Smartsheet’s remarkable 5.4% upsurge in the past month is a feat to behold, especially when juxtaposed against its industry competitors. Asana, a key player in the project management sphere, watched its stock plummet by 10.3% during the same period. This dichotomy sheds light on Smartsheet’s undeniable potential and strategic prowess in the market.

A Glimpse into Smartsheet’s Success Story

During the second quarter of fiscal 2025, Smartsheet exhibited robust growth in its enterprise segment. A whopping 75 customers contributed to an annual recurring revenue (ARR) escalation surpassing $100,000, with notable transactions exceeding $1 million. The company’s clientele also witnessed a remarkable 50% surge in customers with ARR surpassing $1 million, totaling to 77.

Unveiling Smartsheet’s Pricing and Outlook

Smartsheet concluded the quarter with an annualized recurring revenue amounting to $1.093 billion, boasting a user base of over 15.3 million Smartsheet users. The company’s steady ARR growth rate of 17% year over year emphasizes its unwavering trajectory towards success.

The Potential of Smartsheet’s Expansive Portfolio

Smartsheet’s strategic integration of AI tools has been a game-changer. The company’s AI-driven features witnessed a remarkable 50% sequential growth in the second quarter of 2024, benefiting 47,000 users through the saving of an estimated 1 million hours. The introduction of a new Kanban-style board view further enhances task visibility, offering customers a seamless tracking experience.

Insight into Future Prospects: SMAR Q3 Guidance

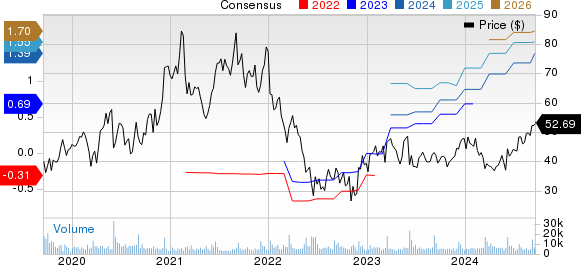

Anticipating a positive trajectory in the third quarter of fiscal 2025, Smartsheet projects revenues to range between $282 million to $285 million, illustrating a 15-16% year-over-year growth. With earnings estimated at 30 cents, showcasing an 87.50% year-over-year growth, Smartsheet is undoubtedly positioning itself as a force to be reckoned with in the industry.

Strategic Positioning and Valuation

While Smartsheet’s stock reflects a slightly stretched valuation at the moment, evidenced by a Value Score of D, it is essential to maintain a watchful position. The forward 12-month Price/Sales ratio of 7.14X suggests a relatively higher valuation than its industry counterparts. With a Zacks Rank #3 (Hold), the stock beckons investors to await a more opportune entry point.

A Glimpse into Zacks’ Investment Approach

Unleash Zacks’ insights by exploring all our recommendations for a mere $1, aimed at showcasing the plethora of opportunities waiting to be tapped. Dive into a realm of possibilities with services like Surprise Trader, Technology Innovators, and more, harnessing the potential to achieve double- and triple-digit gains.

Disclaimer: This article does not reflect the views of Nasdaq, Inc.