be ignored. With AWS contributing significantly, Amazon stands as a versatile titan in the market.

Amazon’s Triumph and Stock Performance

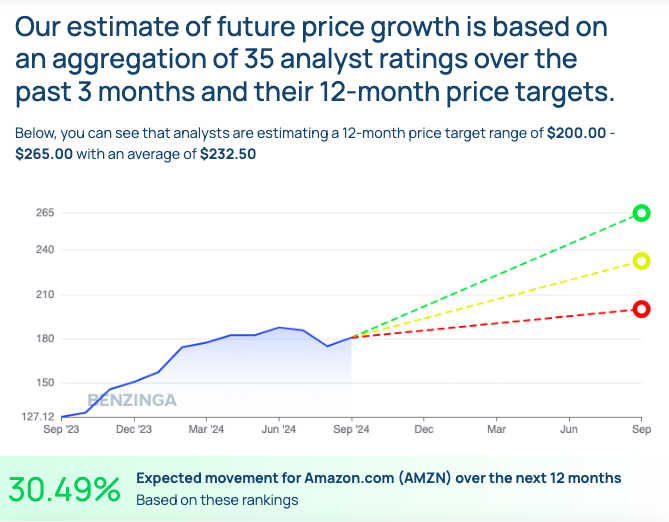

Amazon’s stock has surged by 31.81% in the past year and 23.06% year-to-date. Analysts remain bullish, forecasting a price target range between $200 and $265, hinting at a potential upside of 30.49%.

Technically, Amazon’s stock is on solid ground, soaring above key moving averages and showcasing bullish trends. Despite some negative market sentiments, Amazon’s resilience and outperformance are evident, with the five-year Sharpe ratio sitting at 1.0927.

Disney’s Dwindling Charm

On the flip side, Disney is struggling to keep up with Amazon in both stock performance and the streaming arena. While Disney+ aimed to be a game-changer, it has fallen short of investor expectations.

Disney’s stock has seen a modest 7.61% increase in the past year and a mere 0.86% year-to-date, paling in comparison to Amazon’s impressive gains.

Disney’s Challenges and Market Outlook

Analysts present Disney with a 12-month price target range of $94 to $145, with an average of $119.50, signaling a possible upside of 32.20%. However, Disney’s five-year Sharpe ratio of -0.8229 reflects a turbulent market journey for shareholders.

Disney’s technical indicators paint a grim picture, with the stock trading precariously above essential moving averages, with negative market sentiment prevailing.

The Streaming Showdown

Amazon’s Prime Video and Disney+ are embroiled in a fierce battle for streaming supremacy, with Amazon currently holding the upper hand in the stock market. Leveraging its diversified business model and Prime bundle, Amazon maintains its lead, while Disney faces hurdles in streaming growth and stock performance.

Amazon’s robust technical trends and optimistic price targets position it as a safer bet for investors seeking growth and entertainment. On the other hand, Disney must navigate challenges not only in the streaming wars but also in regaining favor with shareholders, symbolizing a pivotal moment in the entertainment industry.

Concluding Thoughts

As Amazon and Disney engage in this high-stakes entertainment duel, the market watches intently as the streaming narrative unfolds. While Amazon’s stock shines brightly on the charts, Disney is working against the odds to reclaim its former glory.

Photos: Shutterstock

Market News and Data brought to you by Benzinga APIs