Insight into QNB’s Quarterly Dividend

QNB, on February 27, 2024, announced a declared $0.37 regular quarterly dividend per share ($1.48 annualized). The shares need to be acquired before the ex-div date of March 14, 2024, for eligibility. Shareholders of record by March 15, 2024, will receive the payment on March 28, 2024.

Historical Context of Dividend Yields

At the current share price of $24.45 per share, the stock offers a dividend yield of 6.05%. Looking back five years with weekly samples, the average dividend yield stood at 4.35%, with the lowest at 3.39% and the highest at 6.70%. It’s noteworthy that the current yield is significantly above the historical average by 1.98 standard deviations.

The company’s dividend payout ratio, at 0.57, signifies how much of the company’s income is distributed as dividends. A ratio above one indicates tapping into savings to sustain dividend payouts, hinting at potential financial strain. QNB’s 3-year dividend growth rate is a modest 0.06%, showcasing a gradual increase in returns over time.

Fund and Shareholder Positioning

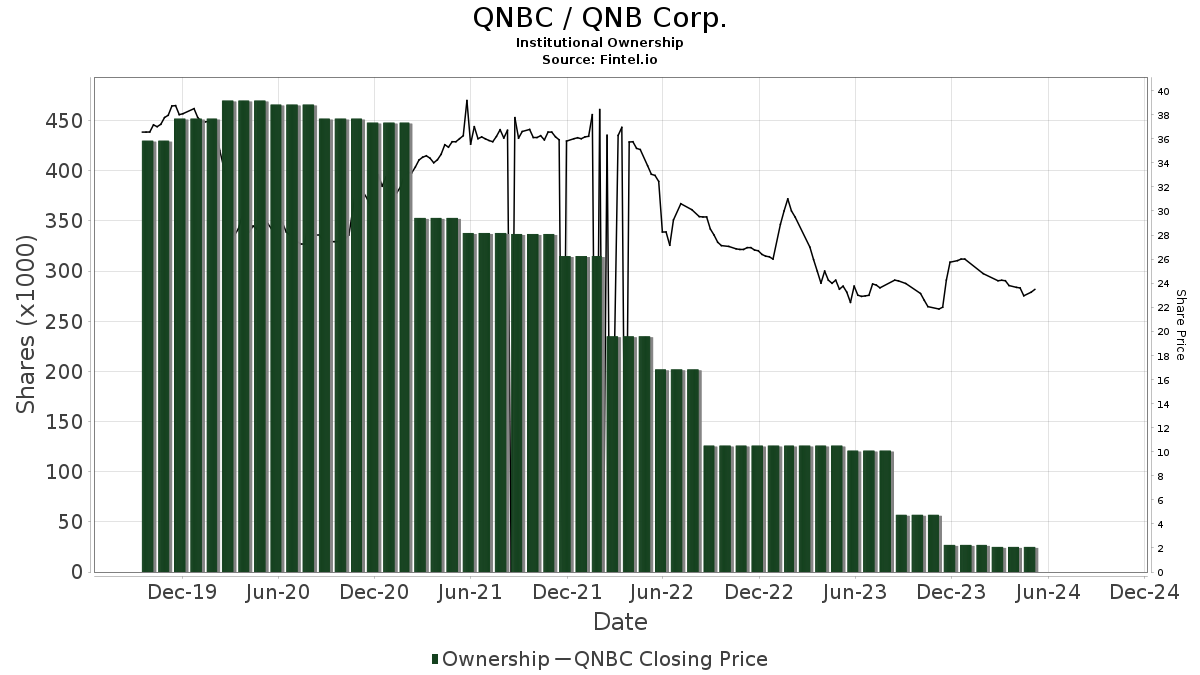

Three funds or institutions currently report positions in QNB, a figure stable over the last quarter. The average portfolio weight across all funds invested in QNBC is 0.03%, reflecting a decline of 12.81%. Over the past three months, institutional ownership saw a 7.24% reduction to 26K shares.

Banc Funds Co holds 26K shares, accounting for 0.70% ownership, with a 7.80% decrease from its previous filing. Meanwhile, Huntington National Bank’s ownership remains at 0.00%. Understanding fund sentiment and shareholder activity provides a nuanced view of market dynamics surrounding QNB.

Enhanced Market Insights with Fintel

For investors seeking comprehensive research platforms, Fintel stands out as a valuable resource. Offering insights into fundamentals, analyst reports, ownership data, and fund sentiment, Fintel aids in making informed investment decisions. Additional offerings include options sentiment, insider trading data, and advanced quantitative models for optimized profits.

Explore deeper insights with Fintel’s exclusive stock picks, crafted through rigorous quantitative analysis, to navigate the financial landscape with confidence.

For more information, visit Fintel for detailed analysis and market trends.