Before diving headfirst into the investing waters, many look to Wall Street analysts for guidance on which stocks to cheer for, or jeer away from. These recommendations, often akin to the flight plan for a flock of migrating birds, can lead investors towards opportunity or peril.

Let’s uncover what these market gurus have to say about Advanced Micro Devices (AMD) while exploring the credibility of brokerage advice and how to harness it to your advantage.

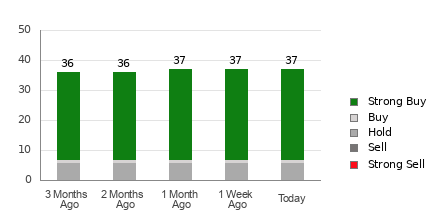

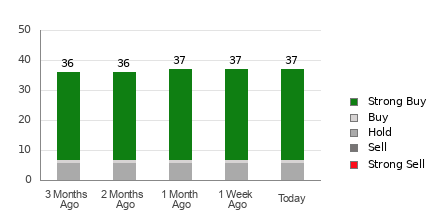

Currently, Advanced Micro boasts an average brokerage recommendation (ABR) of 1.35, perched between Strong Buy and Buy on a 1 to 5 scale. This figure is a collective chorus sung by 37 brokerage firms, with 81.1% chanting Strong Buy and 2.7% humming Buy, out of the 37 voices in the choir.

Insight into the Trends of Brokerage Recommendations for AMD

Explore price targets & stock forecasts for Advanced Micro here>>>

While the ABR twinkles like a North Star guiding sailors, solely making investment decisions based on this data may be akin to navigating treacherous waters without a compass. Research suggests that relying solely on brokerage recommendations offers as much risk as reward in predicting a stock’s rise or fall.

But why is that so? The answer dwells in the cozy relationship brokerage firms have with the stocks they analyze, often casting a rosy hue on their ratings due to vested interests. For every “Strong Sell” signpost, five “Strong Buy” billboards light up, skewing the route for retail investors.

In essence, these recommendations may not steer you to the treasure chest but can serve as a treasure map to cross-verify your own findings or blend with a proven barometer of a stock’s trajectory.

Enter Zacks Rank, a proprietary stock grading tool with an independently verified pedigree, segregating stocks into five tiers, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). Aligning the ABR with the Zacks Rank could plot a course towards profitable investment decisions.

Deciphering the ABR vs. Zacks Rank for AMD

ABR and Zacks Rank may share a numbering system but are as distinct as chalk and cheese.

ABR hails from brokerage affirmations while Zacks Rank taps into earnings whispers. The former dances with decimals, the latter deals in whole numbers, but both yearn for accuracy.

When it comes to who wears the optimist’s cap, brokerage analysts often sport a chapeau two sizes too big for reason. Conversely, the Zacks Rank dances to the beat of earnings estimates, showing a tango between revisions and stock movements.

Moreover, while ABR may linger like a guest overstaying a welcome, Zacks Rank briskly reflects analysts’ earnings somersaults, ensuring a fresh snapshot of where the wind may blow.

Is AMD a Gem to Have in Your Investment Trove?

Eyeing the earnings forecast for Advanced Micro, the Zacks Consensus Estimate for the year holds steady at $3.36 – a signpost suggesting that the company’s earning prowess remains a steady ship in a turbulent sea.

Factoring this muted song of earnings along with additional metrics has pegged Advanced Micro with a Zacks Rank #3 (Hold). Delve into the festival of Zacks Rank #1 (Strong Buy) stocks here >>>>

Given this mixed chorus for Advanced Micro, a prudent investor may opt for a cautious dance around the Buy equivalent ABR.

Chief of Research Unveils “The One Stock Set to Soar”

From a galaxy of stocks, five Zacks maestros have handpicked their shooting stars slated to ascend +100% or more in the coming months. Amidst this constellation, Director of Research Sheraz Mian plucks the most explosive meteor glimmering with promise.

This company serenades the millennial and Gen Z audience, ringing in nearly $1 billion in last quarter’s revenue. A recent dip in its trajectory makes it a ripe moment to hop aboard. While not every serenade is a chart-topper, this aria could outsing past Zacks’ Hits like Nano-X Imaging, soaring +129.6% in just over 9 moons.

Free: Peep Our Star Stock Along With 4 Shining Runners

Seeking the latest serenades from Zacks Investment Research? Today, uncover 5 Stocks Tuned to Thrive. Click for this complimentary score

Advanced Micro Devices, Inc. (AMD) : Complimentary Stock Diagnosis Report

To find this tale spun on Zacks.com click here.

Zacks Investment Research

The sentiments and counsels conveyed herein mirror the musings and cognitions of the author and may not necessarily echo those of Nasdaq, Inc.