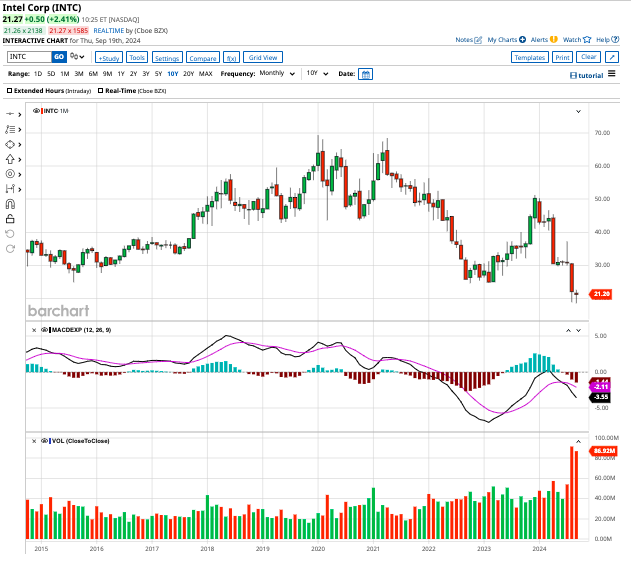

For Intel (INTC), the road to redemption seems fraught with bumps and bruises, as it lags far behind the soaring heights of the Dow Jones Industrial Average ($DOWI). Trailing by a whopping 70% from its all-time highs, the semiconductor behemoth’s stock has taken a beating, nosediving close to 58% in 2024 alone.

Locked in at a market cap of $88.4 billion, the burning question remains – is it wise to bet on the underdog now that it sets its sights on spinning off its foundry business?

Intel’s Bold Move

A glimmer of hope dawned on Intel stock on Monday, Sept. 16, when the company unveiled plans to carve out its foundry business as a standalone entity with its own board. This strategic move promises newfound autonomy for the unit to seek alternate funding streams and revel in a cleaner organizational setup.

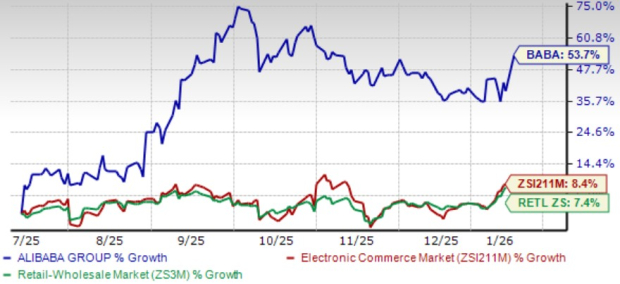

Similar to Taiwan Semiconductor’s (TSM) trajectory, Intel’s foundry arm is poised to churn out chips for third-party entities. With a massive commitment of $100 billion earmarked for this venture, Intel eyes expansive manufacturing expansions across four U.S. states. In 2024, its capital injections in this sector snowballed to $43.4 billion, escalating from $36.7 billion in 2022.

This division bled an operating loss of $7 billion in 2023, followed by $5.2 billion in 2022. Intel’s CEO, Pat Gelsinger, foresees the losses in chip production tapering off this year and breaking even by 2027. Looking ahead, Gelsinger envisions a 40% gross margin by 2030, a tad shy of Taiwan Semi’s 53% margin.

Even as Intel’s traditional chip arm grapples with market woes against Nvidia’s (NVDA) AI dominance, Intel has initiated a workforce trim by 15% to pare costs by $10 billion. Escalating losses nudged Intel to halt its European manufacturing operations for an additional two years and shelve blueprints for a Malaysian facility.

Conversely, in a bid to bolster domestic semiconductor manufacture amid geopolitical ripples, the U.S. government bestowed a $3 billion grant upon Intel, nudging firms to localize chip production and pivot away from contract giants like TSMC.

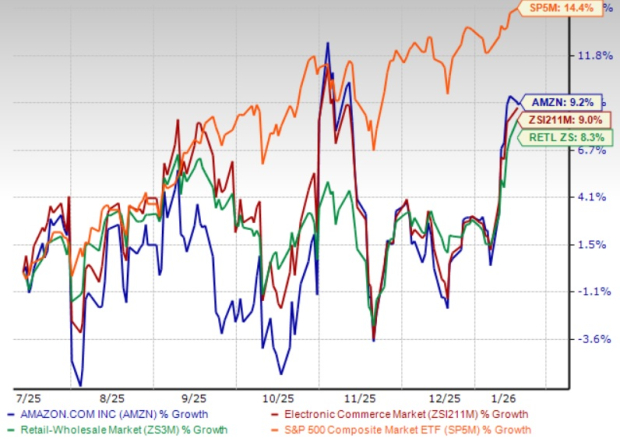

Recent days saw Intel unveil a partnership with Amazon Web Services (AWS). Under this collaboration, Intel will birth an AI fabric chip for Amazon’s (AMZN) AWS on its cutting-edge Intel 18A process node. This co-innovation on tailored chip designs is primed to turbocharge AI application performance.

Forecasting Intel’s Trajectory

Amidst the recent fanfare, Intel stands at a pivotal crossroad, tasked with showcasing prowess in fortifying its financial bastions. In Q2 of 2024, it clocked sales worth $12.83 billion, dipping 1% year-over-year and skirting expectations set at $12.94 billion. Notably, its adjusted earnings of $0.02 per share limped far behind the consensus outlook of $0.10 per share.

An eye-watering GAAP loss of $1.61 billion stemmed from its strategic pivot to rev up AI workload processing chip manufacture. Intel predicts a seismic shift in its AI PC domain, projecting a surge from under 10% in 2024 to over 50% in 2026. The chip giant anticipates shipping 40 million units of AI-powered PC chips this year.

Yet, vis-a-vis Nvidia and Broadcom (AVGO), reveling in twin AI tailwinds, Intel watched its data center and AI revenue plumment to $3.05 billion, marking a 3% slide year-over-year.

Of the 36 analysts dissecting Intel stock, two urge a “strong buy,” one opts for “moderate buy,” a whopping 30 root for “hold,” while one whispers “moderate sell” and two shriek “strong sell,” knitting an overall “hold” consensus from the crowd.

The mean target price for INTC shares perches at $29.26, dangling a lush 38.3% upside from present levels.

Dive into more engrossing Stock Market News from Barchart

This article reflects the views of Aditya Raghunath, who holds no positions in the securities mentioned, serving up informational nuggets for your perusal. For deeper insights, saunter over to Barchart’s Disclosure Policy here.

In this arena of musings, remember – these sentiments are the author’s own, not a reflection of Nasdaq, Inc.’s stance.