It was the spring of 2022, and Netflix (NFLX) found itself in the midst of a fierce battle in the streaming landscape. Competitors, including established Hollywood studios like Disney+, were closing in, aiming to usurp Netflix from its perch as the reigning streaming giant.

Despite facing significant challenges and skepticism from industry experts, Netflix’s co-founder, Reed Hastings, orchestrated a series of bold moves to counter the threat. Initiatives like cracking down on password-sharing amongst users and entertaining the idea of introducing advertising were met with doubt but ultimately set the stage for a remarkable turnaround.

While naysayers predicted Netflix’s downfall, the company surprised everyone with a strategic shift that not only solidified its position at the top but also propelled its stock to impressive heights. In a surprising twist, Netflix emerged as the frontrunner in the streaming wars, outpacing traditional entertainment companies that had poured billions into their own streaming services.

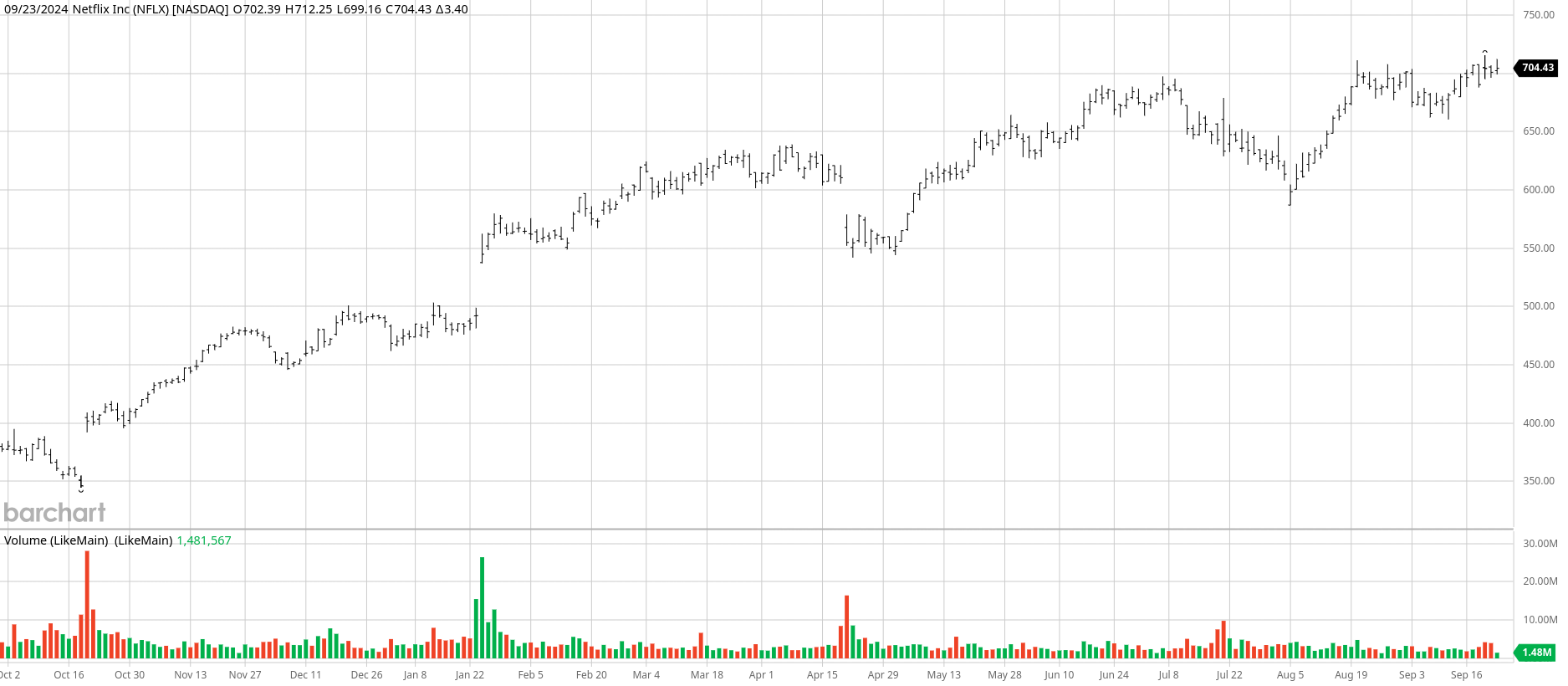

This strategic pivot bore fruit, with Netflix’s stock soaring by 85.7% over the past year, showcasing a remarkable performance compared to competitors like Warner Bros Discovery (WBD), Paramount Global (PARA), Comcast (CMCSA), and even Walt Disney (DIS).

Netflix’s Triumph Over Adversity

The resilience and strategic acumen displayed by Netflix not only confounded its critics but also translated into tangible results. Despite doubts surrounding the password crackdown, Netflix’s subscriber base witnessed a remarkable surge, reaching 277.6 million in the latest quarter – a 16.5% increase from the previous year.

Since the implementation of the password-sharing crackdown in May 2023, Netflix has added a staggering 45 million paying subscribers. This surge in subscriptions has been a key driver behind the company’s share price surge of over 114%, culminating in new record highs.

Even as competing streaming services struggled to gain ground, Netflix maintained its dominance, capturing a significant share of U.S. screen time compared to rivals such as Disney+ and Hulu. This undisputed lead underscores Netflix’s enduring popularity and cultural relevance.

The Future Horizon for Netflix

Looking ahead, Netflix’s growth trajectory appears promising, with several strategic initiatives in the pipeline. From venturing into the advertising space to exploring new avenues like live sports streaming, Netflix is positioning itself for sustained growth and innovation.

Despite facing competition, particularly from Amazon’s Prime Video service, Netflix has remained steadfast in its pursuit of diversification and expansion. By building an in-house advertising platform and investing in live events like NFL games and wrestling programs, Netflix aims to tap into new revenue streams and broaden its market reach.

Moreover, Netflix’s foray into live sports programming aligns with its goal of enhancing its advertising business. With live events commanding higher value for advertisers, Netflix stands to benefit from this segment’s potential for revenue growth and market expansion.

As the unrivaled leader in the video streaming domain, Netflix’s strategic initiatives are poised to drive mid-teen revenue growth and improve operating margins, reaffirming its position as a key player in the digital entertainment landscape.

For investors eyeing opportunities in the streaming sector, Netflix’s stock presents an attractive option. With a track record of resilience and innovation, Netflix remains a compelling investment choice, particularly during market pullbacks. Consider buying NFLX stock below $717, ideally below $700, to capitalize on potential growth opportunities.

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.